After nearly a week of causing a public uproar, today (March 19), Mr. PHA, a credit card holder of Eximbank, and his lawyer had a meeting with senior leaders of Eximbank.

Today, PHA cardholder and lawyer had a meeting with senior leaders of Eximbank.

The content of the meeting was not disclosed. However, both sides agreed to work together to resolve the matter, ensuring the rights of both sides as soon as possible.

Before the incident broke out, the bank and customers gave conflicting information.

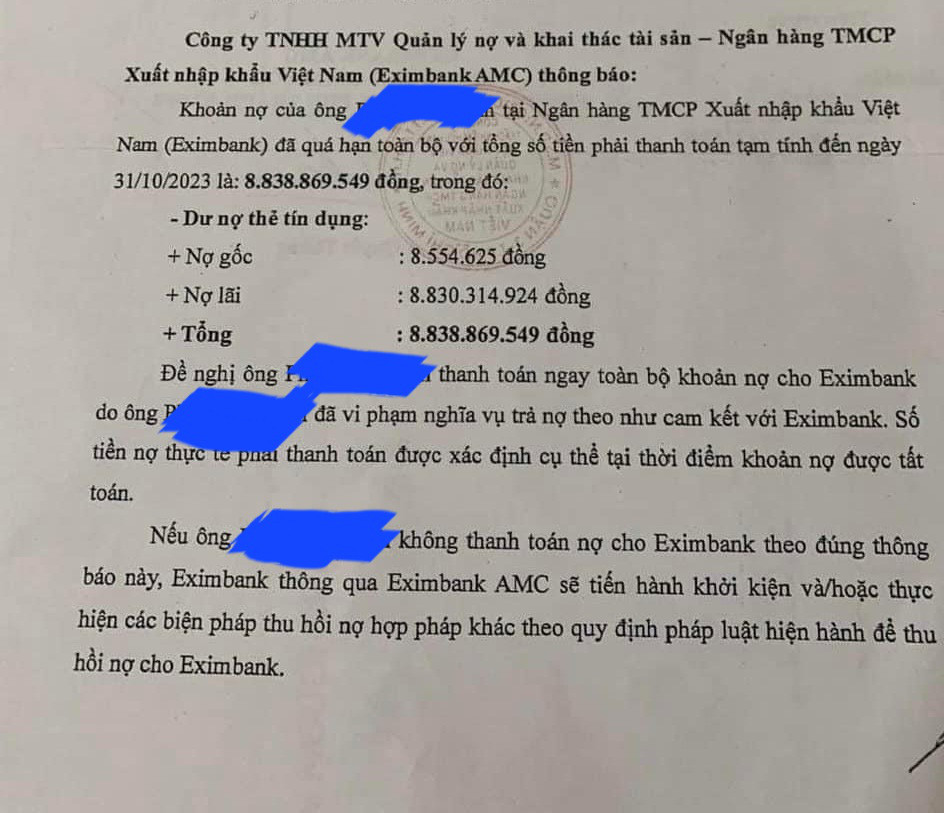

Specifically, Eximbank said that customer PHA opened a Master Card at Eximbank Quang Ninh branch on March 23, 2013 with a limit of 10 million VND.

Then two payment transactions occurred on April 23, 2013 and July 26, 2013 at a card acceptance point.

Since September 14, 2013, the above card debt has turned into bad debt, overdue up to the time the bank issued the above notice for nearly 11 years.

"Over the past 11 years, Eximbank has repeatedly notified and worked directly with customers, but customers still have no debt settlement plan," an Eximbank representative affirmed.

The bank also said that issuing debt obligation notices to customers is a normal business activity in the process of debt handling and collection.

Regarding the method of calculating interest and fees, Eximbank said "it is completely consistent with the agreement between Eximbank and the customer according to the card opening file dated March 15, 2013 with full customer signature. Regulations on fees and interest are clearly stated in the fee schedule for card issuance and usage, which has also been publicly posted on the bank's website."

Meanwhile, speaking to the press, Mr. PHA said that in March 2013, he asked an employee named Giang at the Eximbank branch in Ha Long City (Quang Ninh province) to make him a credit card.

About 1 - 2 weeks after signing the documents, Mr. PHA was called by Giang to the branch office to sign the documents and receive the card.

However, according to Mr. PHA, Mr. A's salary is too low, only about 5 million VND/month, so he is not eligible.

Giang said he had to ask his boss for more advice and promised to contact him again.

After that, this person did not contact him again, so he thought it was impossible.

After more than 4 years (until 2017), when he needed to borrow money from the bank, Mr. PHA was shocked to know that he had bad debt at Eximbank, so he proactively went to this bank to verify.

At that time, the bank branch's board of directors said that Mr. PHA had already signed to receive the card and had to take responsibility.

"I asked why interest and debt were not immediately reported. Why is there a phone number in the card opening file that is not mine?

The bank replied that they had contacted the phone number (not Mr. PHA's - PV) but could not contact him.

I asked why I couldn't contact them using the other phone number I was using, but the bank couldn't answer," said Mr. PHA.

In particular, when requesting a statement, Mr. PHA discovered that someone had paid the first month's interest, so he requested to check who paid the interest and in what form, but the bank did not respond.

After discovering bad debt at Eximbank, Mr. PHA said he filed a complaint about the bank not sending notices to customers.

According to Mr. A., the bank responded in writing that it had sent a notice, but could not prove in what form the notice was sent. While his home address had not changed, the phone number in the file had not changed either.

Also at the working sessions, Mr. PHA proposed a solution to remedy the consequences by returning the principal of 10 million VND and paying an additional 10 million VND as a penalty fee, but the bank did not agree and forced Mr. PHA to pay in full both principal and interest, amounting to more than 63 million VND.

However, Mr. PHA refused on the grounds that he did not spend money in the card account.

Therefore, Mr. A. posted this story. "I think the authorities need to clarify the signs of fraud by the employee named Giang. I am willing to follow this matter to the end," Mr. A. affirmed.

On March 14, the State Bank of Vietnam, Quang Ninh branch, sent a document requesting Eximbank headquarters in Ho Chi Minh City and Eximbank Quang Ninh branch to verify, clarify, report information related to this incident and inform the media.

TT (according to Tuoi Tre newspaper)