Thinking that he did not spend on credit cards, a customer did not pay and after 11 years, bad debt increased from 8.5 million to 8.84 billion VND.

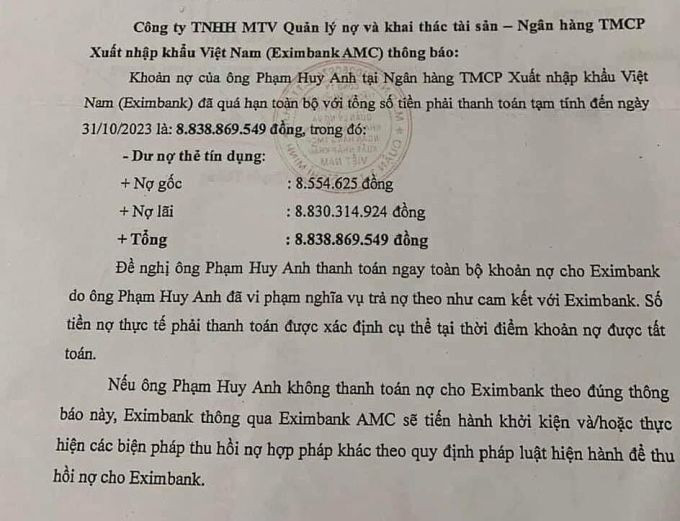

Mr. Pham Huy Anh (Quang Ninh), a customer of the Vietnam Export Import Bank (Eximbank), was sent a notice to recover bad debt due to spending nearly 8.5 million VND by credit card since 2013. But after 11 years, the interest debt has now amounted to 8.84 billion VND.

Speaking to reporters, customer Pham Huy Anh said that in 2013, while applying for a card, a bank employee named Giang asked him to sign the credit card application and card receipt first, and then would notify him of the results later. However, when he received it, the employee only handed him a domestic debit card and informed him that he "did not meet the conditions for a credit card". He affirmed that he did not receive, activate, or spend on the credit card.

In 2017, when he went to another bank to borrow money, the staff informed him that there had been two credit card transactions in 2013 with principal and interest of more than 100 million VND at Eximbank. He confirmed that the signature on the receipts for both transactions was not his. He has not paid the money because he has not reached an agreement with the bank on this case.

Eximbank said that this method of calculating interest and fees is completely consistent with the agreement between them and the customer according to the card opening file with full signatures dated March 15, 2013. According to the bank, the customer opened a credit card in Quang Ninh in March 2013 with a limit of 10 million VND. From September 14, 2013, the card debt turned into bad debt, the overdue period up to the time of notification was nearly 11 years.

The bank said that over the past 11 years, it had notified and worked directly with the customer many times, but "the customer still had no plan to resolve the debt". In September 2013, the bank notified the customer in writing about the violation of the debt repayment obligation. On December 12, 2017, the bank received a complaint from Mr. Pham Huy Anh that it had not received the above notice. At the end of 2017, the bank also responded in writing to the customer, and requested payment of the amount.

However, Mr. Huy Anh informed that, for many years, he did not receive any debt collection notice from Eximbank. "An unusual point in the card opening contract is that the second phone number is not mine. My correct phone number did not receive any contact from the bank," he said.

Eximbank has not responded to this question but said it is continuing to work and coordinate with customers to find a plan to support debt settlement.

According to the 2013 credit card application form taken by Mr. Pham Huy Anh from Eximbank, the application form did not include the customer's email address, the monthly payment method on the form was in cash, there was no form of payment by account. At the same time, the credit card application form stated "Customer does not receive monthly statements".

Meanwhile, to ensure safety when opening a credit card, customers are always advised to receive balance change notifications via text messages as well as monthly statement notifications via text messages, email or via banking applications.

When transacting at the bank, experts recommend that customers carefully read the information on the documents before signing. The customer's signature on the documents is one of the legal evidences in case of disputes.

Late credit card payments cause customers to incur high interest. Not to mention, this causes customers to be classified as bad debt, affecting the customer's credit history stored on the National Credit Information Center (CIC) system, making it difficult for customers to access loan services from all banks.

TB (according to VnExpress)