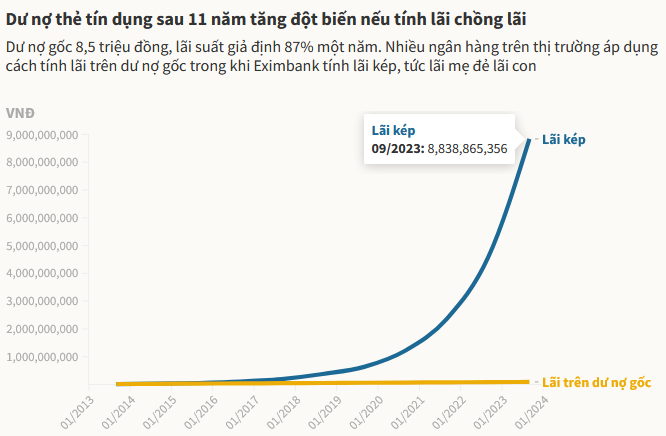

Because of compound interest, the debt from 8.5 million at Eximbank jumped to 8.8 billion VND, thousands of times higher than the usual method applied by many banks.

To date, the Vietnam Export Import Bank (Eximbank) has not yet announced the interest rate and fees applied to customer Pham Huy Anh, who had a credit debt of VND8.5 million but became a bad debt of VND8.8 billion. Banks and credit card lenders have questioned the reasonableness of Eximbank's interest rate calculation. The outstanding debt of VND8.8 billion after 11 years is 100,000% higher than the original principal debt.

Talk to reporters,representatives of 4 different banks includingTwo leaders, a card department head and a credit officer, both confirmed that "the outstanding debt of 8.8 billion VND is unusually high". According to them, the reason for such outstanding debt can only be that the bank has applied compound interest, which means calculating interest on the principal and accumulated interest instead of on the original principal (8.5 million VND).

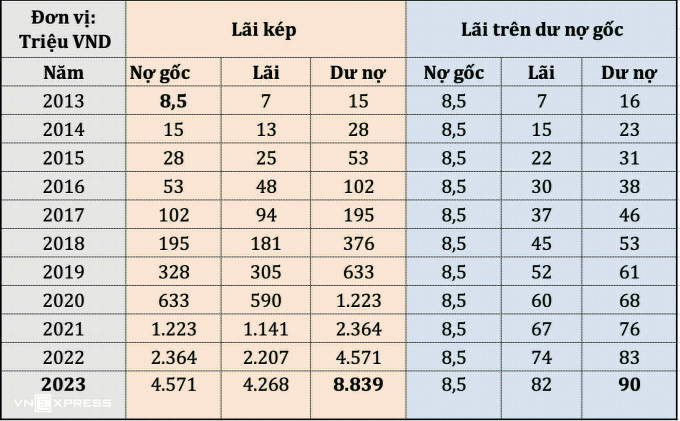

Below is an illustrative table. reporter The calculation is based on two methods (compound interest and interest on principal balance) with results that have a big difference in the amount the customer has to pay.

With the compound interest calculation method, the principal balance of VND 8.5 million in September 2013 is estimated to bear an annual card interest rate of 87% (including interest rates, penalty fees, etc.). After that, the interest is added to the principal and continues to be charged this interest rate. By September 2023, the customer's outstanding balance is VND 8.8 billion.

Meanwhile, many other banks in the market only charge card interest on the original principal debt, here it is 8.5 million VND. With the same assumed interest rate of 87% per year as at Eximbank, the interest and principal that customers have to pay until September 2023 is only about 90.4 million VND.

If applying the overdue interest rate of about 20% per year that a state-owned bank like Agribank is implementing in the market, the interest incurred after 11 years is only 18.8 million VND (assuming the interest rate does not change over the periods). The principal and interest that customers have to pay after 11 years is only 27.3 million VND.

Compound interest formula (interest on interest) is popular in personal finance to emphasize the power of continuous savings and investment over a long period of time. However, the method of calculating compound interest in bank lending is not common practice and is also bound by legal regulations and the State Bank.

Normally, banks only calculate interest based on the principal, not on the compound interest. The general director of another private bank said that after the boom in installment loans, for many years now, the State Bank has issued a document directing not to apply the method of calculating compound interest when granting credit to customers.

However, the head of the card department of a private bank said that the regulations on credit card lending are still "not really clear, there are some unclear points". If credit card lending is considered a consumer lending business, the State Bank does not allow the calculation of interest on top of interest. Depending on the risk appetite of each bank, they will comply with the regulations to what extent, as well as decide whether to calculate interest on top of interest or not.

In addition, considering the reason why many banks do not calculate compound interest, the head of this card department said that this is to ensure that the loan balance is at a reasonable level compared to the principal, and is consistent with the customer's ability to repay. In addition, this person also said that at a certain stage, when the customer is classified as Group 5 Debt - not recoverable, the bank will also have measures to continue to recover but will postpone the debt to avoid incurring interest, avoiding exceeding the actual payment capacity as well as the original principal.

The general director of a private bank said that it is necessary to put in context that Huy Anh's customer's credit card was issued in 2013, more than 10 years ago. At that time, credit card lending services were not as popular as they are today, many banks "copied" the calculation method from foreign banks. At that time, many banks often applied a policy of overdue penalty interest, equal to 150% of the credit card interest rate.

Letting a credit card debt last for 11 years also strikes the banking world as unusual. In addition to sending letters, banks typically send text messages and have staff call to remind customers of the debt.

The average interest rate of 87% is considered by some to be high compared to the general level. According to the deputy general director of a state-owned bank, the legal limit on interest rates applied to late payments is currently a maximum of 10% per year.

However, from a legal perspective, according to lawyer Luong Huy Ha, Director of LawKey Law Firm, applying an interest rate of 87% on both principal and interest is not a violation. In 2013, when customer Huy Anh opened a credit card, there were no specific regulations on the ceiling interest rate calculated on late payment interest. Since 2017, Circular 39 has only stipulated that banks can only apply a maximum interest rate of 10% on customers' late payment interest.

At the same time, during the period from when Circular 39 took effect to now, if Eximbank and the customer do not have an agreement to amend or supplement the credit contract, the agreements under the old contract will still be legal and remain the same as the original.

TB (according to VnExpress)