The price of each tael of gold ring increased by nearly 1 million VND this morning, exceeding 97 million VND per tael.

On the morning of March 18, Saigon Jewelry Company (SJC) listed the price of gold rings at 95.3 - 96.8 million VND/tael, an increase of 800,000 VND/tael compared to yesterday.

Meanwhile, Phu Nhuan Jewelry Company (PNJ) raised the price of plain rings to 95.5 - 97.3 million VND/tael. At Bao Tin Minh Chau, the price of plain rings increased to 95.9 - 97.5 million VND/tael.

This morning, SJC, PNJ, and Bao Tin Minh Chau listed gold bars at the same price of 95.4 - 96.9 million VND/tael, an increase of 800,000 VND/tael compared to yesterday.

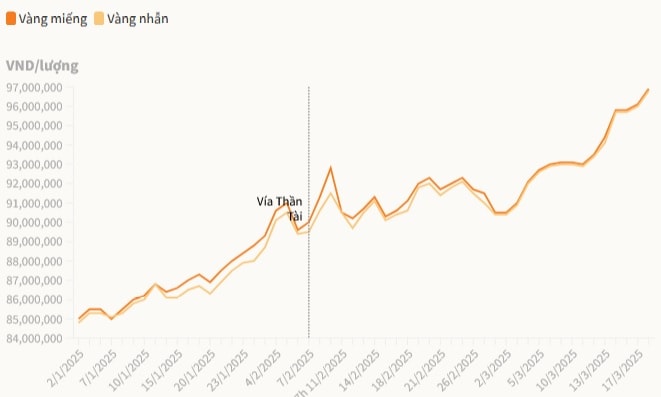

Domestic gold prices have continuously set new peaks in recent days and recorded a somewhat faster increase than precious metals on the international market. If calculated from the beginning of the year, the price of each tael of gold has increased by nearly 12 million VND, equivalent to an efficiency of 14%.

In the world market, the spot gold price surpassed the 3,000 USD/ounce mark and set a record of 3,007 USD/ounce. Converted according to Vietcombank's selling rate, the world gold price is equivalent to 93.2 million VND/tael. The gap between domestic and world gold prices has now widened to nearly 4 million VND/tael.

Currently, people still have to pre-order online when buying gold bars at SJC and state-owned banks. At some times in the early days, SJC still sells gold bars to walk-in customers without requiring pre-orders. At the same time, some brands that are not authorized by the State Bank such as Mi Hong, Bao Tin Minh Chau... have recently returned to selling gold bars. For plain rings, major brands also limit the purchase amount to a few pieces per person per day.

Propose appropriate policies to stabilize the gold market

At the question-and-answer session before the National Assembly on the morning of November 11, 2024, Governor of the State Bank Nguyen Thi Hong stated that the fluctuations in Vietnam's gold market in recent times are also a common trend in other countries around the world. From 2014 to 2019, the Vietnamese gold market was relatively stable and people's demand for gold decreased. However, from 2021, the world gold price increased, and accordingly, the domestic gold price also increased. However, from 2021 to June 2024, the State Bank has not intervened.

Since June 2024, the world gold price has reached a peak, the gap between the world and domestic gold prices has increased. Therefore, the Government and the State Bank have directed strongly. Based on current laws, the State Bank has organized an auction. In the context of the gold price reaching a peak and the market's expectations are also very high, the State Bank has considered 9 auctions, this is a quite effective solution.

In order to quickly narrow the gap between domestic and international gold prices at a high level under the Government's drastic direction, the State Bank has switched to selling SJC gold directly through 4 State-owned commercial banks. Therefore, the gap between domestic and international gold prices has decreased from about 15 - 18 million VND/tael to only about 3 - 4 million VND/tael.

Pointing out that gold prices continue to be complicated and unpredictable, Governor Nguyen Thi Hong said that our country does not produce gold, so intervention depends entirely on international gold imports. Therefore, the State Bank will closely monitor market developments to come up with appropriate policies to stabilize the gold market.

The State Bank also said it will continue to implement a roadmap to narrow and control the difference between the domestic selling price of SJC gold bars and the world price at an appropriate level.