In line with world gold prices, domestic SJC gold ring and gold bar prices continued to decrease slightly this morning.

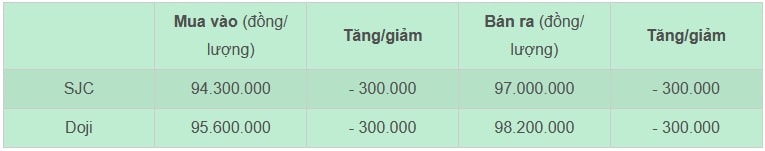

Domestic gold ring prices on the morning of March 22 continued to be adjusted down by brands.

Early this morning, Saigon Jewelry Company (SJC) listed the price of gold rings of type 1-5 only at 94.3 - 97 million VND/tael (buy - sell), down 300,000 VND per tael in both buying and selling compared to the close of yesterday's session.

Doji Gold and Gemstone Group early this morning traded 9999 gold rings at 95.6 - 98.2 million VND/tael (buy - sell), down 300,000 VND per tael in both buying and selling compared to yesterday's closing price.

Notably, the price of gold rings today has a significant difference. If SJC gold rings of type 1 - 5 are listed at only 97 million VND/tael (selling price), the highest price on the market is Bao Tin Minh Chau gold rings at 98.6 million VND/tael, which is 1.6 million VND more expensive.

Meanwhile, the selling price of Doji gold rings is 98.2 million VND/tael, while Mi Hong gold rings (Ho Chi Minh City) is 97.4 million VND/tael recorded at 8:30 am.

Opening the trading session on March 22, the price of SJC 9999 gold decreased by 300,000 VND per tael in both buying and selling compared to the closing price yesterday, down to 94.4 - 97.4 million VND/tael (buying - selling).

The price of 9999 gold was listed by SJC Company at 8:40 and the price of 9999 gold was listed by Doji Gold and Gemstone Group at 8:43 as follows:

| Buy(VND/tael) | Increase/decrease | Sell(VND/tael) | Increase/decrease | |

| SJC Ho Chi Minh City | 94,400,000 | - 300,000 | 97,400,000 | - 300,000 |

| Doji Hanoi | 94,400,000 | - 300,000 | 97,400,000 | - 300,000 |

| Doji Ho Chi Minh City | 94,400,000 | - 300,000 | 97,400,000 | - 300,000 |

At 9:00 a.m. on March 22 (Vietnam time), the world spot gold price was at 3,023.4 USD/ounce, down 10.6 USD/ounce compared to last night. The gold futures price for April 2025 on the Comex New York floor was at 3,021 USD/ounce.

World gold converted to bank USD price is over 94.8 million VND/tael, including tax and fees, about 2.6 million VND/tael lower than domestic gold price.

At the end of the session on March 21, the price of gold bars at SJC closed at 94.7 - 97.7 million VND/tael (buy - sell), down 3.1 million VND per tael for buying and down 2.1 million VND per tael for selling compared to the previous trading session.

The price of SJC gold rings of 1 - 5 chi is listed at 94.6 - 97.3 million VND/tael (buy - sell), down 3.1 million VND per tael for buying and down 2.4 million VND per tael for selling compared to the closing price on March 20.

The price of 9999 gold rings at Doji closed the session at 95.9 - 98.5 million VND/tael, down 2.8 million VND per tael for buying and down 1.7 million VND per tael for selling compared to the previous day's closing price.

The price of gold on the Kitco floor at 8:00 p.m. on March 21 (Vietnam time) was trading at $3,034/ounce, down 0.33% from the beginning of the session. The price of gold futures for delivery in April 2025 on the Comex New York floor was trading at $3,040/ounce.

Gold prices were mostly steady in early Friday trading in the United States amid no notable news developments. The market recorded profit-taking pressure from short-term futures contracts ahead of the weekend session. However, investors were quick to buy as gold prices fell.

The US Dollar Index (DXY), which measures the greenback's movements against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), rose slightly to 103.88 points.

Nymex crude oil futures edged lower and traded around $67.75 a barrel. The current yield on the 10-year U.S. Treasury note is 4.214%.

Speculators are taking advantage of the market and making money, said Alex Ebkarian, CEO of Allegiance Gold. He said that whenever gold peaks, the market sees resistance. Gold has not yet fulfilled its traditional role as a safe-haven asset.

Earlier, the US Federal Reserve (Fed) concluded its Open Market Committee meeting in March. Members voted unanimously to maintain interest rates at the current level of 4.25 - 4.5%.

Markets are betting the Fed will make at least two 25 basis point rate cuts, with the first cut coming in July 2025.

With import tariffs from Canada and Mexico fixed at 25% and 20% on Chinese imports, investors around the world are bracing for the inevitable impact of higher prices and retaliatory measures by other countries in response.

Gold Price Forecast

Central banks were the main buyers behind last year’s gold rally, said Daniel Ghali, senior commodity strategist at TD Securities. This year, the main drivers are currency depreciation and risk-off sentiment.

The trend toward de-dollarization has intensified since sanctions on Russia and countries seeking to diversify away from the dollar have been buying gold this year as a hedge against currency depreciation, Ghali said.

The precious metal has broken records 16 times and surpassed the important threshold of $3,000/ounce four times. Gold is considered a safe haven against geopolitical and economic fluctuations, and tends to increase in price when interest rates are low.

Capital Markets analyst Kyle Rodda predicts that gold prices could fall to around $3,000 an ounce before rising again. This is a necessary correction to create further upward momentum.

According to Citi analysts, the optimistic scenario shows that gold prices could reach $3,500/ounce by the end of the year.

TB (summary)