Cyber fraudsters are becoming more and more complex and sophisticated as they use Deepfake - a technology that applies artificial intelligence (AI) to fake video calls for the purpose of obtaining facial data.

Taking advantage of Deepfake to steal money

On June 16, Maritime Bank (MSB) continued to send out notices to customers to warn about a new form of fraud by scammers in cyberspace. The latest form of fraud is the use of Deepfake technology - faking images and voices to impersonate state officials (police, tax authorities, courts, etc.) or acquaintances of the victim to make video calls (direct video calls) with the victim.

MSB Bank issues warning

When making a video call, the scammer will use different tricks to ask the victim to look straight, look left, look right, look up, look down. The subject will record the video and use it to open an online account (eKYC) at financial institutions - banks. In some cases, the scammer asks the victim to provide additional personal information such as ID card/CCCD number, phone number, address...

Customers who unwittingly follow these requests indirectly help the subject have data to successfully register to open an account. Ultimately, the fraudster will use these accounts for malicious purposes.

Previously, in early June, many other banks also issued notices advising users to be vigilant against scammers using social media accounts (Zalo, Facebook...) or creating fake social media accounts impersonating the victims' relatives. These subjects then collect personal information, images, videos with available voices and use Deepfake technology to create fake videos.

From there, the subjects use fake or hijacked social media accounts to send messages to borrow money or ask for money transfers or notify the victim's relatives in danger to request urgent money transfers...; at the same time, they make fake video calls and broadcast fake videos to verify information and increase credibility to trick the victim into transferring money.

Mr. Ngo Minh Hieu (HieuPC), a cybersecurity expert at the National Cyber Security Monitoring Center and co-founder of Chongluadao.vn, said that scammers are becoming increasingly sophisticated and difficult to control due to the use of AI technology. In particular, Deepfake technology has recently flourished, causing many people to fall into scam traps because they cannot tell who is real and who is fake.

Specifically, 2 months ago, Ms. Nguyen Thi Th. (living in Linh Tay Ward, Thu Duc City, Ho Chi Minh City) was scammed out of 20 million VND by video calling via Facebook. Accordingly, the subject used AI technology to fake her face and voice to call Ms. Th. to borrow money. Although she called back via Facebook to verify, when she saw her friend's face (although sometimes blurry and flickering and the voice was similar), Ms. Th. believed it and transferred the money.

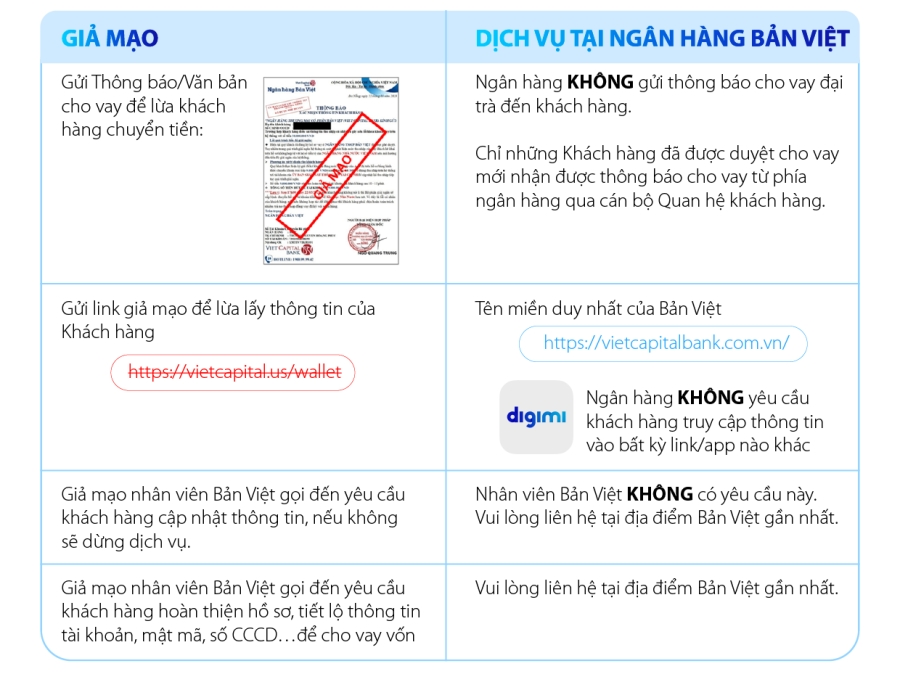

Viet Capital Bank issues warning about fraud tricks

In addition, banks have also continuously warned about fraudulent tricks to take over phone numbers and then take money from banking applications and e-wallets. Specifically, recently, many Vietcombank customers have received a message with the following content: "Your VCB Digibank application has been detected to be activated on a strange device. If you did not activate it, please click http://vietcombank.vn-vm.top to change the device or cancel to avoid losing assets."

Or, MSB Bank customers also received a message with the content "Your account has registered for an advertising program on TikTok, with a monthly fee of VND 2,250,000. Please visit https://msb.vn-cvstop to check or cancel". Similarly, "Your account has registered for an advertising program on TikTok, with a monthly fee of VND 3,600,000. Please visit the link https://shb.vn-ibs.xyz to check or cancel".

The trick is that the above messages are sent in the same section as the real messages from the bank, and the website name is also similar to the domain name of the banks. This makes many users not suspect but think that these are messages sent by the bank.

Discussing this issue, Mr. Le Pham Thien Hong An, IoT security research expert of the Information Security Center - VNPT said that in order to send fake bank messages (brandname), scammers have taken advantage of weaknesses in the telecommunications network infrastructure to commit fraud and appropriate users' assets. Specifically, hackers have faked BTS broadcasting stations to send brandname messages to customers.

According to Mr. Hong An, to achieve this, the hackers “forced” the victim’s signal by using the technique of redirecting LTE waves to 2G, then impersonating the signal column by creating a separate mobile network, texting the victim with any brand name. However, it is currently difficult to patch the vulnerability to remove 2G waves to prevent fraud because it will cost a lot.

Identifying signs of online fraud

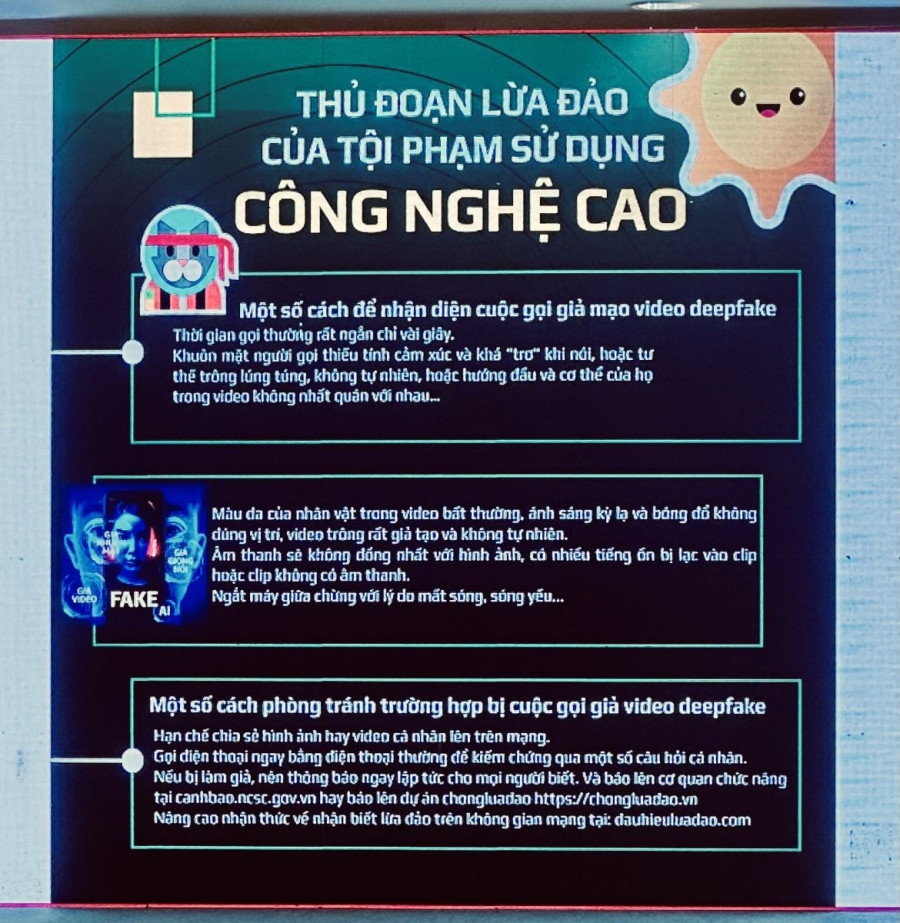

The Ministry of Public Security said that the signs to identify calls using Deepfake technology are that fake calls often have images of the victim, but the sound and image are not clear, the signal is unstable, and the duration is short; then the subject uses the excuse of unstable network, loss of signal, or poor connection to stop the video call. Another sign to identify this fake call is that the content of the response is not directly related to the question of the recipient of the fraudulent call or is not suitable for the context of the communication.

Signs of AI fraud

Accordingly, the Ministry of Public Security recommends that people limit sharing images, videos with real voices, and personal information on social networks. Be vigilant with messages and calls asking to borrow money, requesting money transfers, including video confirmation if there are signs of suspicion. Pay attention to carefully checking the information of the receiving account by calling the contact's phone number directly (not calling via free applications) to verify the information before transferring money.

To prevent the risk of fraud and protect customers' rights, banks recommend that users should be vigilant with calls claiming to be government employees or acquaintances, especially with requests to perform strange actions such as: looking straight, looking to the left, looking up, looking down.

With brandname fraud, cybersecurity experts warn that you should pay close attention to the bank website link, if it is fake, the message will always have additional characters different from the bank's domain name. When customers "click" on the fake link, they are asked to enter information including 16 card numbers, CVV code, card expiration date, OTP code... If they do so, the scammer will take advantage to steal money from the customer's account.

In addition, there are many other forms of fraud that need to be recognized. Specifically, lottery fraud. Accordingly, scammers will call or email you to inform you that you have won the lottery and to receive the prize, you will have to pay a certain fee; or investment fraud, impersonating financial consultants and recommending you to invest in a "ghost company" or a foreign company to make a profit with attractive numbers.

In particular, the subjects impersonate business units to invite additional work from home. Initially, the tasks can be as simple as creating an account on an e-commerce site, then adding items to the shopping cart, buying a low-value item or transferring a few hundred thousand VND to a bank account. The scammer will quickly return the money plus a “commission” to create trust. But not long after that, there will be requests for larger amounts, such as transferring millions or tens of millions of VND.

Using the excuse that the “collaborator” is slow to complete the task, thus failing to meet the requirements, the bad guy will keep this amount and continue to ask the victim to transfer a larger amount to get all the money back. The cycle continues until the victim discovers that he has been scammed or is no longer able to pay. At that time, the bad guy will block all communication and disappear. Notably, the communication channel is often the messaging platform Telegram, which can automatically delete history and is difficult to trace accounts.

Security experts recommend that people do not provide personal information: phone number, ID card/CCCD number, address to anyone they do not know or whose purpose of use is unknown. In case of suspected fraud, immediately contact the 24/7 hotline of the banks or go to the nearest branch or transaction office for timely support; at the same time, notify the authorities at https://canhbao.ncsc.gov.vn or report to the Anti-Fraud Project https://chongluadao.vn.

According to Tin Tuc Newspaper