According to preliminary statistics from four banks, BIDV, Vietcombank, Agribank and VietinBank, about 13,494 customers were affected by storm No. 3 with outstanding debt of about VND 191,457 billion.

On September 18, in Hanoi, Deputy Governor of the State Bank of Vietnam Dao Minh Tu chaired a meeting to discuss and deploy solutions to support businesses and people affected by storm No. 3.

The Deputy Governor requested credit institutions to objectively and transparently review the level of impact and classify the affected subjects to develop appropriate support programs.

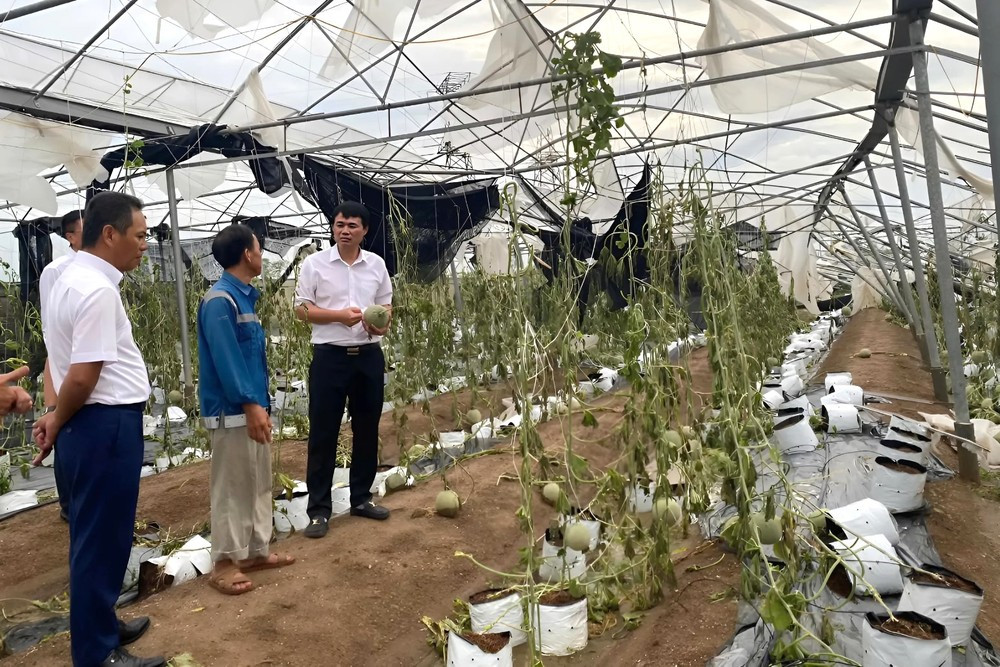

Speaking at the opening of the meeting, Deputy Governor Dao Minh Tu emphasized that storm No. 3 (Yagi) caused serious and heavy damage to people, property, crops, livestock, and socio-economic infrastructure, greatly affecting the material and spiritual lives of the people, production and business activities, especially agricultural production, services, and tourism.

Preliminary statistics up to September 17, 2024, over 307,400 hectares of rice, crops, and fruit trees were flooded and damaged; 3,722 aquaculture cages were damaged and swept away; nearly 3 million livestock and poultry died and nearly 310,000 urban trees were broken... The total property damage caused by storm No. 3 is preliminarily estimated at over 50,000 billion VND, forecast to reduce the GDP growth rate for the whole year by about 0.15% compared to the growth scenario of 6.8% -7%.

According to a quick preliminary summary as of September 17, 2024 from credit institutions and 26 branches of the State Bank in the affected areas, the damage situation is about 73,000 customers affected with an estimated outstanding debt of about 94,000 billion VND. According to preliminary statistics of 4 state-owned commercial banks, namely BIDV, Vietcombank, Agribank and VietinBank, there are about 13,494 customers affected with an outstanding debt of about 191,457 billion VND. It is expected that the number of customers and outstanding debt affected will increase in the coming days as credit institutions and State Bank branches continue to compile and update data.

“The damage caused by storm No. 3 is too great. When we went to the locality, many aquaculture households lost almost everything. Customers faced many difficulties and helplessly watched their assets being swept away by the storm,” the Deputy Governor shared.

With such a large debt impact, the Deputy Governor emphasized that this is also a big problem for the banking industry. Without timely and appropriate policies, not only customers but also the banking industry itself will face difficulties.

In Resolution 143 recently issued, the Government assigned the State Bank to report to the Prime Minister on the classification of assets, the level of risk provisioning, the method of risk provisioning and the use of risk provisioning to handle risks to support customers facing difficulties and losses due to the impact of storm No. 3. In addition, it directed credit institutions to proactively calculate support plans, restructure terms, maintain debt groups, consider exempting and reducing interest rates for affected customers, develop new credit programs with appropriate preferential interest rates, and continue to provide new loans to customers to restore production and business after the storm in accordance with current legal regulations.

At the conference, Mr. Nguyen Viet Cuong, Deputy General Director of Vietcombank, said that on the first working day after the storm, the bank asked branches in the affected areas to make statistics on the damage. At the same time, it launched programs to support people and businesses affected by the storm.

According to statistics at 39 branches of Vietcombank, the outstanding debt affected by storm No. 3 is up to VND 105,000 billion, accounting for 7% of outstanding debt, of which VND 12,900 billion is seriously affected. In parallel, after reviewing, Vietcombank also introduced a policy of reducing lending interest rates by 0.5%/year for existing and new loans of customers directly affected by the storm. According to the bank's estimate, about 130 customers are eligible for support with an amount of VND 22,000 billion.

Through preliminary statistics on the damage caused by storms and floods, Mr. Hoang Minh Ngoc, Deputy General Director of Agribank, said that as of September 16, Agribank had a total of over 12,600 borrowers affected by storm No. 3, with an estimated outstanding loan balance of VND 25,000 billion; expected outstanding loan loss is over VND 8,000 billion, of which the main areas affected are seafood, farming, livestock, etc.

Agribank has directed the entire system, especially branches in provinces affected by the storm, to immediately implement solutions to support customers such as restructuring debt repayment terms, considering interest rate exemptions and reductions according to the level of damage, and continuing to provide new loans...

Specifically, based on the level of damage to customers, the bank will reduce interest rates by 0.5% - 2%/year and waive 100% of overdue interest and late payment interest from September 6 to December 31, 2024. The bank also set up a working group to grasp the damage situation of customers, specifically assess the damage, support insurance payments and propose timely support plans for customer branches. To date, Agribank has coordinated with ABIC Insurance Company and other insurance units to promptly determine the damage and compensate customers about 150 billion VND.

According to Mr. Tran Long, Deputy General Director of BIDV, immediately after receiving the direction of the State Bank, BIDV reviewed and assessed the situation in the whole system. BIDV has proactively restructured debt and reduced interest rates for customers in accordance with the direction of the State Bank. The bank plans to reduce lending interest rates and support interest rates for new borrowers, especially short-term loans, to restore production and business activities arising from September 6. The level of interest rate support for new loans is expected to be about 1%. For existing loans, consider reducing interest rates by 0.5%.

Similar to other banks, VietinBank representatives said they also implemented preferential interest rate programs, credit support to reduce loan interest rates for old customers and support loan interest rates for new customers according to the Government's direction to support customers to overcome production and business activities.

Concluding the conference, Deputy Governor of the State Bank Dao Minh Tu affirmed that banks have taken practical actions and shared and accompanied people and businesses right after storm No. 3 passed.

In the spirit of harmonious benefits and shared risks, the Deputy Governor requested that credit institutions continue to accompany, share, and support customers in many aspects, not only with financial resources and capital, but also with consulting and encouragement, not turning their backs on customers in this difficult time; organize and synchronously implement solutions in a transparent and public manner, absolutely not taking advantage of policies, and applying them to the right subjects.

The Deputy Governor also requested credit institutions to develop a mechanism for timely and complete reporting and monitoring with competent authorities, the State Bank, and local authorities; and to continue to promote and enhance communication of mechanisms, policies, and implementation plans through various means.

In addition, the Deputy Governor requested credit institutions to objectively and transparently review the level of impact and classify the affected subjects to develop appropriate support programs; develop support programs suitable to the capacity of each credit institution in a positive spirit, with the highest responsibility, focusing on policies to extend and postpone debt repayment; policies to reduce interest rates for old loans affected by storms and floods as well as new loans; continue to coordinate with ministries, branches, localities and the State Bank to join hands to overcome the consequences caused by storm No. 3...

“During difficult times for customers, the bank’s encouragement and financial support helps them ease their worries. Banking requires high prestige. Therefore, what you say, do exactly as you say, and be open and transparent,” the Deputy Governor emphasized.

In order for credit institutions to boldly implement support solutions, the State Bank is also developing a Circular guiding the mechanism for extending and deferring debts affected by storm No. 3. During the implementation process, if there are any difficulties or problems, credit institutions should proactively report and propose to the management agency.

VN (according to VNA)