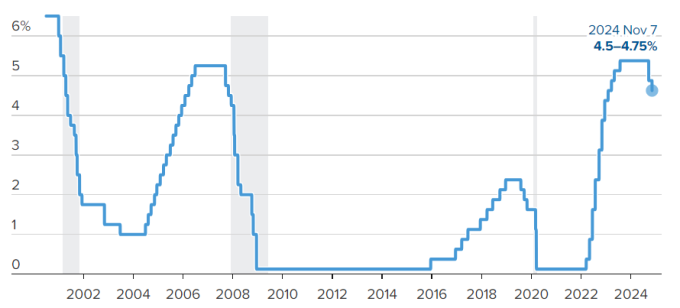

The US Federal Reserve (Fed) cut interest rates for the second time this year, by 25 basis points (0.25%).

On November 7, the Fed decided to continue easing monetary policy. Accordingly, the US reference interest rate fell to 4.5-4.75%, a decrease of 25 basis points (0.25%). This level is half of the adjustment in September (0.5%).

Fed officials said the US job market has eased and inflation is moving toward the 2% target. "Economic activity has been growing at a steady pace," the Fed's Federal Open Market Committee (FOMC) said.

The agency also repeated comments it made two months ago that risks to the job market and inflation are “roughly equal.”

The US stock market has yet to react to the Fed's interest rate decision. The DJIA was almost flat. The S&P 500 rose 0.65% and the Nasdaq Composite rose 1.38%.

Meanwhile, the world spot gold price increased again, at 2,693 USD in the session on November 7. This level is nearly 35 USD per ounce higher than the closing price of the previous session.

The Fed's benchmark rate applies to overnight interbank loans. It's not what consumers and businesses pay, but the Fed's moves affect lending and savings rates.

When interest rates are low, borrowing costs are cheaper, allowing businesses to invest in new projects or hire more employees. Similarly, consumers spend more because savings are less attractive.

However, economists say it will take at least a year for the impact of this adjustment to be felt in the economy. This explains why interest rates in the US increased in early 2022, but inflation only started to cool down a year later.

Over the past year and a half, the Fed has raised interest rates 11 times to curb inflation.

The meeting of this agency comes just one day after the US presidential election. The election of Donald Trump could affect the agency's plan to adjust interest rates, because Trump's policies of raising import tariffs and cutting domestic taxes are expected to push inflation back up.

The Fed has one more meeting next month, and markets are still expecting another 25 basis point rate cut.

University (according to VnExpress)