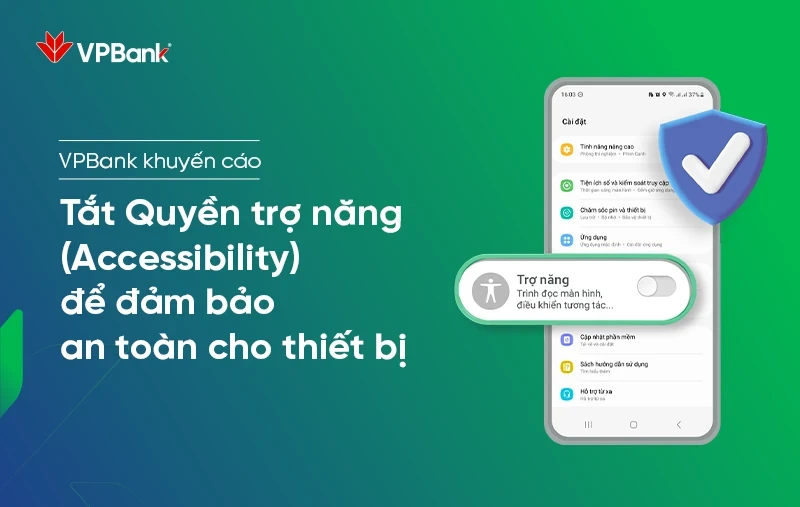

VPBank recommends that customers turn off all Accessibility permissions for harmful applications before being able to successfully log in to VPBank NEO and make transactions.

Recently, authorities have continuously warned about a form of fraud that is currently flourishing in many big cities, with criminals impersonating tax and public service officials to threaten and pressure users to download and install malicious software.

Next is taking advantage of the weakness of the Android operating system's Accessibility to take control of the phone, steal personal information, and steal money from bank accounts.

Banks have almost unanimously warned customers about the risk of having money stolen from their bank accounts and recommended that customers immediately turn off Accessibility permissions enabled for risky applications before making financial transactions on mobile devices.

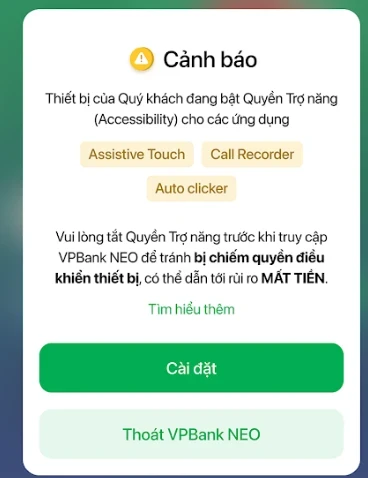

Today (December 8), VPBank leaders said that when customers log in to the VPBank NEO app version 5.11.2 or higher, they will receive a warning screen as below, indicating the names of risky applications that have enabled accessibility rights on the customer's device. According to this bank, only devices that have granted Accessibility Rights to risky applications will receive the warning below.

If the customer selects the “Settings” button, they will be taken directly to the Settings section of the phone to turn off the Accessibility Permissions of the applications that are warned of risks. After the customer has turned off all the recommended applications, the next time they log in to VPBank NEO, they will not receive a warning.

In case the customer selects the “Exit VPBank NEO” button, the next logins will continue to receive warnings. Until all risky applications have been disabled Accessibility, the user can log in to use VPBank NEO.

Explaining this, VPBank representative said that granting Accessibility Rights to risky applications by customers can cause the customer's mobile device to be taken over, from which the attacker only needs to wait for the customer to log in once to the bank account after granting Accessibility Rights to take ownership of that account.

Once the account is taken over, the attacker will perform all transactions on the account right on the device itself, which is now remotely controlled and there is no sign on the phone that the device is being controlled by the attacker. This makes it impossible for customers to know whether their device has been taken over or not and when the attacker is controlling the device.

To help customers avoid this risk, VPBank recommends that customers turn off all Accessibility Rights for dangerous applications before being able to successfully log in to VPBank NEO and make transactions. The warning process will repeat if the customer's device continues to grant Accessibility Rights to new risky applications.

Security experts believe that this action can 100% protect customers who have granted Accessibility Rights to unsafe applications.

Since mid-November, the bank has recommended that customers turn off Accessibility on Android devices before transacting on VPBank NEO.

According to Vietnam+