The global economy is forecast to generally stabilize in 2025 with growth of approximately 3%, inflation cooling, layoffs easing but trade war risks remaining.

"The global economy has shown resilience. Inflation has fallen in line with central bank targets, while growth remains stable," said Mathias Cormann, Secretary-General of the Organization for Economic Cooperation and Development (OECD).

In 2024, the OECD forecasts world GDP growth of 3.2%, in line with the International Monetary Fund (IMF). The organization believes that high interest rates to fight inflation have not caused the sharp recession that most forecasters feared. Meanwhile, spending on services and demand for labor remain strong.

As central banks cut interest rates later in the year, a soft landing—one that cools the economy without triggering a recession—is “on the horizon.” That puts the global economy in a relatively good position to enter 2025, according to S&P Global. Here are some key predictions:

Global GDP up about 3%, 'variable' in US

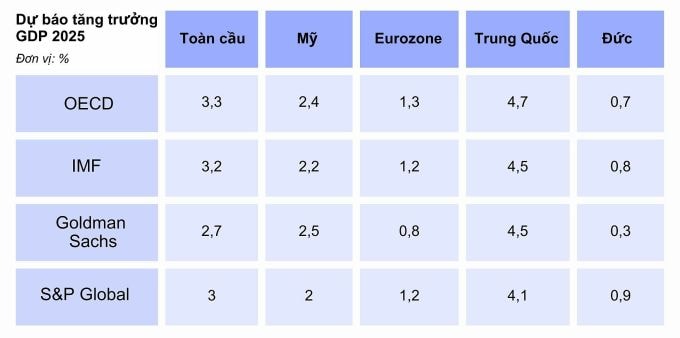

Forecasting global GDP growth in 2025, the OECD is the most optimistic at 3.3%, followed by the IMF at 3.2%. More cautiously, Morgan Stanley and Goldman Sachs forecast 3% and 2.7%, respectively. Outlooks vary significantly across regions.

Goldman Sachs said the world's largest economy expanded faster than other developed countries for the third consecutive year, reaching 2.5%. The OECD said that figure could reach 2.4%. The European economy is forecast to grow only 1.3%, Japan 1.5%, China 4.7%, according to the OECD. However, the "variable" depends on the US.

“The outcome of the US election opens the door to policy changes that will ripple through the global economy,” said Seth Carpenter, chief economist at Morgan Stanley, who said investors will face increased uncertainty.

Eurozone GDP could grow just 0.8% next year, according to Goldman Sachs, due to new US tariffs and regulations – particularly if there is a trade war. China is also not immune to the impact of Mr Trump’s tariffs, so GDP next year will grow just 4.1%, according to S&P Global.

"While China's stimulus measures will support growth, we expect the economy to remain exposed to US trade tariffs on exports," S&P analysts said.

Trade war risk at medium level

Donald Trump’s return to the White House and China’s slowing economy will shape global commodity markets through 2025, according to Reuters. No model can predict the outcome clearly. Prices for crude oil, liquefied natural gas, iron ore, coal and metals will be more unpredictable than ever.

Goldman Sachs said that if trade uncertainty rises to the high levels seen in 2018-2019, US GDP could fall by 0.3%, while the eurozone and China could fall by 0.9% and 0.7%, respectively. "We could lower our forecasts further if the trade war escalates further," said Goldman Sachs Research Chief Economist Jan Hatzius.

If Mr Trump raises tariffs, the risk of a trade war is medium, as retaliatory measures from other countries would be designed to avoid escalating tensions with Washington, according to research organisation Capital Economics (UK).

They believe that retaliation from other countries will be designed to avoid escalating tensions with Washington, in line with the experience of Mr Trump’s first term and meaning global trade will grow – albeit modestly – next year.

A worse-case scenario would see the EU and China respond aggressively, targeting US tech companies for example. In addition, allowing their currencies to weaken against the dollar could be seen by Washington as a tariff “dodging” and a reason for the US to impose additional protectionist measures. A full-blown trade war could then erupt, with a potential 2-3% reduction in global GDP.

But it is also possible that Mr Trump is simply using the threat as a negotiating tactic. In this scenario, Mr Trump might not raise tariffs if he believes he has “won” his trade deals with other countries.

Inflation down, interest rates hard to fall deeply

Inflation, which has worried policymakers and investors for the past few years, will continue to normalize next year, according to Morgan Stanley. However, progress could slow and the specifics will vary from country to country.

Inflation in OECD countries is expected to decline further, from 5.4% in 2024 to 3.8% in 2025, as monetary policy remains tight. In the US, inflation could recover by late 2025, driven by higher prices and labor costs due to Mr Trump’s new tariffs and immigration policies. In the euro area and the UK, inflation will gradually decline.

In Asia, Japan, where deflation has been an economic problem for decades, the Bank of Japan (BOJ) has revised its inflation forecast for fiscal 2025 from 2.1% to 1.9%. Meanwhile, China continues its fight against deflation. Morgan Stanley economists predict that inflation in the country will struggle to recover to positive levels as excess supply re-emerges due to trade disruptions.

A key reason for optimism about global growth is that inflation has fallen sharply over the past two years, indirectly supporting central banks to normalize monetary policy, according to Goldman Sachs Research Chief Economist Jan Hatzius.

However, central banks may take different actions depending on the circumstances. The Fed’s easing will be delayed until mid-2025, while the European Central Bank and the Bank of England may continue to cut. The Bank of Japan will raise rates twice in 2025, according to Morgan Stanley.

Steady hiring, influenced by AI

Despite the large layoffs announced this year, the OECD said unemployment remains at historically low levels. Goldman Sachs Research chief economist Jan Hatzius said the job market is gradually rebalancing.

ManpowerGroup Chairman and CEO assessed that after the personnel fluctuations in recent quarters, companies have gradually adapted to the unstable economic situation and maintained their existing workforce.

ManpowerGroup's latest jobs outlook survey, which collects data from more than 40,000 employers in 42 countries, shows that hiring plans in the first quarter of 2025 are relatively stable compared to the last quarter of 2024, with only a 1% decrease year-on-year.

“Moving into 2025, we see hiring trends stabilizing, with employers retaining existing talent and planning to hire some in the coming quarter,” said Jonas Prising, President and CEO of ManpowerGroup.

Meanwhile, LinkedIn is optimistic that hiring will rebound strongly, with 52% of companies planning to hire more people, compared to just 24% last year. Small businesses are more optimistic than large organizations about expanding their teams. One trend is that many employers will prioritize practical skills over qualifications.

The career social network also assessed that the global job market continues to undergo major changes due to the trend of applying artificial intelligence (AI), changing workforce expectations and economic developments.

Consumer confidence has not taken off yet

Consumer confidence is an indicator of how people feel about the economy and their personal finances, as well as how likely they are to spend. Their sentiment about 2025 reveals the outlook for imports and exports, retail and services, and the stock market.

The Conversation The US economy is expected to remain resilient in 2025, with continued growth in real incomes helping to boost purchasing power. However, some Americans are feeling financial pressure. The unemployment rate edged up towards the end of the year, although it remains low. Therefore, purchasing power is still growing amid “cautious optimism”.

In Europe, the Eurozone consumer confidence index in December, surveyed by the European Commission (EC), reached -14.5 points, continuing to decline compared to -13.7 points last month. Next year, the index is forecast to improve, fluctuating around -2. In the Eurozone, this index ranges from -100 to 100, in which the zero mark represents psychological neutrality.

In Asia, the IMF forecasts growth of 1.9% in 2025, with consumer confidence in major economies fluctuating and challenges ranging from economic policy and global market volatility.

For China, the World Bank raised its GDP growth forecast to 4.5% for 2025, up 0.4 percentage points from its previous forecast. But it warned that weak household and business confidence, along with difficulties in the real estate sector, would continue to weigh on growth.

In South Korea, the consumer confidence index surveyed by the Bank of Korea in December fell sharply to 88.4 points from 100.7 points in November, the lowest since November 2022. More than 50% of respondents expected to reduce spending next year, especially on travel, dining out and entertainment, due to concerns about the economic situation.

The situation was more positive in Japan, with consumer confidence rising in November from October. The country's central bank is set to continue raising interest rates as it forecasts rising inflation, which could affect consumer spending.

There are still many persistent instabilities.

The OECD said that geopolitical conflicts could disrupt energy markets, negatively impacting confidence and economic growth. In addition, escalating trade tensions also risked hindering international trade development. "Geopolitical tensions pose short-term risks, high public debt levels and weak medium-term growth prospects," OECD Secretary-General Mathias Cormann summarized.

Therefore, to stabilize the macroeconomy, countries need to loosen monetary policy cautiously to ensure inflationary pressures are contained in the long term; and rebuild fiscal space to create room for public spending. Officials and businesses must also pay attention to the labor shortage that is a challenge in many countries and is exacerbated by population aging, according to OECD Chief Economist Alvaro Pereira.

Therefore, he said, it is necessary to focus on promoting education and skills development, reducing barriers to market entry, creating more investment opportunities and improving the flexibility of the workforce. "Structural reform is essential to build the foundation for stronger and more sustainable growth," he said.