The Los Angeles wildfires could prompt many insurance companies to leave the California market, leaving residents at risk of not being compensated if the disaster strikes again.

Nick Ramirez looked at a screen in his insurance agency’s office in Los Angeles, watching a map of the wildfires raging in the area. Thousands of million-dollar homes and clients’ belongings were being engulfed in flames.

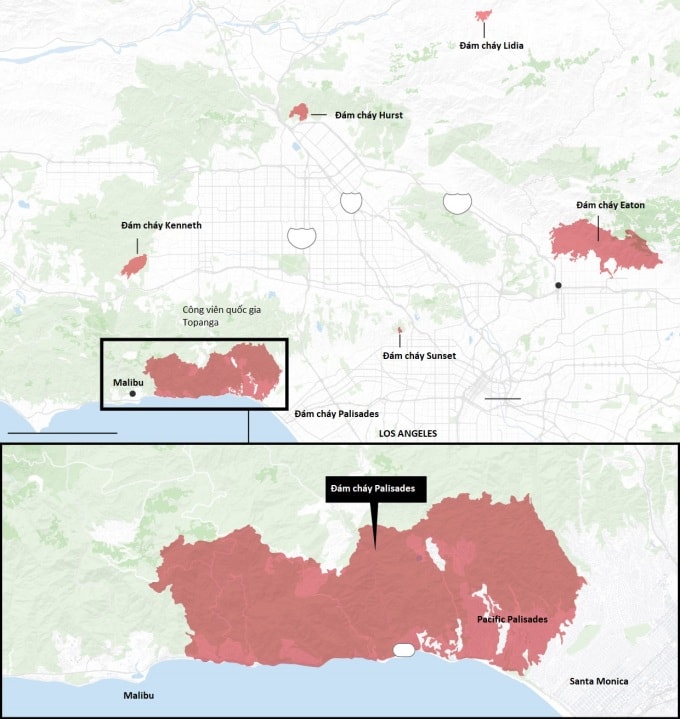

"Haley's house is gone. Oliver's house is gone," Ramirez said, pointing to small dots in a rapidly spreading sea of red. "In almost 10 years of being an insurance agent, this is the worst situation I've ever seen."

The wildfires have been burning in the Pacific Palisades, Eaton and Hurst neighborhoods of Los Angeles since January 7 and have continued to spread, destroying many residential areas. Firefighters say the spread has slowed, but none of the major fires are under control.

The wildfires have destroyed thousands of structures and initial damage estimates are in the tens of billions of dollars. The Palisades Fire alone has destroyed more than 5,000 homes and other structures.

Observers warn that the damage from the devastating wildfires in California could deal a heavy blow to the insurance market, which is already reeling from successive crises.

“It’s a really bad disaster. Wildfires in January? This just proves the point of many insurers that climate change is an increasing risk,” said Amy Bach, CEO of United Policyholders, a consumer advocacy group.

The massive wildfire sweeping through the affluent Pacific Palisades neighborhood could make it "one of the five costliest wildfires in U.S. history," according to brokerage firm Aon.

California is the largest home insurance market in the US, but it is also one of the most challenging regions for insurers. Aon said that as of last year, eight of the 10 costliest wildfires in the US occurred in the state.

Many of the top insurers have been pulling out of the state, leaving many people affected by California's wildfires with only state-sponsored insurance or no insurance at all.

State Farm, the state's largest home insurer, announced in March that it would not renew 72,000 property insurance policies, while Chubb and its subsidiaries stopped writing new policies on high-value homes because of the high risk of wildfires.

It's unclear how many homeowners in Pacific Palisades and elsewhere may be covered by insurance after the disaster, but some say their insurance companies didn't renew their policies before the wildfires.

Actor James Woods, who lost his home in the Palisades fire, posted on X on January 7 that "one of the major insurance companies canceled all policies in our neighborhood 4 months ago."

State Farm announced last year that it would not renew 1,626 policies in Pacific Palisades when they expire in July 2024. A company spokesperson declined to comment on the decision, but said that “our number one priority is the safety of our customers, agents and employees impacted by the wildfires, as well as supporting our customers during this time of tragedy.”

California is facing more frequent and larger wildfires due to long-term climate change, according to the state Environmental Protection Agency. That trend is leading to increased insured property losses and could lead to higher premiums.

“These events will continue to have a profound and negative impact on the state’s insurance market. Increased claims could increase premiums and reduce insurers’ ability to pay,” said Denise Rappmund, senior analyst at Moody’s Ratings.

If insurers continue to pull out of California, it will put pressure on the government-funded FAIR Plan, which is considered a last resort for many California homeowners, even though FAIR Plan policies typically have limited coverage.

FAIR Plan policies cover up to $3 million in damage to property caused by certain causes, including fire. However, they do not include personal liability or other types of protection that private insurers typically provide.

FAIR Plan saw its number of contracts increase from just over 200,000 in September 2020 to over 450,000 in September 2024. Its risk coverage also nearly tripled to $458 billion over the same period.

Pacific Palisades has one of the largest concentrations of FAIR Plan policyholders in California, with the company estimating its coverage in the area at $5.89 billion.

JP Morgan analysts estimate that total wildfire damage in Los Angeles County could be close to $50 billion, while insurance payouts could be as high as $20 billion. Some other estimates suggest the losses could be even greater.

It’s unclear how much FAIR Plan will have to pay for wildfire or other disaster claims this time around, and how that will impact its ability to pay. But observers say FAIR Plan could call on other insurers to help if necessary.

A FAIR Plan spokesperson said it was “too early to provide an estimate of losses as claims have only just begun to be submitted and processed.” The spokesperson said the company had payment mechanisms in place to ensure all customer claims were properly processed.

"I think it will take about 45 days before we can know what the real loss is," said Max Gilman, head of insurance commissions in California at brokerage HUB International.

New fires in Los Angeles this week could further undermine efforts to attract insurers to California. “Insurers will re-evaluate their benefits versus the potential risk of wildfires,” said Sridhar Manyem, senior director at AM Best.

Rising losses from fires, floods, wildfires and storms pushed global natural catastrophe insurance claims to more than $140 billion last year, far exceeding the $94 billion average for the 2013-2023 period.

It's not just insurance companies, many people are also starting to rethink buying a home in California.

Brett Dedeaux, whose home in the neighborhood adjacent to Will Rogers Historical Park was affected by the wildfire, wonders “what’s going to happen to insurance now.” He said few insurance companies are willing to provide coverage in areas prone to wildfires.

“Does it make sense to own a house here with expensive insurance?” he said.

TB (according to VnExpress)