President Donald Trump's desire to impose import tariffs and reduce domestic taxes in the context of high inflation and interest rates will be a test for the US economy.

On January 20, Donald Trump was inaugurated as the 47th President of the United States. He is expected to conduct an unprecedented experiment in the world's largest economy, through a series of tax cuts for domestic citizens and businesses, and increase import taxes on foreign goods in the context of high inflation and interest rates in the US.

During his inauguration, he pledged to quickly overhaul trade relations, increase fossil fuel extraction, and push Congress to pass another round of tax cuts. To do so, the US president signed more than 200 documents on his first day in office. He declared a national energy emergency, withdrew the US from the Paris Climate Agreement, and rescinded former President Joe Biden’s executive orders to promote electric vehicles. He also pledged to “do whatever it takes” to curb inflation.

"I am directing all members of my Cabinet to mobilize the full range of tools at our disposal to defeat record inflation and rapidly bring down prices and costs," he declared in his inaugural address. Mr Trump blamed the soaring prices on "excessive spending".

The president has called for action to lower housing prices and eliminate unnecessary costs and regulations that make health care and household goods more expensive. Trump also wants to roll back climate policies that he says are driving up food and energy prices.

It is unclear whether these policies will help lower prices in the United States. Mr. Trump has asked officials to report monthly on the effectiveness of their policies. But controlling inflation is the job of the US Federal Reserve, which operates through interest rates and other policy levers.

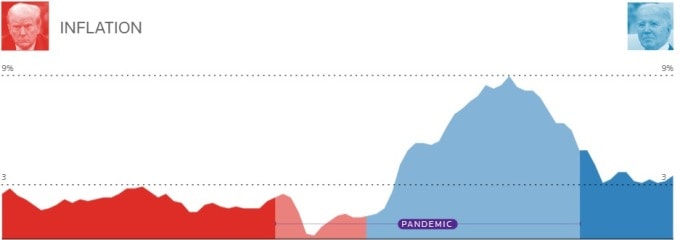

The US economy is very different now than it was when Mr Trump took office eight years ago. Inflation was low, just under 3%, as the US recovered from the recession.

Inflation has cooled, but commodity prices are still 20% higher than they were four years ago. The US economy is forecast to slow down in 2025 and 2026. The country's public debt has exceeded the $36 trillion ceiling, and negotiations to raise the debt ceiling in the US Congress have always been difficult.

Many economists are skeptical that Mr Trump’s policy agenda will have the desired effect. “We think these policies will tip the US towards stagflation,” said Paul Ashworth, an economist at Capital Economics.

Paul predicts that Trump’s tariffs will push inflation up to nearly 3%. US inflation was previously forecast to be close to 2% this year. Growth could also slow to 1.5%, from 2.5% last year.

The US President's announcement of a series of major changes in the fields of trade, energy, and immigration also makes experts worried. "Uncertainty is also a tax on the economy. In economic management, you have to have a clear plan. Otherwise, people will stop making decisions, causing economic activity to slow down," said David Kelly, chief strategist at JPMorgan Asset Management.

Meanwhile, the fight against inflation in the US is not over yet. The consumer price index (CPI) in December increased by 0.4% compared to November, according to the US Department of Labor. This is the highest increase since the beginning of last year, showing that the Fed still has a lot of work to do.

Some Fed officials have also expressed concern that Trump’s policies could cause prices to rise again. Earlier this month, Richmond Fed President Thomas Barkin predicted that the impact of Trump’s immigration and trade policies could lead to higher prices and wages. The strength of the economy could keep inflation high.

The president’s advisers, however, have dismissed these concerns. Members of Trump’s Council of Economic Advisers have argued that broad tariffs would not cause inflation, as the dollar would appreciate, making imports cheaper. They also believe that cutting taxes and regulations would boost US GDP and shrink the deficit.

One of the biggest uncertainties facing the US economy right now is Mr Trump’s import tariffs and the response from America’s trading partners. During his campaign, he called for a 10% tariff on all goods entering the US. After taking office, he revealed that he might impose a 25% tariff on Canada and Mexico and a 10% tariff on China starting in early February.

Mr. Trump may not impose tariffs as harshly as expected and there will be exceptions, but the retaliation of other countries could make the situation worse. Canadian Foreign Minister Mélanie Joly said on January 20 that she is “preparing retaliatory measures” if the US imposes tariffs.

Many economists say tariffs hurt consumers. During the trade war of Mr. Trump’s first term, the impact of tariffs was most clearly felt when other countries raised their own tariffs in retaliation, making American agricultural products and wines more expensive abroad.

Within the Republican Party itself, many lawmakers are skeptical about the tax. "I'm worried. Because tariffs are a double-edged sword," said Ron Johnson, a Republican senator from Wisconsin.

In his inaugural address, Mr. Trump said he would not hesitate to make decisions on import tariffs and would act quickly to reshape the global trading system. He announced plans to create an agency to collect the tariffs and asserted that the policy would make Americans more prosperous.

"Instead of raising domestic taxes and enriching other countries, we impose import tariffs, tax foreign countries to enrich our own people," he said.

VN (according to VnExpress)