In the first trading session of the week on April 22, the stock market had a strong recovery.

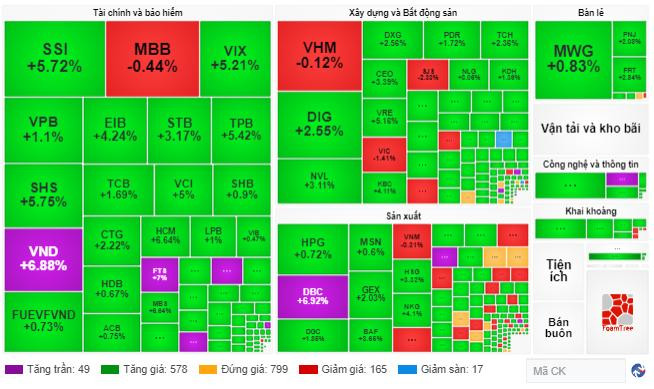

At the end of the afternoon session on April 22, VN-Index increased by more than 15.37 points, to 1,190.22 points; HNX-Index increased by more than 4.51 points, to 225.31 points. The entire market had nearly 630 stocks increasing and nearly 200 stocks decreasing. The top stocks with the strongest increase were BID, CTG, SSI, TCB, VRE, GVR, TPB, HVN, VND, FPT.

Although the market increased by more than 15 points today, the trading volume was not much, only reaching nearly 824 million shares, with liquidity of nearly 17,920 billion VND.

The industry group that increased positively today helped the market increase, including stocks, because the news that HOSE is striving to put the KRX system into operation (go-live) from May 2 is expected to bring new products, trading and payment solutions to the Vietnamese stock market.

Contributing to this growth momentum is the indispensable participation of the banking group when recording widespread green color although the increase was not much, with typical large-cap codes such as BID, CTG, TCB and VPB...

In addition, the real estate industry also received attention from investors with most of the leading stocks increasing from the beginning of the morning session, with prominent codes such as VRE, NVL, KBC and DIG....

This week (April 22-26), securities companies predict that the VN-Index will continue to fluctuate around the 1,175 point threshold. If it breaks through this threshold, the index may fall to the support level of 1,150.

Specifically, Vietcap Securities predicts that selling pressure will continue to be pushed to challenge the MA200 support at 1,175 points of VN-Index. If this line breaks, the index may retreat to the 1,150-point area to seek support from new demand. In case VN-Index can narrow the decline and close above 1,175 points, the index may experience a technical recovery to 1,200 - 1,210 points. On the contrary, VN-Index will temporarily enter the bear market area.

Phu Hung Securities Company (PHS) recommends that the general strategy is to wait for a recovery to restructure the portfolio, with the recommended weight at a low to medium level; for investors holding a lot of cash and able to withstand risks, they can consider bottom fishing with a low weight of stocks that have fallen too far to support. In addition, investors should stay calm and take advantage of the recovery to reduce the weight of stocks to a safe level, and should not bottom fishing because the market has not shown any signs of stopping its decline.

Yuanta Vietnam Securities Company also forecasts that this week, the VN-Index may return to the 100-session moving average (ie 1,190 points). At the same time, technical indicators have fallen deeply into the oversold zone, especially the short-term sentiment indicator has fallen to the overly pessimistic zone, indicating that the market may soon experience a technical recovery in the coming trading sessions. In addition, the 1,160 - 1,165 point zone is considered an important support zone for the VN-Index, with short-term risk expectations gradually decreasing.

The short-term trend of the general market remains bearish. Therefore, Yuanta recommends that short-term investors can limit selling at this stage and observe market developments. At the same time, if investors accept high risks and have a high cash ratio, consider disbursing with a low ratio to explore the short-term trend.

According to Beta Securities Company, domestic and international macro news has not really brought positive signals to the Vietnamese stock market in the past time. Therefore, in the coming time, the risks of fluctuations and adjustments are still likely to remain high, investors should be cautious in making decisions on stock trading to effectively manage risks.