The basic salary increased from July 1st, with the highest increase ever, but many people did not have time to celebrate but were worried because they suddenly became subjects of personal income tax.

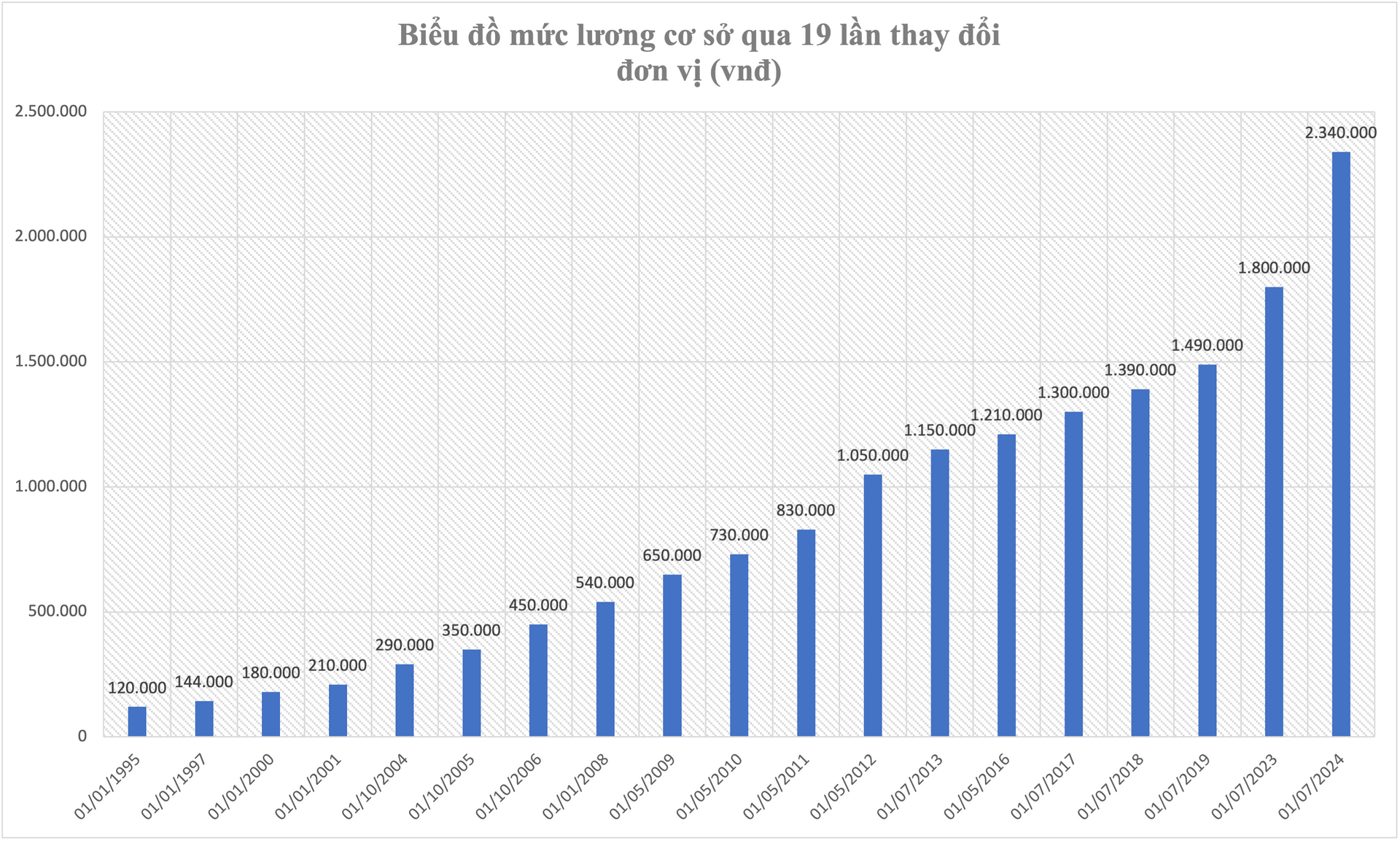

Starting today, July 1, the basic salary will be adjusted up from VND1.8 million to VND2.34 million for all cadres, civil servants and public employees. This 30% increase is the highest increase ever, contributing to improving the lives of workers and creating motivation to increase productivity. In addition, pensions and social insurance benefits will also increase by 15%.

Although happy because of the significant increase in salary, many people are still worried that the actual amount of money they receive will not be much when prices are at risk of increasing and most importantly, they will have to pay more taxes because the family deduction level remains the same. In fact, many people suddenly become subjects of personal income tax (PIT) even though they were not previously subject to this.

Ms. Mai Lan (Hanoi) shared that when she heard the news of salary increase from July 1, she was very happy because her salary will be increased by nearly 2 million VND. In addition, the agency also paid the additional salary based on business results and many other allowances, so her total salary increased from nearly 10 million VND to nearly 12 million VND. Thus, Ms. Lan, who is not subject to tax, has had to pay personal income tax from this month.

"I will have to pay tax on an income of nearly 1 million VND. Although it is not too much, but combined with the increasingly expensive prices of goods, the risk of further increases according to salary, it can be seen that the income from salary increase is really not worth much. For me, this joy is not complete.", said Ms. Lan.

Although she did not suddenly have to pay taxes like Ms. Mai Lan, Ms. Thanh Ha (Hanoi) was also disappointed to see that along with the increase in salary, the amount of tax to be paid also increased. Specifically, the increase in salary has brought Ms. Ha's total income from more than 18 million VND to an estimated more than 20 million VND. Meanwhile, the personal income tax she currently has to pay is 450,000 VND/month and from July 1 is expected to increase to 650,000 VND, an increase of 200,000 VND. This increase is equivalent to 10% of the increased salary, and accounts for nearly 1/3 of the tax payable.

"We hope that salaries will increase to compensate for the increased living expenses, but if we keep the current family deduction level, a significant portion of the income from salary increases will "return" to the budget because of taxes. In addition, the price of goods is increasing, so the salary increase will not be able to compensate for any of it.", Ms. Ha said.

Ms. Thu Huyen (Hoang Mai) suggested: "I think the family deduction for taxpayers should be increased to correspond to their salary, for example from 11 million VND it can be increased to 14 million VND; the family deduction for dependents from 4.4 million VND can be increased to 6 million VND. Only then will the salary increase be truly meaningful.".

Mr. Minh Thanh (Dong Da, Hanoi) also worriedly calculated: "My total income is about 17 million VND/month. The personal income tax after calculating the family deduction for 2 children is enough to not have to pay any money. But from July 1st, my salary will increase, my income can be up to 19 million VND/month. Meanwhile, the family deduction is not increased, which means I will have to pay tax.".

Not only the people but also many National Assembly deputies believe that the family deduction applied from July 1, 2020 to present for taxpayers and dependents is no longer appropriate. The goal of increasing wages is to improve the lives of workers. However, if the family deduction is not adjusted in time, the effectiveness of this policy will be limited.

Delegate Ta Van Ha (Quang Nam) commented:"Now that the standard of living is increasing, costs are expensive and salaries have increased by 30%, family deductions should at least increase by 30%, or even 50% to be reasonable."

Delegate Nguyen Thi Thuy (Bac Kan) also said that the deduction for dependents of 4.4 million per month is really no longer suitable for the current situation, especially in big cities, causing damage to taxpayers. The deduction of 4.4 million has been maintained since 2020, while recently many essential goods and services have increased, some essential goods and services have even increased faster than income.

Delegates cited data from the General Statistics Office, compared to 2020, education service prices increased by 17%; food prices increased by 27%, especially gasoline prices increased by 105%...

If a family has young children and needs to hire a babysitter, they will have to pay at least 5 million VND, not to mention the expenses for the children. If the family has children going to school, the cost of education now accounts for the majority of the total expenses. If the family has elderly parents as dependents, it is not only the cost of food and living but also the cost of medical care and medicine.

Therefore, according to Ms. Thuy, the current family deduction level does not truly reflect the basic spending of families and individuals nor does it reflect the actual standard of living.

VN (according to VTC News)