The stock market fell across the board, especially in the real estate, banking and securities groups.

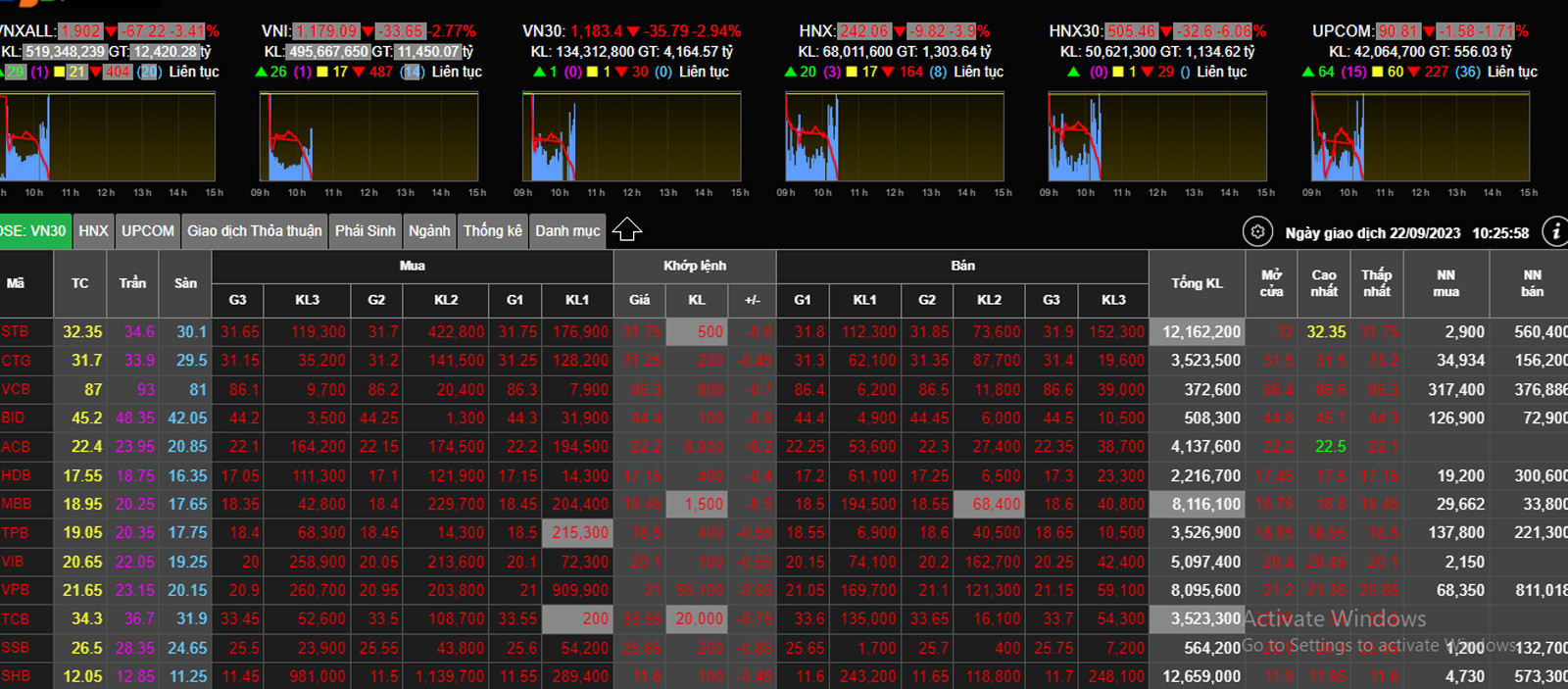

As of 10:30 a.m. on September 22, the VN-Index fell 37.5 points to 1,175 points (equivalent to a decrease of 3.1%). The VN30 Index fell more sharply. The HNX-Index fell more than 4.2% to 241 points. The Upcom-Index fell more than 2%.

All 30 stocks in the VN30 pillar group decreased in price. Of which, real estate and securities codes decreased sharply.

13 bank stocks in the VN30 group decreased, but the decrease was lower than that of real estate and securities stocks.

At 10:30 a.m., Vingroup (VIC) shares of Chairman Pham Nhat Vuong decreased by VND1,800 to VND50,400/share; real estate giant Vinhomes (VHM) decreased by VND1,900 to VND48,300/share; Vincom Retail (VRE) decreased by VND900 to VND27,250/share.

SSI Securities (SSI) at times fell almost to the floor.

Insurance, retail, steel stocks… all fell sharply.

At the end of the morning session on September 22, the VN-Index decreased by 32.81 points (-2.71%) to 1,179.93 points. Hoa Phat Group (HPG) decreased by 1,400 VND to 27,000 VND/share; Mobile World (MWG) decreased by 2,400 VND to 51,800 VND/share; Masan (MSN) decreased by 2,900 VND to 75,900 VND/share; VietJet (VJC) decreased by 2,500 VND to 96,800 VND/share...

Selling pressure increased sharply in the context of the stock market receiving some negative information, including the signal of tightening monetary policy of the US Federal Reserve (Fed) as well as the action of withdrawing money from the State Bank (SBV) in the context of the escalating USD/VND exchange rate.

Mr. Luu Chi Khang, Director of Research Center of CSI Securities Company, said that the high USD/VND exchange rate is the main factor affecting investors' psychology recently.

Regarding the decision to withdraw 10,000 billion VND in the open market by the State Bank, Mr. Khang said that the level is not large but is the cause.

In fact, over the past month, the USD/VND exchange rate has increased sharply, bringing the total increase of the USD compared to VND since the beginning of the year to over 2.9%.

The USD has risen from a stable level of around 23,600-23,700 VND/USD (selling price at banks in June-July) to 24,500 VND/USD (as of the morning of September 22). Recently, the central exchange rate announced by the State Bank of Vietnam also surpassed 24,000 VND/USD for the first time in history.

The situation became more worrying after the Fed decided to keep the federal funds rate (FFR) at a 22-year high of 5.25%-5.5% as expected. The agency signaled that it could make another hike later this year and fewer rate cuts than expected next year.

Thus, US interest rates are expected to continue to rise and remain higher for longer to fight inflation.

US interest rates are at 5.25-5.5%, while overnight interest rates in the Vietnamese interbank market are only around 0.2%. One-year interest rates at major commercial banks are only around 5.5%. Pressure on the VND is great.

On the afternoon of September 21, the State Bank of Vietnam unexpectedly issued 28-day term bills after half a year, thereby attracting nearly VND10,000 billion with an interest rate of 0.69%/year.

This move is considered appropriate in the context of excess system liquidity, and the goal is to reduce pressure on exchange rates in the coming time.

Mr. Luu Chi Khang said that the State Bank of Vietnam is withdrawing money to control the exchange rate without using other operations such as selling USD or increasing interest rates. This is a quite flexible way of doing things and it also shows that the State Bank of Vietnam still has room to intervene in the exchange rate.

The exchange rate issue is not as worrying as it was in October 2022 because Vietnam's import-export surplus is high. Disbursed and registered FDI both grew in the first 8 months of the year. Remittances remain stable. Meanwhile, foreign exchange reserves are high, at 95 billion USD.

Previously, many securities companies also gave similar assessments. Accordingly, instead of having to sell USD in the first 6 months of 2023, the SBV can still buy about 6 billion USD to increase foreign exchange reserves. And this could be a useful tool to help the SBV stabilize the exchange rate in the coming time.

According to Vietnamnet