Grab recently announced that Moca e-wallet will officially stop providing services from July 1.

On May 31, in a notice sent to customers, Moca said that it will officially stop the Moca e-Wallet service from July 1, 2024. Accordingly, this is part of the company's decision to restructure towards sustainable growth after careful assessments.

Moca also thanked users and said that if there is still a balance in the wallet, users can actively spend or withdraw to an active linked bank account from now until June 30. From July 1, Moca will refund if users still have a balance in the wallet, ensuring customer rights.

In addition, Moca also encourages customers to switch to other payment applications available on the Grab app such as ZaloPay, MoMo, or bank cards.

Finally, Moca provides detailed instructions for users on how to withdraw money from the e-wallet on the Grab app to a linked bank account.

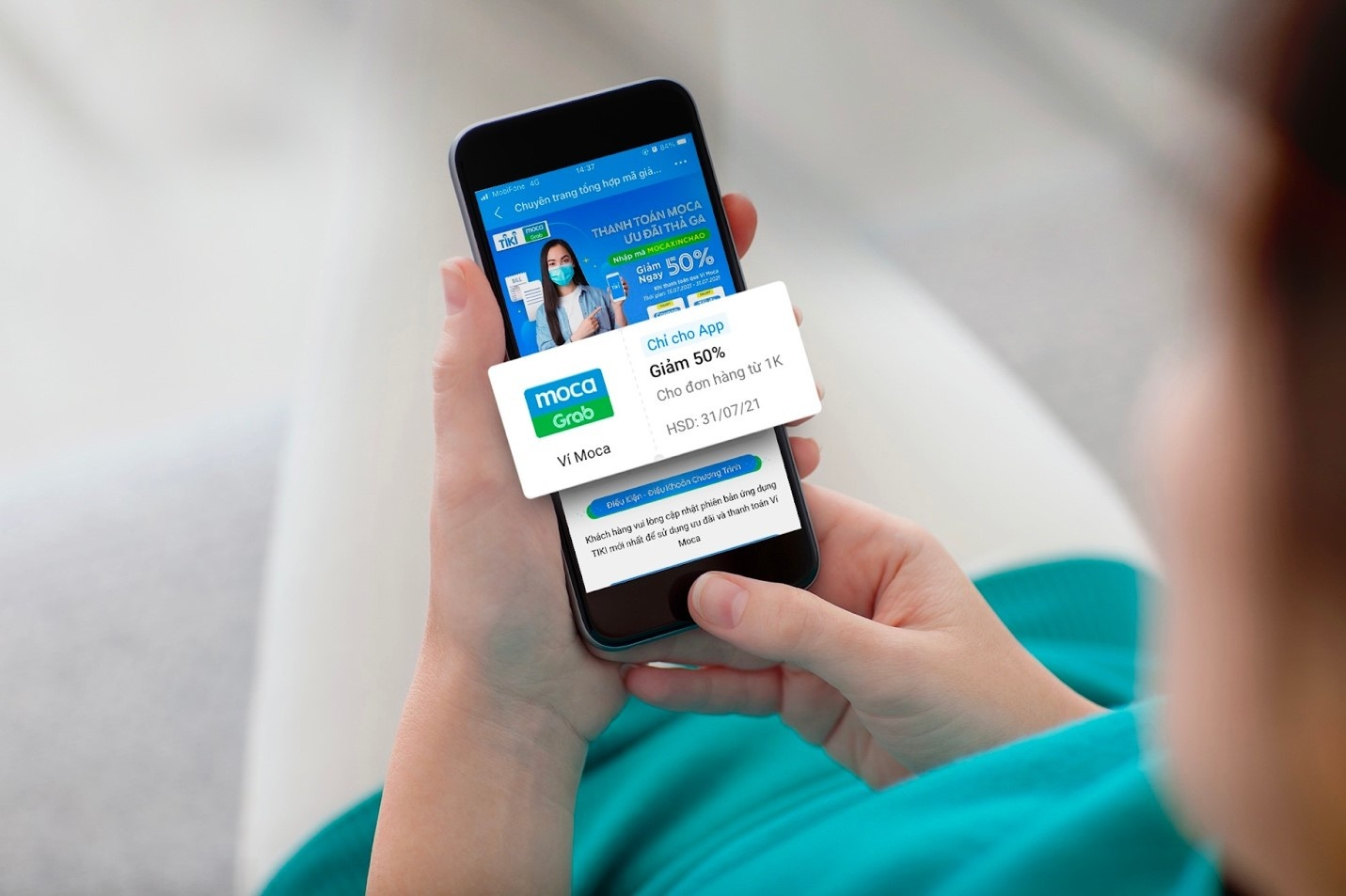

Moca Wallet, developed by Moca Technology and Services Joint Stock Company, has been operating since 2016. Since 2018, Moca has cooperated with Grab Vietnam to integrate this service on the Grab application. Thanks to its fast and convenient features, after its launch, Moca on Grab has attracted many users to pay bills even though there are not many incentive programs.

According to Vietdata, in 2022, Moca's revenue will reach nearly VND500 billion, up 102% compared to 2021 and up 75.5% compared to 2020. However, Moca's after-tax profit has remained negative for 3 consecutive years. Specifically, in 2020 and 2021, Moca's negative profit increased from more than VND55 billion to VND164 billion. By 2022, the negative profit had dropped sharply by 77%, to nearly VND40 billion.

Currently, Vietnam's online payment market is increasingly vibrant with more than 40 domestic commercial banks and 51 e-wallets and intermediary payment platforms competing fiercely, according to data from the State Bank.

Research by Decision Lab in Ho Chi Minh City shows that MoMo, ZaloPay and ShopeePay are the most used e-wallets. These wallets often cooperate with super apps like Grab, Gojek or other platforms like TikTok. Competition among e-wallets is increasingly fierce and is still a "money-burning" game.

According to FiinGroup, despite impressive growth figures in recent years, e-wallets are still facing a race to burn money to attract and retain customers. The main reason is that many users only pay via e-wallets when there are attractive promotions and coupons. After taking advantage of promotions, users often switch to other providers with better deals. According to a report on Decision Lab, promotions are the second biggest reason why users choose to use e-wallets, accounting for 65% of those surveyed.

This forces e-wallets and payment gateways to continuously launch promotions, creating a huge cost burden. As a result, even leading providers with millions of users such as MoMo or ShopeePay continue to incur losses, despite growing net revenue.

Although banks’ QR codes have few promotions and are not getting much attention, the growth of QR code payments in Vietnam is still led by banks. According to Data.ai, six banks, including MB Bank, Vietcombank, BIDV, VietinBank, Agribank and Techcombank, are in the top 10 most downloaded apps, along with MoMo, ZaloPay and two payment apps from Viettel and Home Credit.

HQ (according to VTC News)