After last weekend's plunge and the possibility that the Fed will not lower interest rates next week, Wall Street experts predict that gold prices will continue to fall.

Spot gold started last week at $2,325.26 an ounce and traded in a relatively narrow $25 range for most of the first four days. On June 6, the European Central Bank cut interest rates by 25 basis points, helping gold hit a weekly high of $2,386.75 an ounce.

However, the price of this precious metal turned down when the People's Bank of China (PBOC) announced the end of an 18-month streak of buying gold reserves. Then, a stronger-than-expected US jobs report pushed the price of gold below the $2,300 mark. By the end of trading on June 7, the price of gold was $2,292 an ounce.

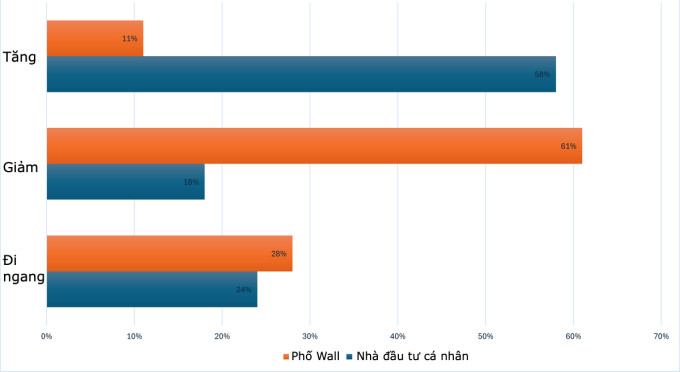

After this downturn, a survey byKitco NewsFew Wall Street analysts are optimistic about gold prices next week. Only two of the 18 experts surveyed believe gold prices will continue to rise. In contrast, 11 people (61%) predict a decrease and five (28%) think the market will move sideways.

Meanwhile, retail investors remain relatively optimistic. More than half predict the precious metal will rise next week. Those who think gold will fall and stay flat account for 33% and 24%, respectively.

Marc Chandler, CEO at Bannockburn Global Forex, said a stronger-than-expected US jobs report and China halting its gold reserves purchases pushed gold to a new one-month low.

"Losing the $2,300 mark in the spot market would send gold prices towards the May low of nearly $2,277. If it falls below $2,270, gold could even fall to the $2,220 per ounce price range," he predicted.

Adam Button, head of currency strategy at Forexlive, also said that the news that China stopped buying gold reserves over the weekend was negative for the gold market and that the price of the metal could fall further. Darin Newsom, senior market analyst at Barchart, agreed, saying that the downtrend was not completely completed last week, looking at the trading chart.

Gold prices will move next week depending on factors such as the US consumer price index (CPI) for May and the Federal Reserve's monetary policy announcement on the same day on Wednesday (June 12). On Thursday (June 13), some other information that can affect market sentiment include US unemployment benefits data and the Bank of Japan's monetary policy decision.

Colin Cieszynski, chief market strategist at SIA Wealth Management, said the Fed is unlikely to cut interest rates next week. "That's good for the dollar and bad for gold in the near term," he said.

VN (according to VnExpress)