Bitcoin dropped nearly 10% in just a few hours, causing the market to be red and many other coins to lose more than 20% of their value.

Cryptocurrencies are entering the realm of a “bear market” – a price decline of 20% or more.

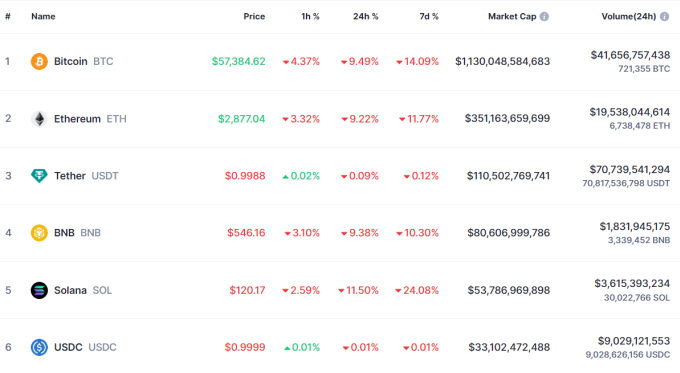

Bitcoin - the largest cryptocurrency by market capitalization - fell nearly 10% as of this afternoon, to $57,000. Compared to its all-time high of over $73,000 reached in mid-March, this currency has lost more than 20% of its value.

According to analysts, the selling pressure has increased sharply in the cryptocurrency market due to the lack of interest in the Hong Kong-based spot ETF and investors' concerns about interest rates.

The CoinDesk 20 (CD20) market index fell even more in the same period, while other cryptocurrencies such as Ethereum (ETH), Solana (SOL) recorded a decrease of 9-11%. Coins with a market capitalization of several hundred million USD lost 15-25% in just a few hours.

According toCoinglass, nearly $100 million in futures positions on exchanges were liquidated in the past hour. In 24 hours, nearly $500 million was liquidated. Futures trading allows investors to use large-scale leverage, up to 50-100 times the initial capital. Liquidation occurs when the loss of trading orders exceeds the initial margin.

The cryptocurrency’s decline was in line with traditional markets. A series of U.S. economic reports showed slowing growth and continued price pressure. The Nasdaq fell 2% on the day, while the S&P 500 lost 1.6%.

Joel Kruger, chief market strategist at LMAX Group, said in a report on April 30 that expectations for a Federal Reserve rate cut have been significantly lowered as inflation remains hot, which is weighing on the cryptocurrency market.

“We see evidence that the Fed needs to keep interest rates higher for its long-term policy outlook, despite investors calling for a dovish stance,” Kruger said, adding that the resurgence in the dollar’s favor is also weighing on cryptocurrencies.

With today's steep decline, Bitcoin and the cryptocurrency market are on track for their worst monthly decline since November 2022 - the year Sam Bankman-Fried's FTX exchange collapsed.

In April alone, this coin lost nearly 18%, while Ethereum fell about 19%. Small-cap cryptocurrencies are under deeper correction pressure. Altcoins that investors are interested in such as SOL, Dogecoin (Doge), AVAX fell 35%-40% this month.

The total cryptocurrency market capitalization has fallen nearly 20% in value since its peak in March. This is also the largest drop in the value of cryptocurrencies since June 2022, according to TradingView data..

TT (according to VnExpress newspaper)