Men who have paid social insurance for 15 to under 20 years and start receiving pensions between July 1, 2025 and December 31, 2029 may have their benefits adjusted to narrow the gap with women.

The latest draft of the Social Insurance Law adds a provision assigning the Government to issue a pension adjustment policy for male workers who have paid social insurance for 15 years but less than 20 years and receive pension from July 1, 2025 to December 31, 2029 and are adversely affected compared to female workers. The funding source for implementation is paid by the Social Insurance Fund.

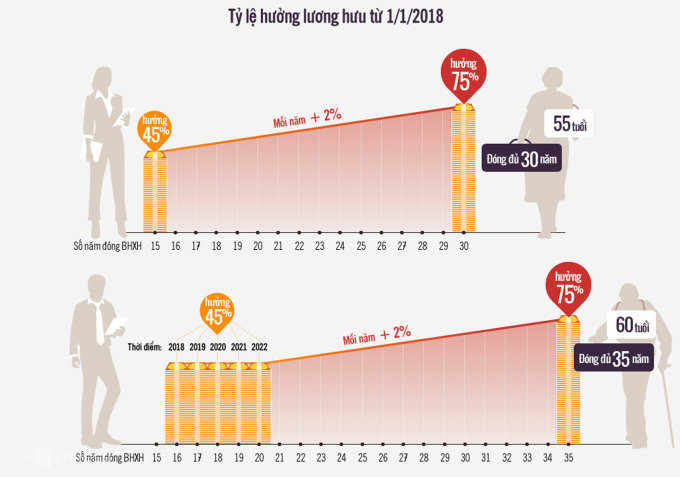

The adjustment is to accept the opinion of National Assembly deputies that reducing the social insurance payment period to 15 years creates a big difference in pension benefits between men and women. With the same pension benefit of 45%, women pay social insurance for 15 years, while men need 20 years. If they pay for 15 years and reach the prescribed retirement age, male workers will receive 33.75% of the average salary used as the basis for social insurance payment.

Workers receive an additional 2% for each year of participation thereafter, until reaching the maximum pension level of 75%. This means that male workers pay social insurance for 35 years and female workers pay 30 years to receive a maximum pension of 75%.

The National Assembly Standing Committee assessed that the labor market is not really stable, the number of people working in the informal sector is high, the number of workers withdrawing social insurance once a year is large. Many people have their contracts terminated by businesses when they are 45-50 years old.

As a result, a number of male workers who reach retirement age only contribute from 15 years to less than 20 years or even longer, but when they retire, they will be at a disadvantage, and the social security system will lose its attractiveness. Therefore, the National Assembly Standing Committee recommends adjusting the pension level for men accordingly. The specific adjustment level will be issued by the Government with detailed instructions.

The latest draft of the Social Insurance Law also adds provisions on conditions and pension levels for workers in certain occupations and jobs in the armed forces, as specified by the Government. Funding is drawn from the budget.

Previously, delegates proposed to amend the regulations to protect the rights of military officers and soldiers. The reason is that military activities are special in nature, recruitment is difficult, and the working environment is harsh. Soldiers must meet strict health requirements, especially in the specialties of special forces, air defense - air force, navy, chemistry, armored vehicles, radar, and submarines.

Many fields employ people under 40 years old, such as special forces fighters and submariners. The service age of some groups also ranges from 46 to 52. After this age, if they are not assigned or transferred to a position with a higher rank, they will have to retire and be replaced by someone else.

The latest draft maintains the regulation on one-time retirement benefits for employees who have paid more than the ceiling. 35 years of social insurance for men and 30 years for women, although many delegates previously proposed to increase the subsidy level. According to the National Assembly Standing Committee, this subsidy level has been calculated and evaluated to ensure the long-term solvency of the Social Insurance Fund, in accordance with the contribution-benefit principle.

Thus, employees who retire early will still have their benefit rate deducted by 2% each year, but if they contribute more than the 30-35 year frame, in addition to their pension, they will only receive a subsidy equal to 0.5 times the average salary paid for social insurance.

According to statistics from the Social Insurance industry, the gap between the number of pensioners and pensioners is getting smaller. In 1996, there were 217 pensioners for every one pensioner; in 2000, the number of pensioners decreased to 34; in 2016, there were 9 pensioners; and currently, there are about 6.5 pensioners for every one pensioner.

TB (according to VnExpress)