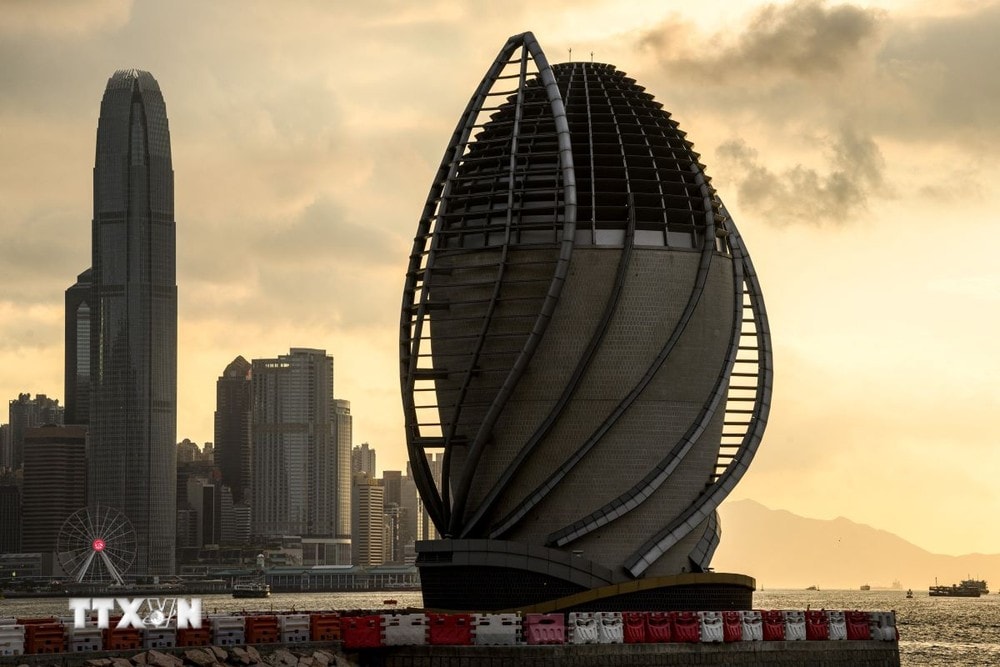

In the overall ranking, Hong Kong (China) ranked third in the world, up one place in March, and topped the Asia-Pacific region.

According to the semi-annual “Global Financial Centers Index” report compiled by the British Z/Yen Group and the Shenzhen-based China Comprehensive Development Research Institute and released on September 24, the Hong Kong Special Administrative Region (China) has overtaken Singapore to become Asia’s top financial center for the first time in two years.

Globally, Hong Kong ranks third after New York and London, with Singapore and San Francisco in fifth place.

Hong Kong lost its top spot in Asia to Singapore in the September 2022 ranking, after it imposed anti-COVID-19 measures in April that year.

In the overall ranking, Hong Kong ranked third in the world, up one place in March, and topped the Asia-Pacific region.

A strong stock market and new listings have enhanced Hong Kong's position as a leading financial centre in the region.

Speaking on the sidelines of the 5th Belt and Road Initiative Tax Administration Cooperation Forum recently, Treasury and Financial Services Secretary Christopher Hui said that the Global Financial Centres Index ranked Hong Kong highly in many areas, from business environment to fintech and banking to asset management, showing that Hong Kong has made great improvements in many areas.

Improved stock market sentiment coupled with the China Securities Regulatory Commission's announcement in April to support leading mainland companies to list in Hong Kong have boosted the Hong Kong initial public offering market, said Christopher Hui.

Shares of Chinese electronics maker Midea surged more than 9% in its Hong Kong debut on September 17, after raising about $4 billion in its biggest initial public offering in more than three years. It was Hong Kong’s biggest since JD Logistics’ $3.64 billion offering in 2021.

A Hong Kong government spokesman said the report clearly affirmed Hong Kong's position as a leading global financial centre.

Hong Kong ranks among the best in terms of business environment, human capital, infrastructure, reputation and overall competitiveness.

Hong Kong's ranking in many financial industry sectors has also increased significantly, including investment management, insurance, banking, professional services, etc., in which Hong Kong's ranking in investment management has jumped to number one in the world.

In addition, the report also assessed the level of fintech in financial centers, in which Hong Kong rose 5 places to 9th place, entering the top 10 leading fintech centers.

Hong Kong's asset and wealth management business is booming, with assets under management up about 2% year-on-year to more than HK$31 trillion (US$3.983 trillion) at the end of last year, and net inflows of nearly HK$390 billion, up more than 3.4 times year-on-year. Hong Kong's family office business continues to thrive.

The new capital investor access programme has continued to receive enthusiastic response since its launch in March. To date, Hong Kong has received more than 550 applications and is expected to bring in more than HK$16.5 billion in investment to Hong Kong.

The US Federal Reserve (Fed) cut interest rates by 0.5 percentage points on September 18 in the beginning of its monetary easing cycle, while Hong Kong commercial banks cut their base and deposit rates by 0.25 percentage points. These, along with a series of measures recently announced by China, have further boosted the stock market.

TB (according to VNA)