After its regular policy meeting, the US Federal Reserve (Fed) decided to keep interest rates at the current level of 5.25%-5.50%, and forecasted to cut interest rates only once this year.

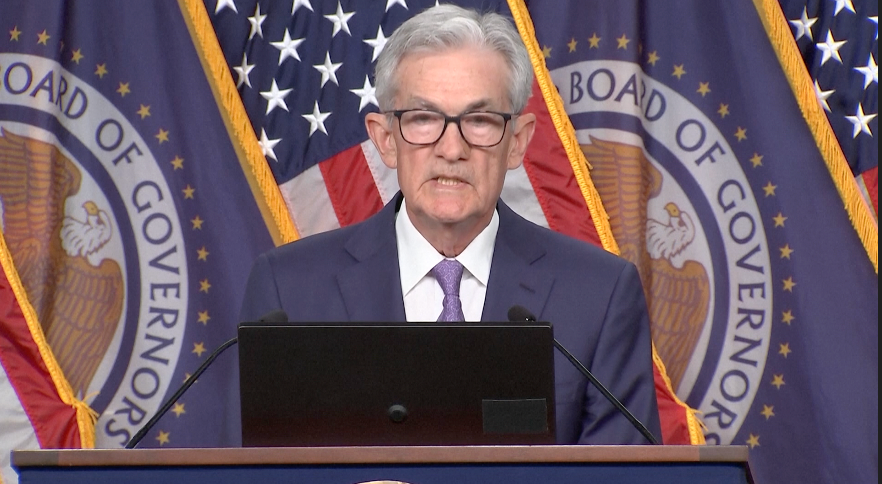

In a statement given at a press conference on June 12 (local time), Chairman of the US Federal Reserve (Fed), Mr. Jerome Powell noted that the central bank is not yet confident enough to cut interest rates, even when inflation has eased from its peak and it is too early to know whether the Fed's policy is 'sufficiently restrictive'.

Fed Chairman Jerome Powell added that the Federal Reserve's dovish stance on monetary policy is influencing inflation, but it will take time to see full progress.

According to Mr. Powell, currently, inflation remains high, but the rate of price increases has decreased "significantly" and the US has a growing economy and a strong labor market.

Earlier in the day, the US Department of Labor released a report showing that the CPI - a measure of the price of a basket of goods and services in the economy - was flat in May compared to April, but increased 3.3% compared to the same period last year, 0.1% lower than the results of a survey of experts by Dow Jones news agency.

Core CPI, which excludes energy and food prices, rose 0.2% from April and 3.4% from a year earlier, both 0.1 percentage points lower than forecasts of 0.3% and 3.5%, respectively.

Both headline and core CPI came in below forecasts, but housing inflation rose 0.4% for the month and was up 5.4% year-over-year, stronger than expected. Housing figures have been a stubborn force in the Fed’s fight against inflation, and they account for a large portion of the CPI basket.

However, the pace of price increases was largely controlled by a 2% drop in energy prices and a 0.1% increase in food prices compared to the previous month. In the energy group alone, gas prices fell 3.6%. Another service that saw a modest increase in prices in May was the car insurance group, which increased 0.1% in the month, although it was still up more than 20% compared to the same period last year.

There is finally some optimism, with both headline and core inflation coming in lower than expected, said Robert Frick, an economist at Navy Federal Credit Union. Inflationary pressures at the gas station have eased, but home prices continue to rise and are the main source of inflation. Until home prices start to fall, there will be no significant decline in inflation.

Persistent inflation has kept the Fed on hold since its last hike in July 2023. At its March meeting, the Fed forecast three rate cuts this year, totaling 0.75 percentage points, but after its June 12 meeting, the Fed forecast just one rate cut this year.