A series of large-cap stocks fell sharply today, wiping out the gains of yesterday afternoon's bottom-fishing session. The VN-Index returned nearly 12 points to 1,205.15 points.

The sharp decline in large-cap stocks today has erased the gains of yesterday afternoon's bottom-fishing session. The VN-Index returned nearly 12 points to 1,205.15 points amid foreign net selling of VND1,658 billion. In addition, liquidity on the HoSE floor fell to a two-week low.

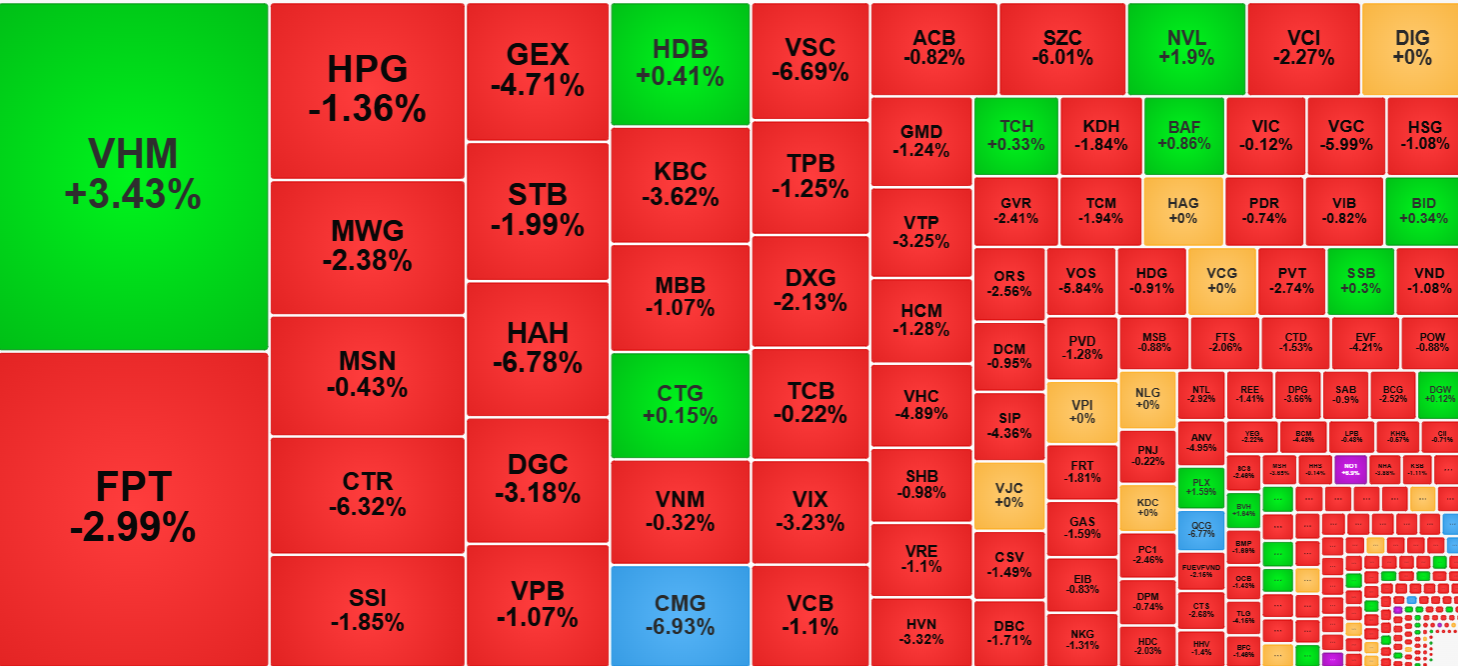

The slight recovery efforts at the end of the morning session failed to create any momentum this afternoon. The entire afternoon session was a continuous decline. The VN-Index closed at its lowest price, down 0.98% with 287 stocks increasing/83 stocks decreasing. The number of stocks decreasing by more than 1% jumped to 154 stocks compared to 78 stocks in the morning.

The pressure this afternoon was quite strong, HoSE liquidity in the afternoon session increased by 74% compared to the morning, reaching 7,206 billion VND. With a very narrow spread and a significant increase in the number of stocks that decreased sharply, it is clear that the sellers have completely controlled the price and continuously lowered the price.

Of course, the blue-chip group is also the main "culprit" when taking away many points from the VN-Index, further deepening the pessimistic state. FPT decreased by 2.99%, VCB decreased by 1.1%, HPG decreased by 1.36%, GAS decreased by 1.59%, VPB decreased by 1.07%. These are all stocks in the group with the largest market capitalization. These codes did not decrease much in the morning, bringing a certain feeling of "safety". When the pillar group forced the VN-Index to fall deeper and deeper, fear also increased and selling pressure appeared on a large scale.

Statistics in the VN30 basket showed that more than half of the stocks (18 codes) closed at the lowest level of the day. This reflects the pressure that remained until the end of trading. The VN30-Index closed down 0.88% with 6 codes increasing/23 codes decreasing, of which 13 stocks decreased by more than 1%. The liquidity of the VN30 basket in the afternoon session also increased by 23% compared to the morning session, confirming increased selling pressure.

FPT pillar saw the deepest decline in nearly 4 months when it lost 2.99%. Liquidity of over 1,000 billion VND is also the highest level in 28 sessions and leads the market this session. Foreign investors recorded selling 3.93 million shares, including negotiated transactions, the total net amount was -312 billion VND. In contrast to FPT is VHM, the price increased by 3.43% with liquidity of 1,105 billion VND. VHM was also net sold by foreign investors for 342.3 billion VND, but domestic capital bought very strongly, buying 95% of total liquidity. FPT's capitalization is slightly higher than VHM's, but thanks to its stronger increase, VHM still offset all the points lost by VN-Index due to FPT. However, the large number of other stocks falling made this balance meaningless.

With selling pressure increasing significantly this afternoon, many stocks widened their decline and recorded high liquidity. Of the 154 stocks that fell more than 1% at the close of the VN-Index, 24 stocks had trading volume exceeding VND100 billion, of which VN30 contributed 9 stocks. The rest were concentrated in the midcap group.

With the sharp decline in the index, small and medium-sized stocks were also severely affected. Midcap closed down 1.6%, Smallcap down 1.7%. CTR, GEX, HAH, DGC, KBC, CMG, VSC… plummeted with very high liquidity.

The majority of stocks that went against the trend today were low-liquidity stocks. Except for VHM, a few notable stocks were NVL up 1.9% with 131.4 billion VND; PLX up 1.59% with 24.5 billion; NO1 up 6.9% with 12.7 billion; BWE up 1.83% with 10.3 billion; TRC up 4.06% with 9.6 billion.

Foreign investors continued to net sell another VND547.6 billion in the afternoon session, after withdrawing VND1,110.4 billion in the morning session. In terms of scale, the selling level in the afternoon decreased slightly by about 13% compared to the morning session but still reached VND1,295.2 billion. The buying side increased to VND747.6 billion, still very small compared to the selling side. Overall, foreign investors net sold more than VND1,658 billion on HoSE. The largest sold codes were VHM -342.3 billion, FPT -312 billion, HDB -208.2 billion, HPG -131.2 billion, SSI -108.6 billion. UpCOM had MCH net bought VND239.6 billion through agreement since the morning.

The sharp decline this afternoon shows that yesterday's reversal is not yet reliable. The cash flow this session clearly no longer pushes up prices and the sharp decline in liquidity shows that demand is still only interested in very low prices.

TH (according to VnEconomy)