Profit-taking pressure and weakness in pillar stocks once again caused the VN-Index to "miss" the 1,300-point mark today.

VN-Index today reached its highest peak in the first few minutes of the afternoon session, reaching 1,302.22 points, which is the second time in 3 sessions that it has exceeded the psychological threshold of 1,300 points. However, from this peak, the entire remaining time was a downward slide. The index closed back at 1,292.2 points, up 0.33%.

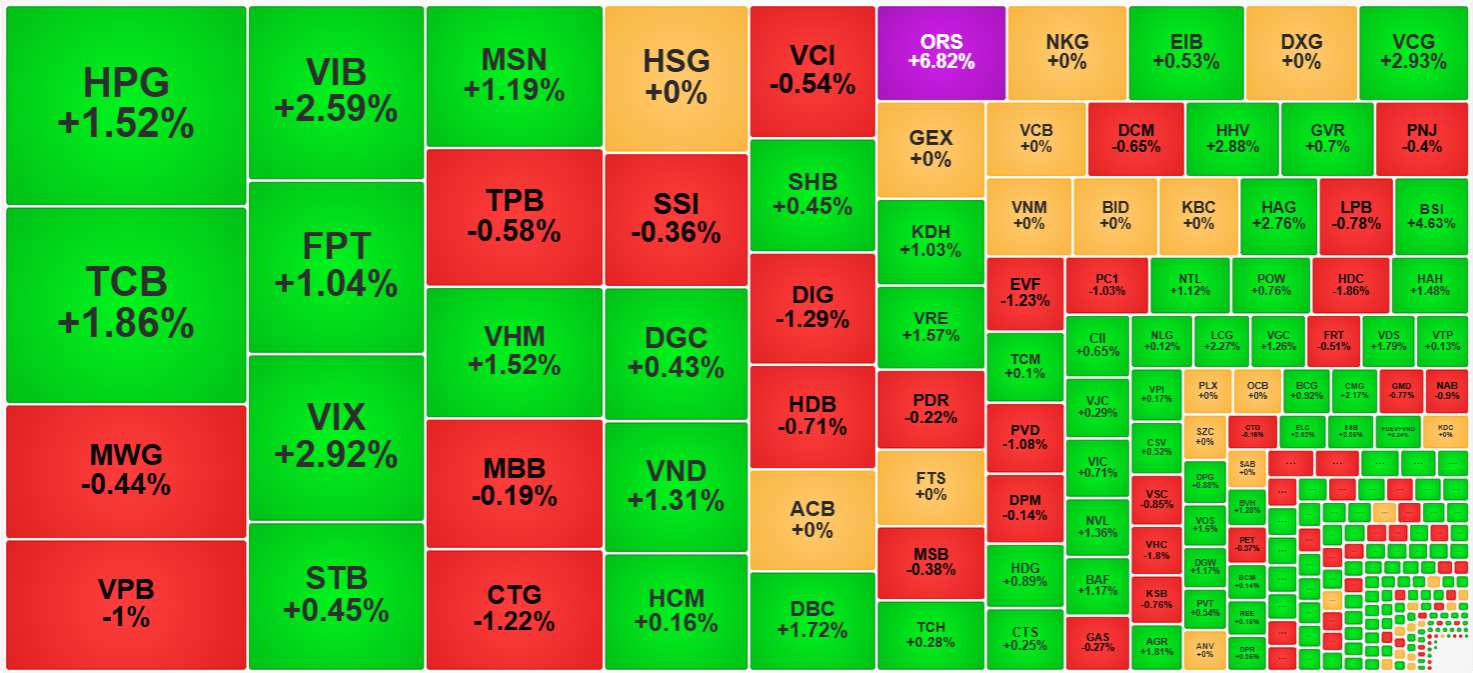

The market once again “missed” the 1,300-point mark due to the poor ability to maintain the strength of the leading stocks. In the morning, banking stocks, especially pillar stocks, increased very well but gradually weakened in the afternoon. The most disappointing were CTG and VPB, the two stocks that reversed to red. CTG lost 1.48% compared to the closing price in the morning and closed down 1.22% compared to the reference price.

In addition, VCB and BID, the two largest stocks in the market, are also not doing well. VCB closed the morning session up 1.2% but this afternoon lost everything, closing at the reference price. BID did the same, losing all of its 1.81% increase in the morning and falling to the reference price. These four very large banking stocks alone have significantly dissipated the strength of the VN-Index, but statistics in the VN30 basket this afternoon showed that there were 21 stocks that had decreased in price compared to the closing price of the morning session. The inevitable consequence is that the VN-Index is not strong enough to stay above the 1,300 point threshold.

Today is a rare session where pillar stocks have a fairly long consensus period. Closing, VHM increased by 1.52%, VIC increased by 0.71%.

Foreign investors also surprised today when they returned to net buying VND689.2 billion on HoSE, of which they bought the VN30 basket for VND783 billion net. The stocks that were bought extremely well were TCB +359.6 billion, FPT +328.9 billion, VHM +173.7 billion, MWG +164 billion. The selling side had HDB -94.6 billion, VPB -88.3 billion as outstanding. The strong net buying reversal session today has leveled off yesterday's selling level, showing that the reversal signal of this capital flow continues to be strengthened.

TH (according to VnEconomy)