All these banks have been asked by the State Bank to find every measure to reduce interest rates.

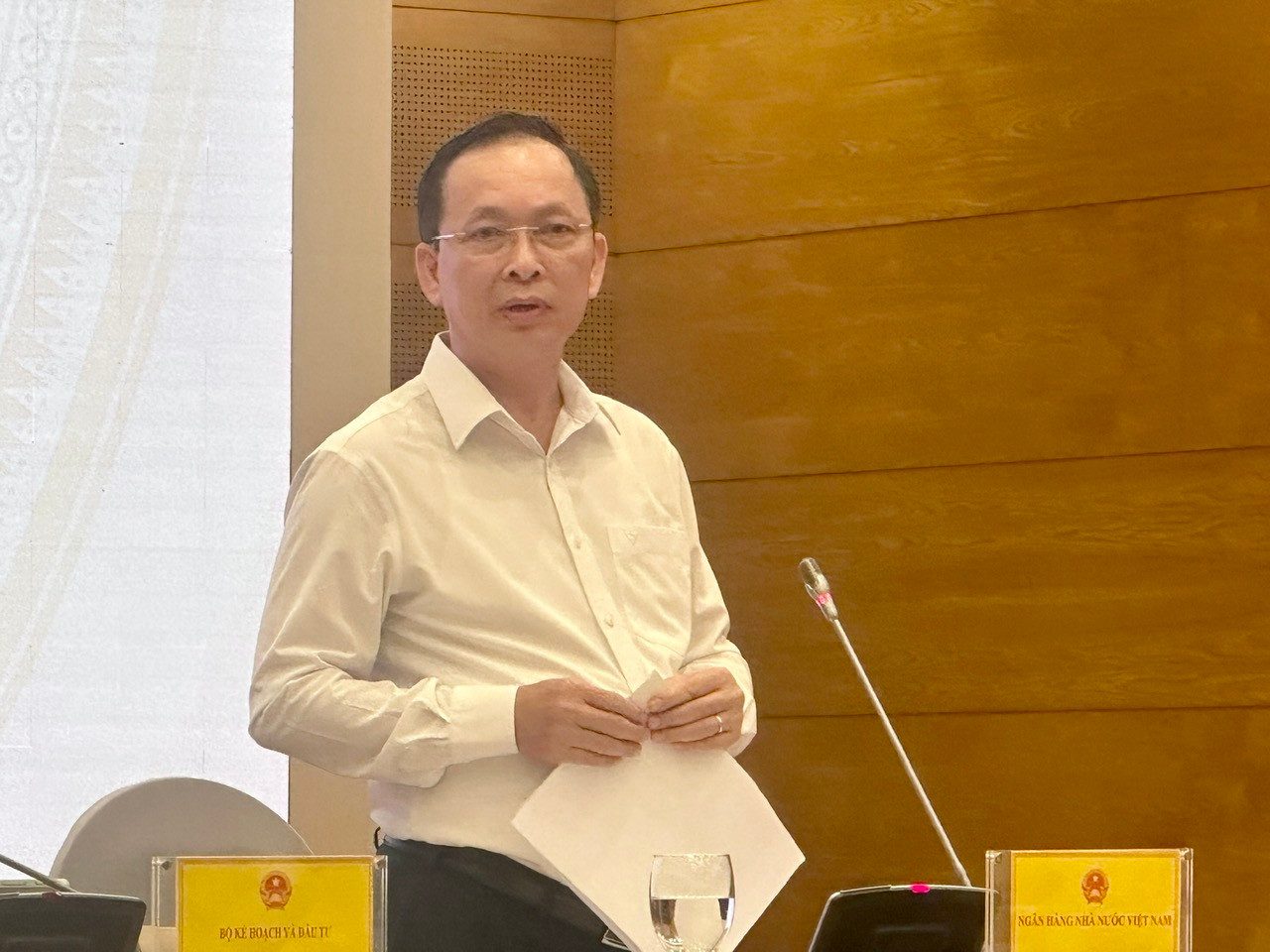

"There are still banks lending capital at high average interest rates, around 9%, even above 9%. All of these banks have been required by the State Bank to find every measure to reduce interest rates," Deputy Governor of the State Bank Dao Minh Tu emphasized at the regular Government press conference held on the afternoon of November 4.

According to Deputy Governor of the State Bank of Vietnam (SBV) Dao Minh Tu, the SBV recently held a conference for the whole industry with 35 large commercial banks (CBs) that account for the main proportion of lending to the economy.

“The conference pointed out which banks have high interest rates and which banks have low interest rates, so that the banks with high interest rates can find ways to reduce interest rates to support people and businesses. Although it was an internal conference, the banking system implemented it very resolutely and specifically,” said Deputy Governor Dao Minh Tu.

Taking the example of state-owned commercial banks that have seriously reduced interest rates, the Deputy Governor of the State Bank of Vietnam said: At Vietcombank, the average interest rate for both old and new loans is currently at 5.94%/year, down 1.75% compared to the end of 2022 and down 0.29% compared to the same period last year.

At BIDV, the average interest rate is 6.46%/year, down 2.59% compared to the end of 2022 and down 0.15% compared to the same period in 2022.

Since the beginning of the year, the State Bank has issued many messages and used many tools to support interest rate reduction, including four reductions in operating interest rates. Therefore, by the end of July and early August 2023, interest rates at commercial banks had decreased by 1% compared to the end of 2022.

According to the Deputy Governor, from the beginning of the year, based on calculations of the level of impact from the world economy, with the dual impacts of the epidemic and geopolitical conflicts, and the resilience of the domestic economy, the management of monetary policy must ensure the target of controlling inflation, the State Bank expects the average interest rate reduction of commercial banks from 1 - 1.5%.

But so far, according to statistics from the State Bank, the average interest rate for new loans has decreased by 2 - 2.2%, which is higher than the expectation from the beginning of the year. "Of course, there are still some loans that were previously mobilized by banks at high interest rates, so the interest rate is still high, due to policy delays and to ensure the harmony of financial plans. The State Bank has asked commercial banks to reduce interest rates by all means to support businesses," the Deputy Governor stated.

According to Tin Tuc Newspaper