In the first working week after Tet, Hai Duong collected over 600 billion VND in domestic taxes.

According to the Provincial Tax Department, as of February 11, the total domestic budget revenue of the province managed by the Hai Duong tax sector reached VND5,000 billion, reaching over 59.5% of the plan for the first quarter of 2025, equal to over 21% of the annual ordinance estimate and up 4% over the same period last year. Of which, total revenue minus land use fees, lottery, profits, and dividends reached VND4,090 billion, equal to 27% of the annual estimate and up 9% over the same period last year. In the first working week after Tet alone, VND600 billion in domestic taxes were collected.

Areas with large revenue potential currently achieve high revenue rates such as the foreign-invested enterprise sector reaching 29%; the local state-owned enterprise sector reaching 31% and the non-state tax collection sector reaching 41%, all compared to the annual revenue estimate. The rates of registration fee collection, fees, charges, and personal income tax collection compared to the annual estimate are all better than the average rate.

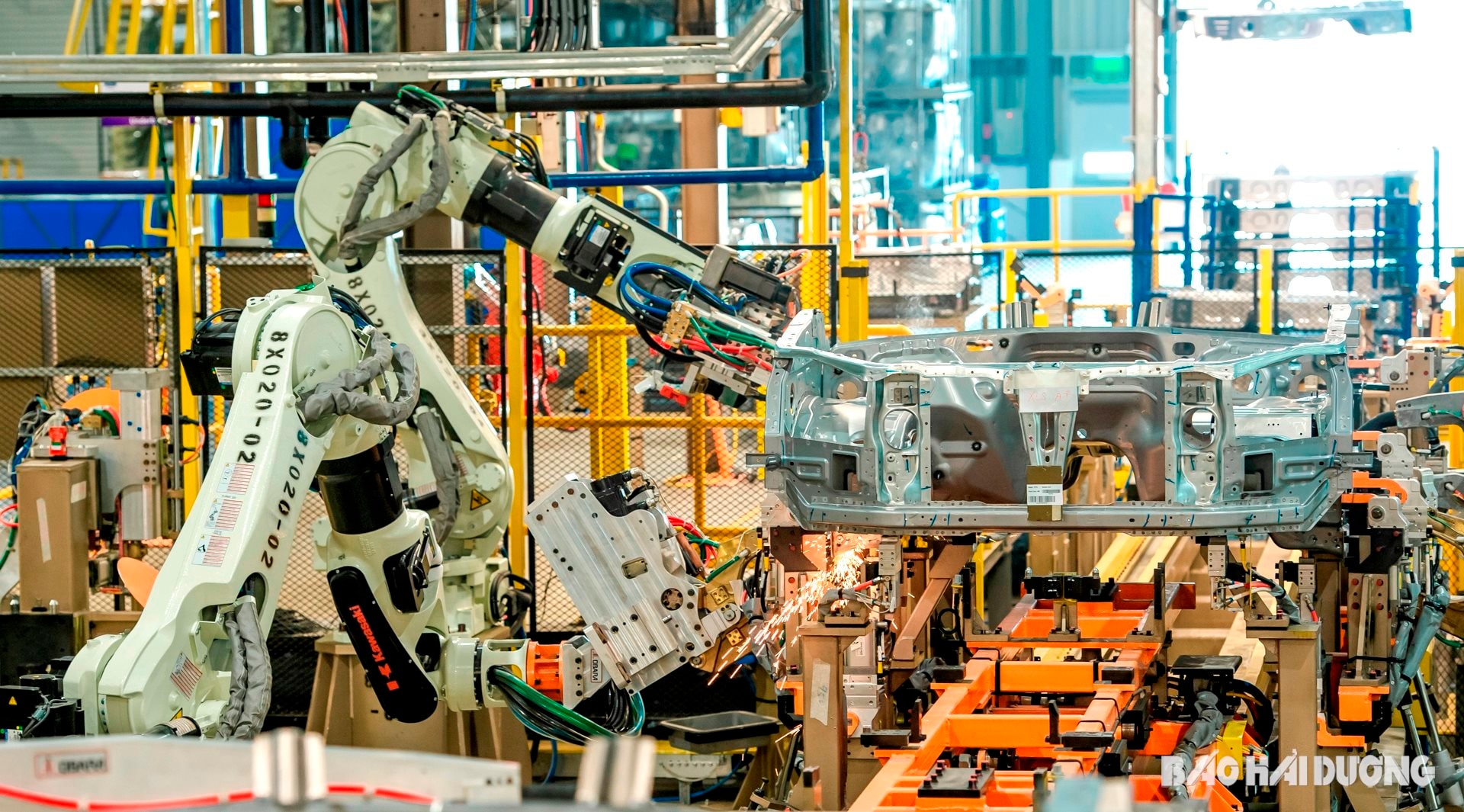

From the beginning of the year to February 11, the revenue from 15 key enterprises reached 1,339 billion VND, still maintaining the proportion of nearly 33% of total domestic tax revenue if not counting land revenue, lottery, profits, and distributed dividends. Among them, there are high domestic tax payments such as the following companies: Ford Vietnam Co., Ltd., Hoa Phat Steel JSC, Brother Vietnam Industrial Co., Ltd., Hoa Phat Energy JSC...

PV