From the beginning of 2024, a number of tax and fee policies will directly affect the pocketbooks of car and motorbike users. Most notably, the car registration fee will no longer be preferential under the Government and will return to its old level, causing the price of the car to increase back to its original level.

Below are some important policies and regulations on taxes and fees related to the automobile and motorbike group from January 1, 2024:

Car registration fee returns to old level, car price increases

From January 1, 2024, the Government's preferential policy of reducing 50% of registration fees for domestically produced cars will expire. This fee will return to the old level according to the provisions of Decree No. 10/2022/ND-CP and current Resolutions of the People's Council or current decisions of the People's Committees of provinces and centrally run cities. Currently, the registration fee for new cars with less than 9 seats in Hanoi, Da Nang, Hai Phong, Quang Ninh is 12%, in Ha Tinh is 11%, in Ho Chi Minh City and other provinces and cities is 10%.

Previously, the domestic automobile market in the second half of 2023 benefited greatly from the Government's policy of reducing 50% of registration fees from July 1, 2023 to December 31, 2023 (Decree No. 41/2023/ND-CP regulating the registration fee for domestically manufactured and assembled automobiles issued on June 28, 2023). This is the third reduction in registration fees since 2020 to remove difficulties for domestic automobile manufacturing and assembly enterprises, while stimulating market demand after the Covid-19 pandemic.

Thus, from the beginning of 2024, the on-road price of domestically produced and assembled cars will increase again to the prescribed level. For popular low-cost car models priced from 450-600 million VND, the on-road cost will increase again from 50-60 million VND. For luxury car models worth billions, the on-road cost will increase again from 100 million VND.

Electric motorbikes and gasoline motorbikes under 125cc have their value added tax reduced from 10% to 8%.

On December 28, 2023, the Government issued Decree 94/2023/ND-CP stipulating the policy of reducing value-added tax (VAT) according to Resolution 110/2023/QH15 of the National Assembly. Accordingly, groups of goods and services currently applying a VAT rate of 10% will be reduced by 2%, down to 8%, applied from January 1, 2024 to June 30, 2024, except for some types of goods and services. Thus, the policy of reducing VAT by 2% in the second half of 2023 (from July 1, 2023 to December 31, 2023 according to Decree 44/2023/ND-CP) will continue to be extended by the Government for another 6 months.

In the automobile and motorbike industry, vehicles that are not subject to special consumption tax will be in the group of goods that will receive a 2% VAT reduction.

Specifically, these are electric motorbikes, gasoline motorbikes with a displacement of less than 125cc, cars with more than 24 seats, specialized vehicles such as ambulances, prisoner transport vehicles, hearses, cars running in entertainment, recreation and sports areas that are not registered for circulation and do not participate in traffic.

In the current market, electric motorbikes and gasoline motorbikes under 125cc are popular. Gasoline motorbikes have many "hot" models from Honda such as Wave, Air Blade, Vision, Vario; Yamaha has models such as Yamaha PG-1, Grande... Electric motorbikes have brands such as VinFast, Yadea, Giant, Pega... With an average value of 20-60 million VND, the 2% VAT reduction also creates more appeal to young customers.

Regulations on road usage fees

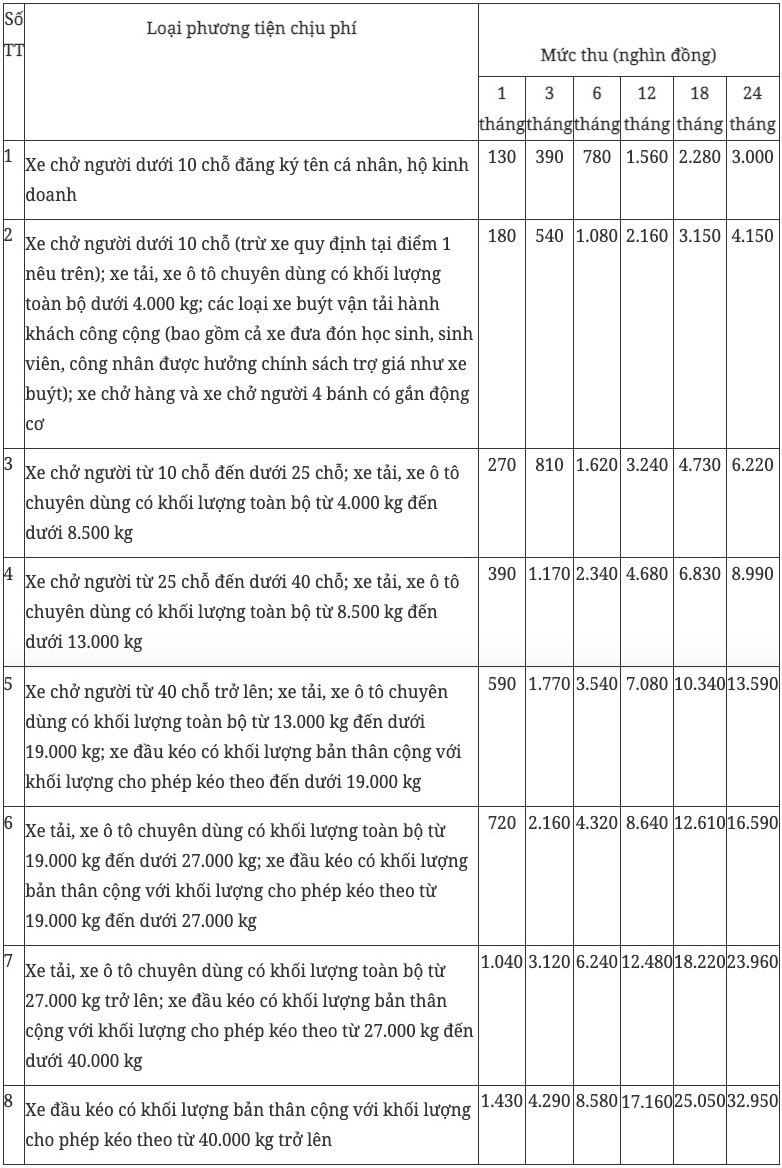

On December 13, 2023, the Government issued Decree No. 90/2023/ND-CP stipulating the collection rates, collection, payment, exemption, management and use of road use fees. The effective date is February 1, 2024. However, the contents on the collection rates, collection and payment methods... are almost unchanged, basically inheriting the original from the previous regulations.

Since the Law on Fees and Charges was issued in 2015, this is the first Decree issued on road use fees, with higher legal value than the Circular, helping to improve the effectiveness of State management. Previously, regulations on road use fees were implemented according to Circulars of the Ministry of Finance such as Circular No. 293/2016/TT-BTC issued on November 15, 2016, then replaced by Circular No. 70/2021/TT-BTC issued on August 12, 2021.

According to Decree 90, the road use fee schedule remains unchanged compared to 2023. Passenger cars with less than 10 seats registered under the name of individuals or business households have the lowest fee of 130,000 VND/month. This fee has been maintained for the past 10 years since 2013, when road use fees began to be standardized and collected at the registration office instead of being collected directly at toll stations, or indirectly through gasoline, through transportation revenue, etc.

From the second year, the road usage fee will be gradually reduced. Specifically, the monthly fee in the second year is 92% of the monthly fee in the first year, and in the third year is 85% of the monthly fee in the first year.

Thus, in theory, the longer the vehicle owners or transport business owners pay road usage fees, the more beneficial it will be.

TH (according to Vietnamnet)