An online seller in Hai Duong said that she received a text message deducting 622,000 VND from her account opened at BIDV with the content 'BSMS service fee for October'.

On November 20, many customers with payment accounts opened at the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) were upset when they received an SMS message notifying them of changes in their balance, with the content "BSMS service fee October 2024" with the fee to be paid in October being many times higher than in previous months.

Sharing on social networks, Ms. Nguyen Thi H. - owner of a fresh flower shop in Hanoi was still surprised: "Why did BIDV bank deduct 1.1 million VND for BSMS fee? Normally it's 9k (9,000 VND/month)"...

Ms. Do Thi V., an online seller in Hai Duong, said that she received a text message deducting 622,000 VND from her account opened at BIDV with the same content "BSMS service fee October 2024". This amount shocked her, she did not understand why the service fee for October had skyrocketed.

According to research, some other customers in Hai Duong have also had several hundred thousand dong deducted from their accounts with similar content.

BIDV's media representative said that since September 2024, through means such as the bank's website, app, customer messages and emails, BIDV has announced the new fee policy.

"Along with that, BIDV has instructed customers to receive balance change information via the app, which is very convenient, safe and free of charge," BIDV said.

On September 15, BIDV announced an increase in BSMS service fees from October. The bank explained that the fee increase is to comply with the roadmap for adjusting banking SMS service fees of telecommunications networks and according to market practices.

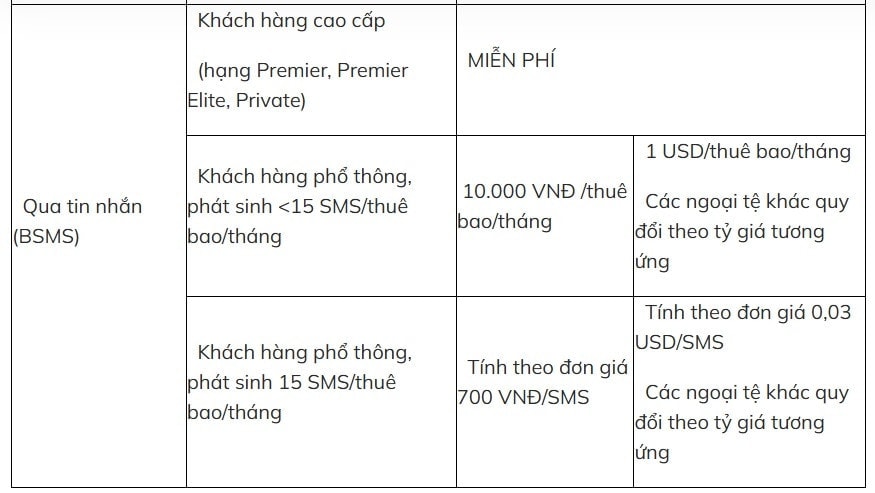

Accordingly, from October 1, regular customers who generate less than 15 SMS messages/subscriber/month will have to pay a fixed fee of VND 10,000/month.

Regular customers generating 15 SMS messages/subscriber/month will not have to pay the fixed fee as above. Instead, BIDV will charge based on the actual number of messages with a unit price of 700 VND/SMS.

The new policy means that sellers with many transactions occurring in a month like Ms. H. and Ms. V. mentioned above may have to pay a monthly fee of up to millions. To avoid paying a lot of money for this fee, customers must cancel the service of receiving balance change notifications by logging into the BIDV SmartBanking application, going to "Balance Changes" and then selecting "Cancel Registration".

To track balance fluctuations, customers can choose the free text messaging service on the digital banking application (OTT message).

The bank said it only sends text messages to notify customers of balance changes for transactions of VND30,000 or more.

Not only BIDV, many other commercial banks such as Vietcombank, ACB, VietinBank, Agribank, Sacombank, VPBank, Nam A Bank, OCB, Eximbank... have also changed the way they calculate SMS Banking service fees since the beginning of this year. Most banks have the same way of calculating fees based on the actual number of messages generated.

Accordingly, the SMS fee for notifying changes in deposit balances and payment accounts is a service provided and collected by a third party - a telecommunications network operator. In the past, banks paid a portion of this fee to encourage users to make electronic payments. However, with the increasing trend of non-cash payments, banks have had to increasingly compensate for this fee.

In addition to changing the SMS banking fee policy to suit the actual needs of each customer's message generation and reduce message costs, another important reason is to prevent the risk of fraud, cheating, and theft of personal information and customer accounts.

Previously, from March 2, 2022, commercial banks and telecommunications enterprises agreed on a plan to collect a fixed package fee of VND 11,000/month (including VAT) and an unlimited number of messages when using non-cash payment services.

However, recently banks have stopped applying this policy. The change has caused many customers to not understand and have incurred account balance fluctuation fees of up to millions of dong.

VN (synthesis)