The amount of money that people deposit in banks reaches 15-16 million billion VND. Prime Minister Pham Minh Chinh requested that there must be solutions so that this capital source can effectively serve production and business, not just stay in banks.

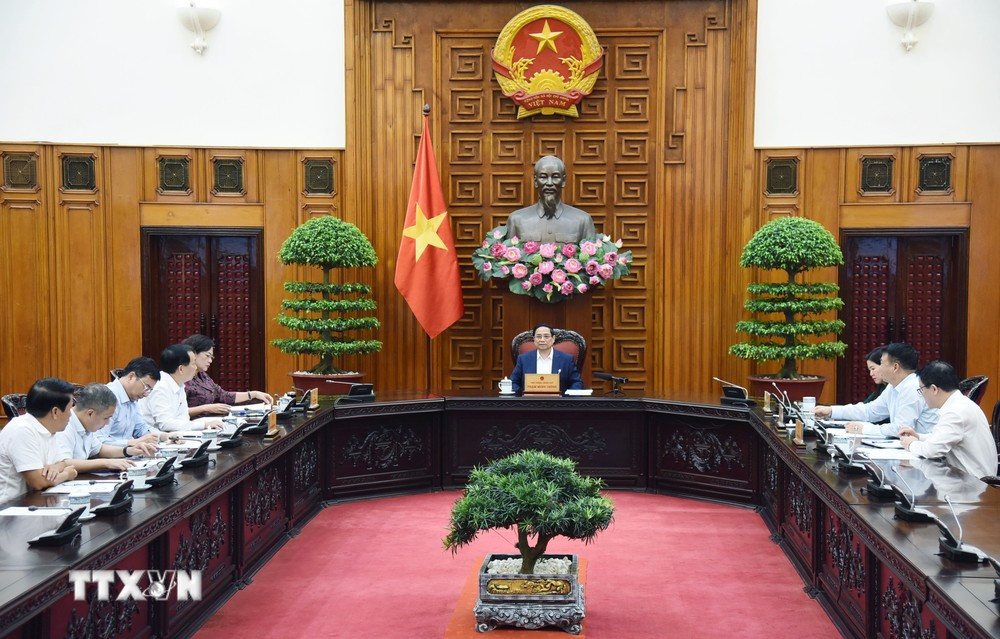

On the afternoon of August 5, Prime Minister Pham Minh Chinh chaired a meeting with leaders of the State Bank of Vietnam, the Ministry of Finance, the Ministry of Planning and Investment and a number of ministries, branches and agencies on monetary policy.

Monetary policy plays an important role, therefore the Government regularly holds meetings to manage monetary policy to ensure smoothness and efficiency, serving the development of the country, people and businesses, avoiding errors that affect the macro economy and general development, while ensuring the safety of the national banking and financial system, especially when the situation fluctuates.

Prime Minister Pham Minh Chinh said that in general, opportunities and advantages are less than difficulties and challenges. Therefore, the Prime Minister asked delegates to re-evaluate policies to see what has been done and what has not been done; point out the causes and lessons learned, and continue to have appropriate and effective policies for industries and fields that need priority development.

In particular, reviewing monetary policy, especially the policy of implementing proactive, flexible, effective and timely monetary policy; reviewing the implementation of a number of legal regulations, proposing a number of mechanisms and policies to create more favorable conditions for people and businesses; reviewing the credit growth situation since the beginning of the year.

According to the Prime Minister, from now until the end of the year, we will focus more on growth, so we must supply money, but the supply of money must ensure that the cash flow is directed to traditional growth drivers, new growth drivers, and control bad debt which is on the rise. It is said that the amount of money that people deposit in banks is 15-16 million billion VND, the Prime Minister requested that there must be solutions so that this capital source can effectively serve production and business, not just stay in banks.

The Prime Minister emphasized that we have a good monetary policy, especially in managing the gold market, but in the long term, we must calculate thoroughly and have fundamental solutions to combat dollarization and gold-ization, not allowing people to hoard dollars and gold, but must encourage investment, expand production and business, create jobs and livelihoods for people, thereby generating income and improving the material and spiritual life of the people.

According to the State Bank of Vietnam, in the first 7 months of 2024, closely following the policies of the Party, the National Assembly, the Government, and the direction of the Prime Minister, the State Bank has proactively followed domestic and foreign economic developments to synchronously deploy solutions to create favorable conditions for businesses and people to access bank credit, restore production and business, increase capital absorption capacity, promote growth associated with macroeconomic stability, control inflation, and ensure the safety of the credit institution system.

As of July 31, the central exchange rate was 24,255 VND/USD, up 1.63% compared to the end of 2023, at a low and stable average level compared to currencies in the region and the world. Interest rates for new and old loans continued to decrease, by the end of June 2024, the average lending interest rate was 8.3%/year, down 0.96% compared to the end of 2023. The average deposit interest rate was 3.59%/year, down 1.08%/year compared to the end of 2023.

Credit growth of the whole system recovered from the end of March and gradually increased over the months, higher than the growth rate in the same period in 2023, reaching 6% by the end of the second quarter of 2024 according to the direction of the Government and the Prime Minister.

By the end of July 2024, outstanding credit balance was nearly VND 14.33 trillion, up 14.99% over the same period in 2023 and up 5.66% over the end of 2023.

The State Bank, ministries, sectors and localities coordinate to implement sectoral and sectoral credit programs such as: the VND120 trillion program for loans for social housing, worker housing, apartment renovation and reconstruction projects; credit programs for forestry and fishery sectors, with a cumulative total of VND34.4 trillion...

At the meeting, leaders of ministries, branches and agencies said that continuing to reduce lending interest rates and stabilizing exchange rates and the foreign exchange market faced many difficulties and challenges; inflationary pressure increased; credit growth in some localities was still low; difficulties in implementing some credit programs and policies such as the VND120 trillion credit package for loans for social housing, workers' housing, and projects to renovate and rebuild apartments, etc.

Concluding the meeting, Prime Minister Pham Minh Chinh emphasized that since the beginning of the year, the policy of implementing a proactive, flexible, timely and effective monetary policy; coordinating synchronously, harmoniously and closely with a reasonable, focused and key expansionary fiscal policy and other macroeconomic policies is an appropriate policy; the State Bank has implemented it effectively. Thereby, contributing to achieving socio-economic development goals...

However, according to the Prime Minister, the situation still has many difficulties because the interest rate level tends to increase, there must be solutions to control it with banking tools; credit growth has not met requirements, it must be promoted but the loan interest rate must be maintained, even reduced for priority areas, especially the high demand for loans at the end of the year; the demand for foreign currency increases due to increased imports; geopolitical risks and tensions are unpredictable and complicated; large credit balances, but must be put into the economy, increasing jobs, increasing livelihoods for people...

Presenting lessons learned, the Prime Minister said that we must be calm, confident, and courageous; direction and management must be flexible, but not jerky; policies must be synchronous, coordinated, and mutually supportive; messages and policies must be clear, decisive, and suitable for reality, following the motto "what is said must be done, what is committed must be implemented"; refer to world experiences that are suitable for Vietnam's conditions...

In the coming time, Prime Minister Pham Minh Chinh requested relevant ministries and branches to grasp and closely follow the situation; continue to implement proactive, flexible, timely and effective monetary policies; coordinate synchronously, harmoniously and closely with reasonable, focused and key expansionary fiscal policies and other macroeconomic policies to promote growth, ensure macroeconomic stability, control inflation and ensure major balances of the economy.

The Prime Minister requested to implement measures to increase revenue and save state budget expenditure; drastically implement digital transformation, apply electronic invoices in revenue management; thoroughly save regular expenditure; effectively implement policies to extend, exempt, and reduce taxes, fees, and charges; promote public investment, taking public investment as the leading factor in private investment; promote the issuance of government bonds; increase credit for traditional growth drivers and new growth drivers; promote exports, strive to achieve a new export record, reaching from 750 to 800 billion USD, with a trade surplus of over 20 billion USD in 2024.

Prime Minister Pham Minh Chinh directed to promote domestic consumption; combat smuggling and trade fraud; promote border trade, effectively exploit signed free trade agreements (FTAs) and promote negotiations on new FTAs; promote domestic production; diversify markets and supply chains; improve the investment environment, call for and attract investment; effectively implement newly promulgated laws, especially those related to land and housing to develop the real estate market...

The Head of Government requested to focus on stabilizing exchange rates and the foreign exchange market; increase access to credit capital, focusing on priority areas for traditional growth drivers and new growth drivers; flexibly manage exchange rates, associated with bond mobilization, foreign currency supply, FDI attraction, export promotion and foreign deposits; mobilize banks to reduce costs to reduce lending interest rates for growth drivers and important infrastructure development projects, in which State Banks must take the lead, with the motto "harmonized benefits, shared risks".

Directing the harmonious and reasonable management of exchange rates and interest rates, the Prime Minister requested that credit management must be consistent with ensuring macroeconomic stability, controlling inflation and economic developments; operating the credit room publicly and transparently; strengthening supervision, inspection, and proactively withdrawing a number of credit indicators; drastically implementing incentive programs; ensuring security and safety of the system; controlling bad debts; enhancing information and communication fully and clearly so that people have knowledge and participate in the market appropriately and effectively; continuing to implement digital transformation; fundamentally controlling the gold market, foreign currency market, especially USD; completely restructuring credit institutions...

Regarding the 120 trillion VND credit package for social housing loans, the Prime Minister stated that this is a humane policy to help the poor have homes, so there must be appropriate and reasonable policies for people to access this credit package, especially when the 4 Laws on Land and Housing have just come into effect.

The Prime Minister believes that the banking sector and ministries and sectors “have done well, so they will do even better”; promote and boost the achieved results, overcome difficulties and challenges to do better in the coming time, contributing to the country's rapid and sustainable development.

VN (according to VNA)