Housing prices in big cities are increasingly outstripping people's incomes, making the dream of having a home for the poor increasingly distant and difficult to realize.

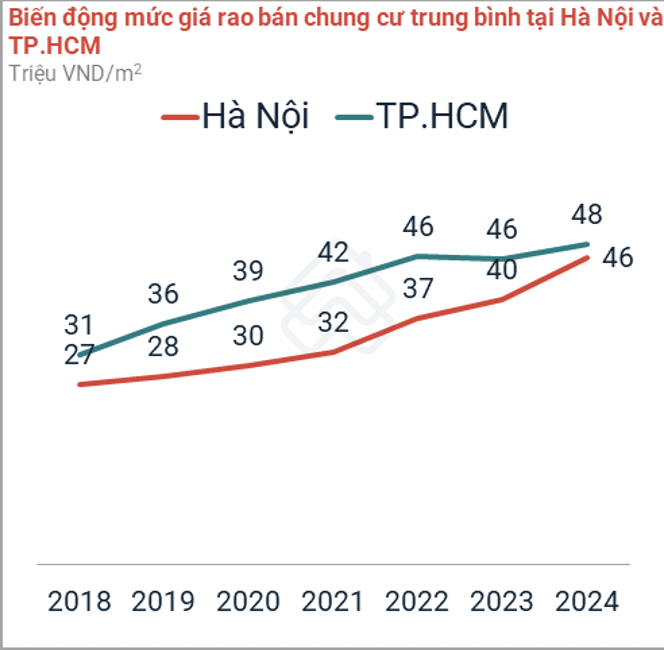

According to the first quarter 2024 real estate market report of PropertyGuru Vietnam, after 6 years, the average price increase of apartments in Hanoi reached 70%. Specifically, apartments in Hanoi have an average price of 46 million VND/m2, while the price of apartments in Ho Chi Minh City is 48 million VND/m2.

At the beginning of 2018, the selling price of apartments in Hanoi and Ho Chi Minh City was only 27 and 31 million VND/m2.

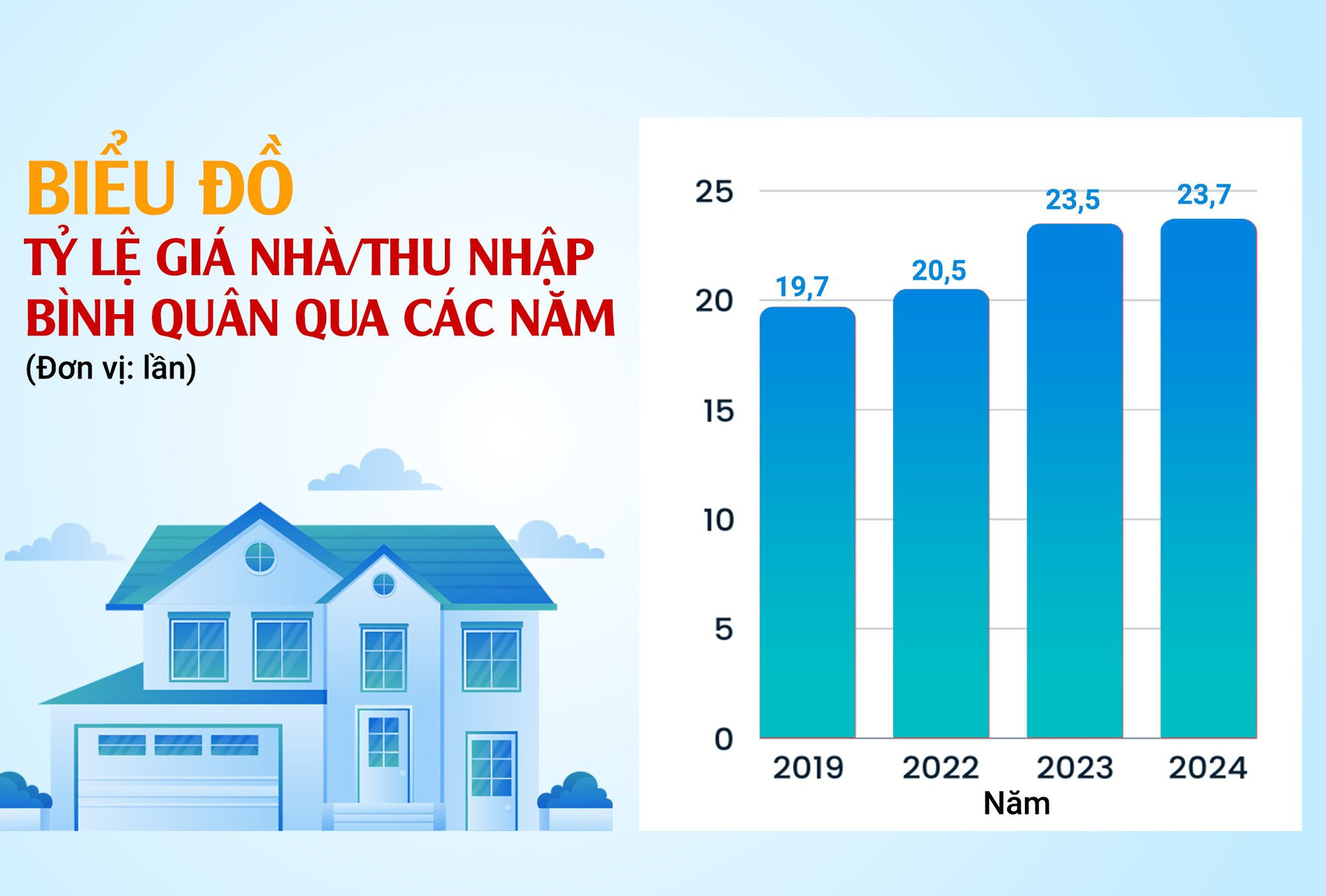

House prices are nearly 24 times income.

The latest report by Numbeo.com (a website specializing in statistics on living standards in cities and countries around the world through surveys) shows that the average house price in Vietnam in 2024 is nearly 24 times the average annual household income.

In Ho Chi Minh City, according to Ms. Giang Huynh, Deputy Director of Research & S22M, Savills Ho Chi Minh City, apartment prices are currently about 30 times higher than the average income of city residents.

Specifically, the average income of a household in Ho Chi Minh City is only about 15 million VND/month. Meanwhile, the average price of an apartment in a new project is currently 5.5 - 6 billion VND. If people are able to save 40 - 50%/month, it will take several decades to be able to buy a house, in case they do not use credit or do not have support from relatives.

“It will be very difficult for a household based on pure income, average income to buy a house in Ho Chi Minh City at this time. You must have a fairly high income, as well as support from financial leverage to be able to buy an average apartment,” said Ms. Giang.

Many studies have also shown that over the years, the growth rate of housing prices is much higher than the growth rate of people's income. According to a report by Savills Vietnam, Hanoi is striving to have an average income per capita of 150 million VND/person/year in 2023, compared to 2019, the average income growth rate is 6%/year.

Meanwhile, apartment price growth from 2019 to the first half of 2023 is up to 13%/year.

“This figure shows that the growth in per capita income in Hanoi is nearly half lower than the growth in apartment prices,” said Ms. Do Thu Hang, Senior Director, Consulting and Research Department, Savills Hanoi.

Ms. Hang warned that home ownership will become even more difficult if this gap widens.

Dr. Le Xuan Nghia, a finance and banking expert, also cited evidence of the huge gap between housing prices and people's income.

Specifically, a worker aged 30 or younger with an average income of about 15 million VND/month, minus living expenses in big cities like Ho Chi Minh City or Hanoi, has about 6 million VND left, so it would take at least 20 years to save 1.5 billion VND. With an income of 20 - 30 million VND/month, to buy a 1.5 billion VND apartment, it would take 10 - 15 years to save.

According to PropertyGuru Vietnam, the average selling price of all types of housing in Hanoi is 22.8 billion VND/unit for townhouses; 17.8 billion VND/unit for villas; 6.3 billion VND/unit for private houses and 3.1 billion VND/unit for apartments. Meanwhile, the estimated average income of workers in Hanoi in 2023 is 135 million VND/year.

Thus, to own a street-front house in Hanoi, people need to "work hard" for 169 years, to own a private house it takes 132 years, and to buy an apartment it takes 23 years (assuming that workers use all their income to buy a house).

Why do house prices only increase and not decrease?

According to experts, housing prices are increasing due to high demand while supply is scarce. Explaining the limited supply, the Ministry of Construction said that many real estate projects are currently facing many difficulties in implementation (having to temporarily stop, delay, postpone progress, difficulties in accessing credit loans, issuing bonds and mobilizing capital).

Another reason, according to Mr. Giang Anh Tuan, Director of Tuan Anh Real Estate, is that real estate prices depend on many factors such as land prices, construction costs, legality... If these factors affect at the same time, it will make it difficult for businesses to reduce housing prices.

Specifically, for a real estate project, land cost is one of the important input costs that affect the output price. On average, in urban areas, land use fees account for about 10% of the price of an apartment, 20-30% of the price of a low-rise townhouse, and about 50% of the price of a villa.

In recent years, land prices have increased by 15 - 30%, pushing housing prices up by 2 - 8%.

Not only land prices, construction materials such as iron, steel, sand... also increased sharply. For example, iron and steel prices increased by about 15-20%, while the cost of raw materials accounts for 65-70% of the estimated value of construction projects.

In addition, the cost of implementing the project has also increased due to many legal issues that have prolonged the construction time. Mr. Tuan said that there are projects that take up to 4-5 years to complete legal procedures.

Mr. Tuan further explained that if a business buys a plot of land worth 500 billion VND, it will lose 10% of its loan interest expense each year, which is 50 billion VND. The business is forced to add this expense to the price.

Agreeing with the above opinion, Mr. Tran Khanh Quang, General Director of Viet An Hoa Real Estate Company, said that a major obstacle that makes it difficult for real estate prices to decrease is that investment costs are too high. "In the current project cost structure, construction costs have nearly doubled compared to 4-5 years ago, from 7-7.5 million VND/m3 to more than 12 million VND/m2," said Mr. Quang.

According to Dr. Nguyen Duy Phuong, Investment Director of DGCapital, when implementing a project, the investor mortgages both land and future assets to borrow capital from the bank. Reducing the selling price will affect the value of the collateral at the bank.

According to experts, the best way to control housing prices is to increase supply.

To do this, according to Mr. Le Hoang Chau, Chairman of the Ho Chi Minh City Real Estate Association (HoREA), two important steps need to be taken. The first is to remove legal obstacles related to the projects to ensure that these projects can be implemented and built.

Second, it is necessary to solve the credit "problem" and stimulate cash flow by promoting policies aimed at people with real housing needs and helping businesses develop projects that meet these needs. For example, it is necessary to solve difficulties in building social housing and affordable commercial housing, thereby increasing supply.

According to Mr. Nguyen Quoc Anh, Deputy General Director of PropertyGuru Vietnam, it is necessary to promote the construction and upgrading of public transport systems, including metro lines. Convenient transportation will encourage people to move out of the city center, reducing the pressure on housing demand in the inner city area.

TN (according to VTC News)