The US Federal Reserve (Fed) decided to keep interest rates unchanged at current levels, but opened the door to cutting lending costs at its next meeting in September.

Early morning of August 1, Vietnam time, after a two-day policy meeting, the Fed decided to continue keeping interest rates at the current level, but opened the door to cutting lending costs at the next meeting in September, in the context of positive inflation developments and approaching the 2% target.

In a statement released at the end of the meeting, the Fed decided to keep its benchmark interest rate in the range of 5.25% - 5.5%, the highest level in 23 years, while noting that inflation continued to make some progress towards the agency's 2% target.

The steady decline in inflation in recent months has fueled a broad consensus among Fed policymakers that the fight against inflation is nearing an end. The Fed now sees inflation as “moderately rising,” a significant change from the “elevated” inflation assessment the agency has used frequently in recent months.

In its statement, the Fed did not commit to cutting rates in September, reiterating that policymakers still need “greater confidence that inflation is progressing sustainably toward our 2% objective” before lowering borrowing costs. However, the changes in the Fed’s latest policy statement appear to be consistent with that belief and are reinforcing investor expectations that the US central bank will begin cutting rates at its next policy meeting on September 17-18.

In June 2022, the US Consumer Price Index (CPI) peaked above 9%, prompting the Fed to respond with a series of interest rate hikes that ended in July 2023. Since then, the Fed has kept its benchmark interest rate in the range of 5.25% - 5.50%, remaining steadfast in its 2% inflation target.

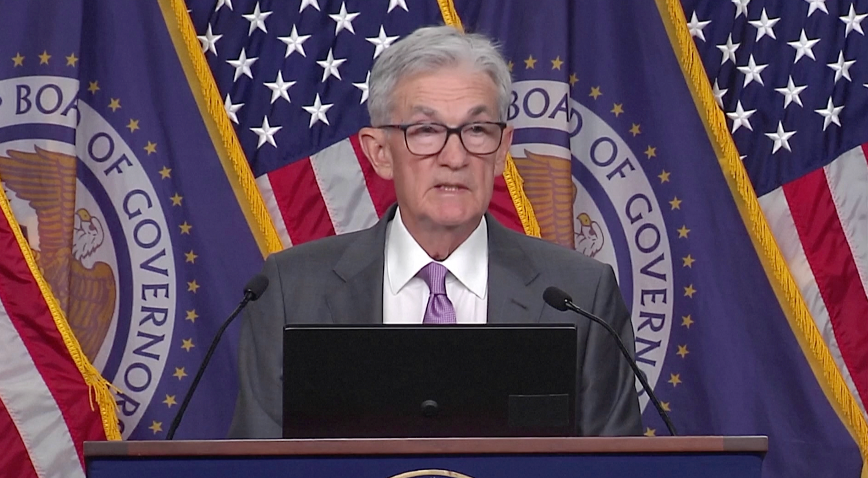

After the June CPI data was released, especially the Fed Chairman's statement, experts predicted that the Fed would start lowering interest rates from next September.

Although Fed officials indicated at their June meeting that they were likely to cut rates by 0.25% this year, many analysts expect a cut in September and at least one more by the end of the year, according to CME Group’s FedWatch tool. Moreover, traders even estimate a 40% chance of a third cut in December.