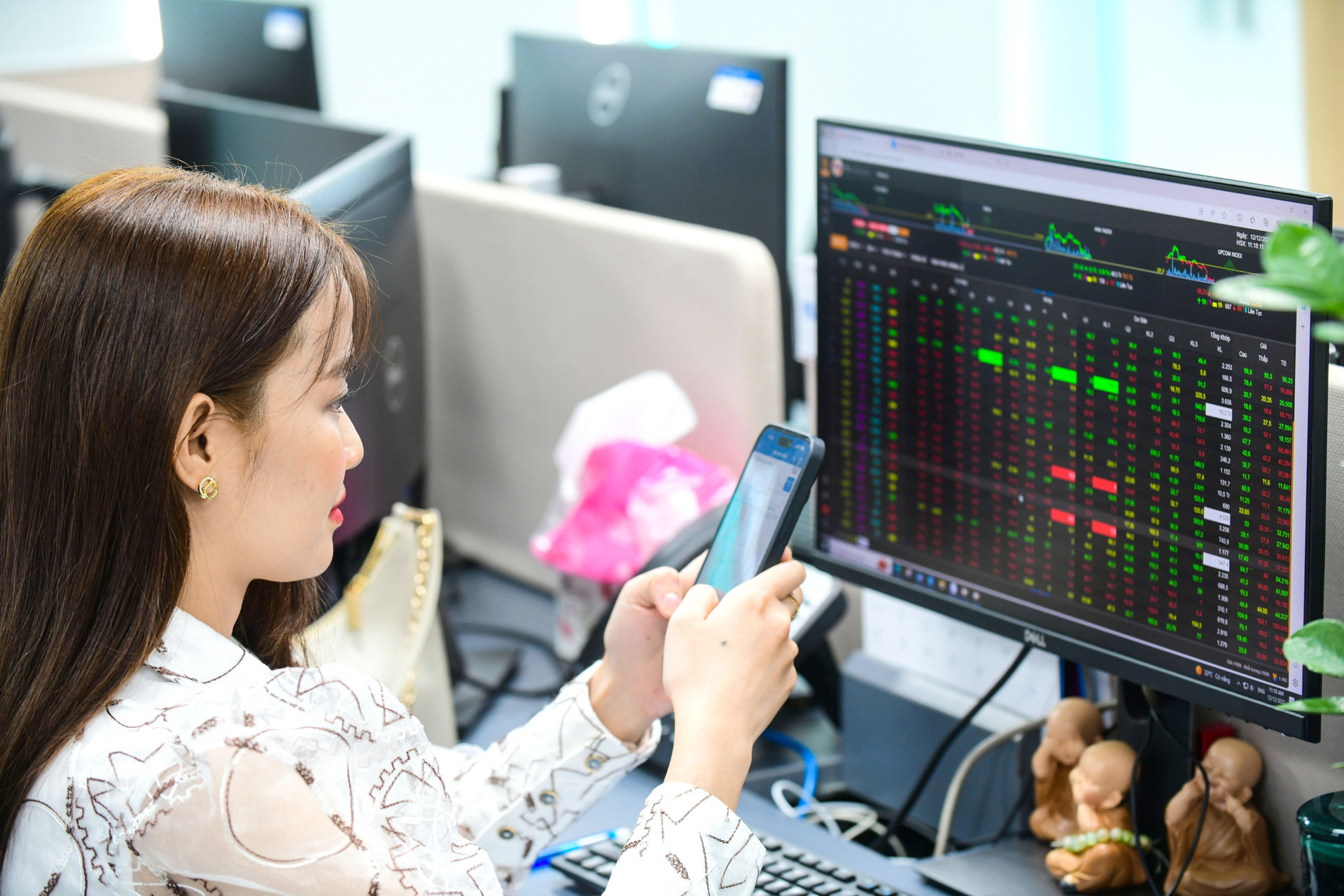

The selling pressure was very strong after 10am this morning, March 18, the stock market was covered in red with "huge" liquidity of nearly 2 billion USD. Even when some unrelated information appeared, it also led to the phenomenon of investors racing to sell, according to experts.

The Vietnamese stock market has just experienced a tense trading session. The VN-Index fell dramatically in the morning session (March 18), then gradually decreased towards the end of the afternoon session.

In this morning's session, at one point more than 460 stocks lost points on HoSE, VN-Index dropped 36 points. Order matching liquidity reached more than 25,400 billion VND, 2.3 times higher than the previous session and 2.3 times higher than the average of 5 sessions at the same time.

After that, the decline gradually narrowed, at the end of the session, VN-Index was pulled back up to the 1,243 point area, down more than 20 points compared to the end of last week. The entire HoSE floor had more than 400 stocks losing points compared to more than 100 stocks remaining green.

The selling pressure was high, but the buying pressure was also not small, the transactions were very active, pushing the market liquidity very high. After one day, the matched value on HoSE reached 43,126 billion VND. The three floors were about 48,000 billion VND (approximately 2 billion USD).

Ms. Tran Thi Khanh Hien - Director of Research at MB Securities (MBS), said that the market has gone through a long period of growth, this is the time to take profits.

Therefore, even when some information appears that is not related to fundamental market factors, it will lead to a phenomenon of investors "racing" to sell, Ms. Hien explained.

On the positive side, according to Ms. Hien, liquidity today is very high, with strong "bottom-fishing" demand.

Normally, if it goes down quickly and has good liquidity, the possibility of a rebound is even better.

However, at different times, the market will have different movements.

Ms. Hien also said that it is quite difficult to make a forecast for the current market. The State Bank is still continuing to withdraw money through the treasury bill channel, stabilizing the exchange rate, and needs time to observe.

But in general, investors should be careful to avoid panicking and selling off. Especially with information that does not affect the fundamentals of the market, but only affects psychology, they should stay calm.

The director of a securities company in Ho Chi Minh City said today's session was a combination of many factors and information.

"Experiencing" today's session, many investors associated it with the record drop on August 18, 2023. In this session, VN-Index recorded a drop of 55 points after failing to climb to the 1,250 mark.

Last August, the market witnessed a broad-based increase in stocks, with increases occurring in most industry groups, especially those with loss-making business results.

If we compare the market at this stage with the context at the end of August last year, there are some similarities such as the US inflation trend or the story of net absorption of treasury bills from the State Bank.

Observers are increasingly commenting on the double top model.

However, whether VN-Index will repeat the scenario of last September is still a question that depends on many factors.

Mr. Dinh Quang Hinh - head of macro and market strategy department, VNDirect analysis block, predicted that the VN-Index could "test" the "resistance zone" around 1,280 points.

He also acknowledged that the stock market did not react too negatively to the State Bank's move to issue treasury bills. This is because the market currently has many supportive factors.

"Domestic cash flow is quite fierce, supported by the low interest rate environment and expectations for market upgrades," the expert said.

Back to today's trading performance, there were quite positive signs in some real estate stock groups.

In the top 10 stocks with good price increases today, VRE, DPG, QCG, DIG... hit the ceiling. Many other real estate codes also recorded green such as SCR, CEO, TCH, HQC, ITC...

In the VN30 group, 28 stocks decreased in points, only two stocks maintained their "performance" today, VIC and VRE, both belonging to the Vingroup "family".