In just the first week of June (June 3-8), the market recorded 13 banks increasing deposit interest rates, only one bank adjusted down the terms from 15-36 months.

13 banks increased deposit interest rates including: VietinBank, TPBank, VIB, GPBank, BaoViet Bank, LPBank, Nam A Bank, OceanBank, ABBank, Bac A Bank, MSB, MB, and Eximbank.

On the contrary, Eximbank is the only bank that increased deposit interest rates for terms of 1-9 months, but reduced them by 0.1%/year for terms of 15-36 months.

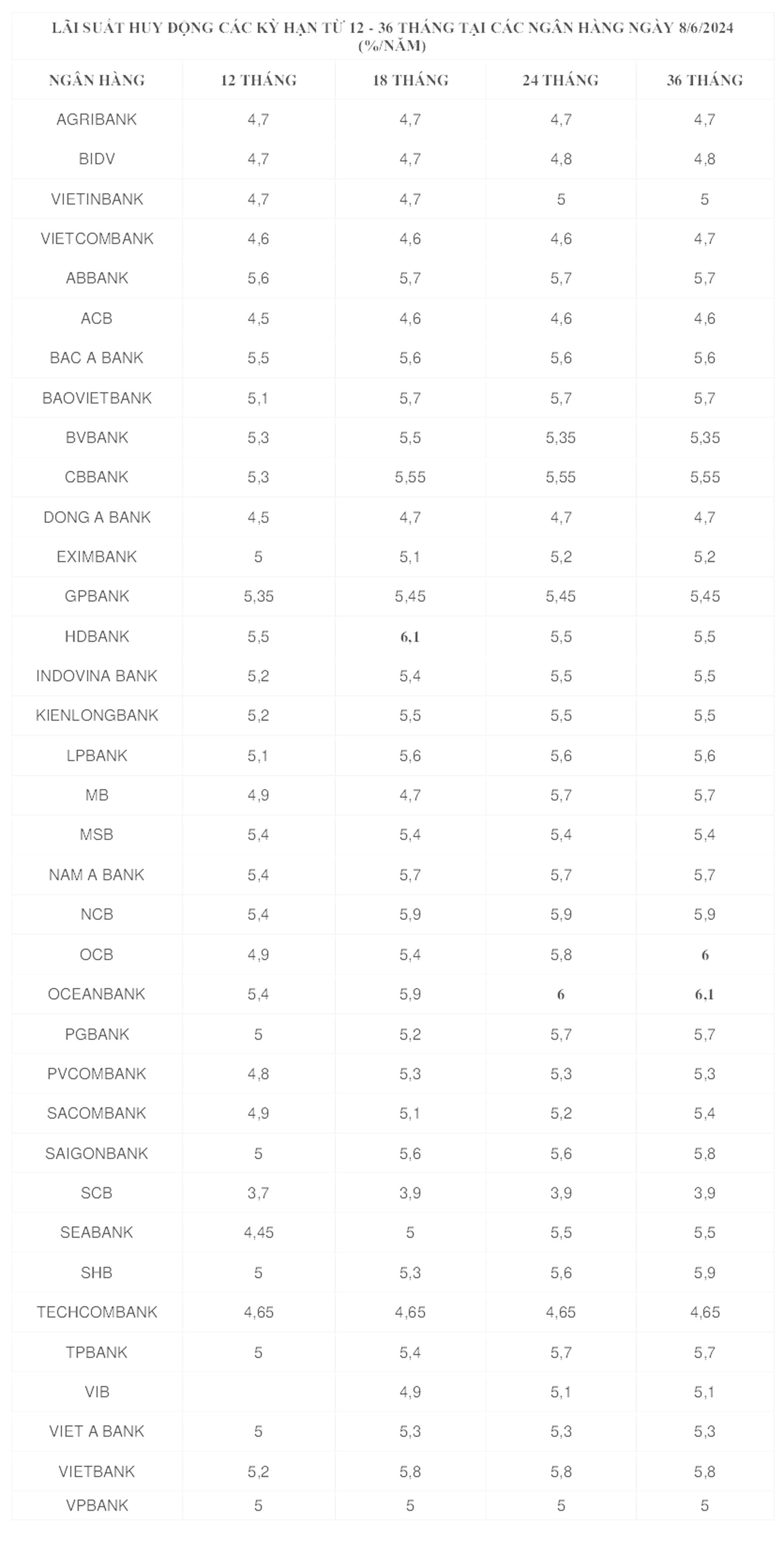

Interest rates of 5%/year are increasingly appearing on banks' interest rate tables, especially for terms of 12 months or more. Deposit terms that were previously listed by banks at interest rates of over 5%/year are now closer to 6%/year.

Of which, HDBank, OCB and OceanBank lead the market in long terms with interest rates from 6-6.1%/year.

Specifically, HDBank pays interest rates of 6%/year for 15-month term and 6.1%/year for 18-month term. OceanBank is paying 6%/year for 24-month term deposits, and 6.1%/year for 36-month term. As for OCB, this bank lists interest rates of 6%/year for 36-month term deposits.

Currently, the highest 6-month deposit interest rate is at CBBank at 5.15%/year.

The highest 9-month savings interest rate is still 5.1%/year at Nam A Bank, followed by NCB with 5.05%/year, while KienLong Bank and Bac A Bank are listed at 5%/year.

Meanwhile, the interest rate of 5%/year is increasingly dominant for deposit terms of 12 months or more.

Recently, the State Bank sent an official dispatch to credit institutions (CIs) requesting them to continue to drastically implement solutions to reduce costs, simplify procedures, etc., and strive to reduce lending interest rates by 1-2%/year.

Along with that, the State Bank also requires credit institutions to maintain a stable and reasonable mobilization interest rate level, consistent with the ability to balance capital, the ability to expand healthy credit and the ability to manage risks, stabilize the market and the market interest rate level.