Selling pressure showed signs of strengthening, the index breadth from after 10:30 started to dominate the down side. VN-Index broke through the 1,250 point mark from around 10:55 and the number of stocks falling in price started to completely overwhelm.

Selling pressure showed signs of strengthening, the index breadth from after 10:30 started to dominate the down side. VN-Index broke through the 1,250 point mark from around 10:55 and the number of stocks decreasing in price started to completely dominate. Trading on HoSE also increased by more than 22% compared to the previous session, confirming signs of a price decrease.

VN-Index closed the morning session down 4.62 points, equivalent to -0.37% compared to the reference. The index still had a weak increase, peaking at 9:45 a.m. 3.7 points above the reference. Although it has broken through the 1,250-point mark (to 1,247.09 points), it is still not lower than the lowest level of the session on September 11 (1,244.79 points). If the market recovers positively in the afternoon, this decrease is still considered a test of the support level.

However, it is undeniable that the market was weak this morning. At its peak, the VN-Index had 197 gainers/111 losers. When the index started to turn red at 10:40, it recorded 154 gainers/185 losers. At the end of the morning session, the HoSE floor had only 115 gainers/252 losers. It is clear that the index's slide has a consistent breadth, showing that the price decline appeared across the board.

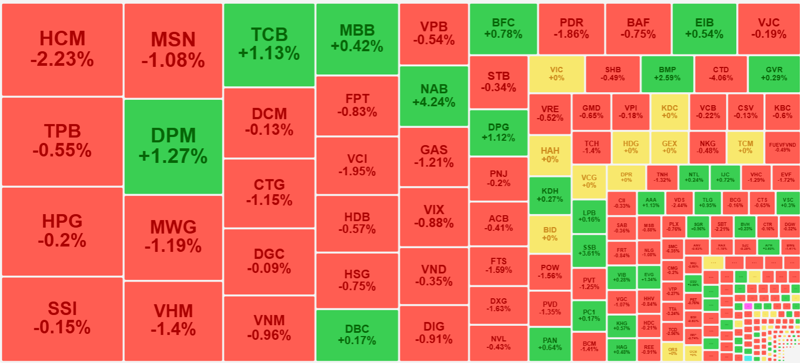

VN30-Index is down 0.33%, with only 6 stocks increasing/22 stocks decreasing, of which 7 stocks decreased by more than 1%. Fortunately, in the top 10 market capitalization, only CTG decreased by 1.15%, VHM decreased by 1.4%, GAS decreased by 1.21%. POW fell the deepest in the VN30 basket, losing 1.56%. This stock officially broke the bottom last July. On the upside side of the VN30 basket, only TCB increased by 1.13% and SSB increased by 3.61%, which is significant.

The entire HoSE recorded 71 stocks decreasing by 1% or more and this group accounted for about 27.6% of the total matched value of the floor. Blue-chip stocks accounted for most of the liquidity such as MSN decreased by 1.08%, matched 157.1 billion; MWG decreased by 1.19%, matched 140.5 billion; VHM decreased by 1.4%, matched 132.5 billion; CTG decreased by 1.15%, matched 105.8 billion. In addition, there were some mid-range stocks such as HCM decreased by 2.23%, VCI decreased by 1.95%, PDR decreased by 1.86%, FTS decreased by 1.59%...

The selling pressure was also quite evident in the top liquidity group. HoSE recorded 13 stocks with a trading value of VND100 billion or more, of which only DPM increased by 1.27% and TCB increased by 1.13%, the rest were all red. Of course, not all of the remaining 11 stocks decreased sharply, but the failure to maintain the price above the reference price is also a weak sign, especially when the breadth shows complete dominance on the red side.

The bullish side still has 115 stocks going against the trend but trading is very weak. The group with the best increase of 1% or more has 32 stocks, accounting for only 10.4% of total floor liquidity, because the majority are stocks with little trading. NAB increased by 4.24% with 70.6 billion; BMP increased by 2.59% with 33.5 billion; DPM increased by 1.27% with 157.1 billion; AAA increased by 1.13% with 11.4 billion; TCB increased by 1.13% with 128.3 billion and DPG increased by 1.12% with 46.2 billion are the most significant stocks.

The selling pressure was quite clear this morning, contributing to the increase in matched liquidity on both exchanges by nearly 21% compared to the previous session, reaching VND5,014 billion. On HoSE alone, liquidity increased by 22%, reaching VND4,728 billion. This shows that liquidity improvement can only be achieved through proactive selling, because those holding money are mostly placing low-priced buy orders to wait.

Foreign investors are also trading in a depressed manner with a slight net selling of VND17.6 billion on HoSE. The stocks with the largest net selling are MWG -32.6 billion, VCI -28.4 billion, HSG -27.2 billion. On the buying side, TCB +40.4 billion, NAB +30 billion are the most.

The weakening performance with very low liquidity is partly due to the lack of motivation for the money flow to move more enthusiastically. This week, the market is waiting for the FED meeting on interest rates as well as derivatives maturity, so supply and demand are fragile. Any time one side gets a little stronger, it can change the price color.

TH (according to VnEconomy)