All eyes in the market this morning were on the developments of the US presidential election. The ability to access the results in real time has helped the market trade more excitedly.

VN-Index closed the session on November 6 up 0.72%, equivalent to +8.93 points compared to the reference. In fact, almost all of this increase was achieved in the first minutes of opening, while the fluctuations during the session were almost insignificant.

The anchor point is high and less volatile as supply and demand are balanced and there is no obvious pressure from sellers. Buyers are clearly more enthusiastic while sellers are also pausing to observe.

The order matching value of the two exchanges increased by about 41.1% compared to yesterday morning, reaching nearly VND5,339 billion. The HoSE increased by 36.1% with VND4,893 billion. Although the ratio increased sharply, the absolute number was still insignificant, still a very low trading level compared to previous weeks.

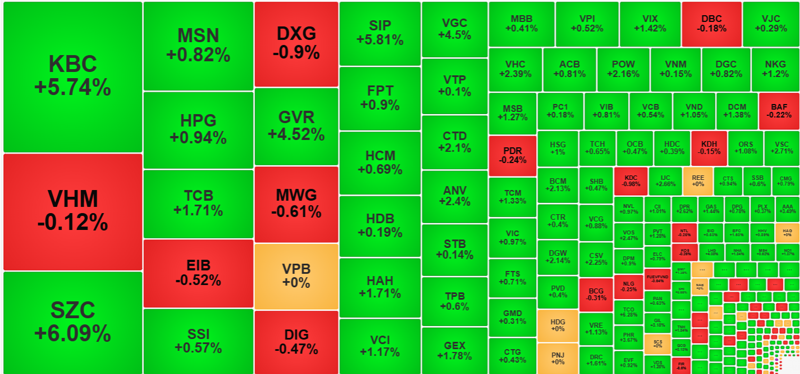

Although liquidity is low, the price increase effect is impressive. VN-Index ended the morning session with 238 stocks increasing/101 stocks decreasing. Only 26 stocks decreased by more than 1% and all were illiquid stocks. The largest transaction belonged to FIR, which only reached more than 6 billion VND, and even out of these 26 stocks, only 5 stocks had transactions exceeding 1 billion VND.

There were not many impressive codes on the upside, but overall liquidity was better. Specifically, out of 238 green codes, 94 codes increased by more than 1% and 36 codes traded at VND10 billion or more.

A notable change occurred in KBC, this stock is very sensitive to the US election results when it increased continuously with the advantage of candidate Donald Trump. This stock is even leading the whole market in liquidity with more than 348.7 billion VND, the price increased by 5.74%.

KBC's closing price this morning is the highest in 3 months. However, KBC is a small-cap stock in the VN-Index, contributing only 0.3 points to this index.

A series of other stocks increased quite strongly and attracted good cash flow: SZC increased by 6.09% with 239.7 billion VND; TCB increased by 1.71% with 126.5 billion; GVR increased by 4.52% with 109.1 billion; SIP increased by 5.81% with 88.1 billion; HAH increased by 1.71% with 81.9 billion; VCI increased by 1.17% with 77.4 billion; VGC increased by 4.5% with 62.4 billion; CTD increased by 2.1% with 60.6 billion... In general, the 94 stocks with the best increase this morning accounted for 40.9% of the total matched value on the HoSE floor.

The group of blue-chip stocks increased quite steadily this morning but there were few prominent pillars, so they did not create a sudden push but only maintained stability for the index. Of the 10 leading capitalization stocks, only VHM decreased by 0.12%, VPB was reference, the rest increased.

However, only TCB increased by 1.71% and GAS increased by 1.44%, which were outstanding. The mid-cap group in the VN30 basket, including GVR, POW, BCM, and VRE, also increased by more than 1%. The VN30-Index closed the morning session 0.59% above the reference with 26 stocks increasing/2 stocks decreasing.

Foreign investors continued to net sell about 173.4 billion VND on HoSE, which is the lowest level in the last 6 morning sessions. Only a few notable codes were sold: VHM -84.4 billion, MSN -64 billion, SSI -27.6 billion, DBC -26.3 billion. The net buyers were SZC +27.8 billion, HPG +23.7 billion, which were significant.

VN-Index gained nearly 9 points this morning, conquering the 1250-point mark again, reaching 1254.65 points. This is temporarily the best increase in the last 20 sessions of this index. The market turned around positively after a downward trend that lasted throughout October and the index retreated to the bottom of September 2024.

This could be a positive reaction around the technical support level. However, the liquidity is still small, indicating that the wait-and-see attitude still prevails.

TB (according to VnEconomy)