On the morning of May 17, US President Joe Biden met with House Speaker Kevin McCarthy and congressional leaders to find a solution to the debt ceiling issue.

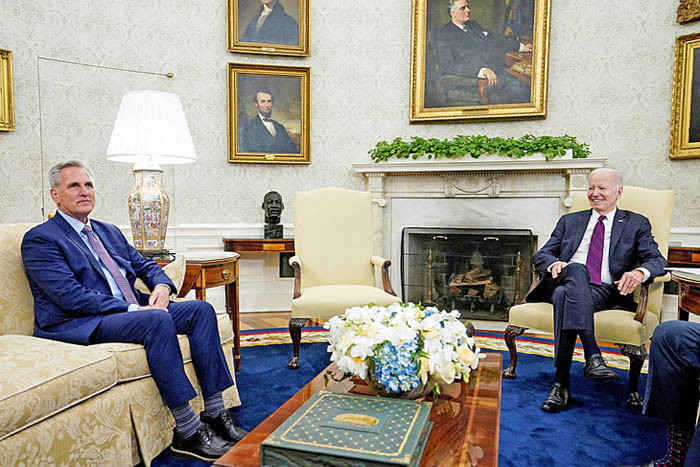

US President Joe Biden (right) discusses with US House Speaker Kevin McCarthy

The White House meeting took place just over two weeks before June 1, the date predicted to be the day the US officially defaults on its debt if it fails to resolve the issue of raising the debt limit.

Pressure on Mr. Biden

Currently, the total US public debt has reached the milestone of 31.4 trillion USD. According to the debt ceiling, the government cannot borrow more than this amount. That means the government is about to run out of money and will not be able to pay its debts and public expenses.

To finance debt or public expenditures such as social security benefits or public employee salaries, the government needs to borrow more money. So President Biden’s Democratic Party wants Congress to raise the debt ceiling.

However, borrowing more money is only a temporary solution and can lead to many consequences. Therefore, this move is opposed by the Republican Party, which controls the House of Representatives. The Republicans accept raising the debt ceiling, but conditional on the government cutting public spending. They oppose the Democrats' tax cuts, saying that this is a factor that depletes the budget. In April, the House of Representatives passed a law to increase the debt ceiling by $1.5 trillion, along with cutting spending by $4.8 trillion.

Democrats disagree with other provisions of the bill. The cuts would affect a series of social security projects, which are the goals and considered policy “victories” of the Biden administration. With the election campaign just starting, Democrats have reasons to not want to reduce public spending and thus negatively affect a series of policies.

In other words, Mr. Biden and the Republicans must find a solution to balance the debt ceiling increase and the reduction of government spending. According to a Reuters/Ipsos survey on May 15, 76% of Americans said that the two sides must reach an agreement on the debt ceiling because they are concerned that a default would put them under financial pressure.

Long-lasting concerns

Before the meeting, most did not believe that the two sides could find common ground in such a short time. The White House press secretary said that at the meeting, President Biden reiterated that raising the debt ceiling is the constitutional responsibility of Congress.

Meanwhile, observers still hope that both sides can make concessions. According to Republican Representative Don Bacon, a potential deal could include details such as raising the debt ceiling by 2% instead of the 1% that Republicans want.

But the urgency is making negotiations difficult. The May 17 meeting took place just a day before Mr. Biden was due to leave for Japan for the G7 summit. Asked whether Mr. Biden could go to Japan without a debt ceiling deal, House Speaker McCarthy said on May 16: "Look, I think an American president should focus on solutions for the American people. And I think that speaks to your values and your priorities."

A prolonged stalemate would also be a concern, regardless of the outcome of the talks. A similar situation in 2011 caused a historic drop in the US credit rating, which led to a stock market sell-off and higher domestic borrowing costs. The current situation has also pushed the cost of insuring the US government to record highs.

On May 16, US Treasury Secretary Janet Yellen continued to warn that the US economy was suffering and the burden of national debt was increasing. Previously, Ms. Yellen had affirmed that a US default would create an "economic and financial disaster", causing a global economic recession and threatening to weaken the country's ability to lead the world.

More than half of the world’s foreign exchange reserves are held in the US dollar. A sudden drop in the value of the dollar in the event of a default would affect the Treasury bond market. According to the Council on Foreign Relations (New York, USA), low-income countries that are heavily indebted will have a harder time paying interest on their public debt. When the dollar weakens, debts in other currencies will be heavier, which can easily push emerging economies into debt crises.

Many US exporters could benefit from a weaker dollar, which would be bad news for US export partners, but US businesses would also face higher borrowing costs due to rising interest rates.

According to Tuoi Tre