Workers who retire early will have their social insurance premiums deducted at a rate of 2% per year, while those who exceed the maximum contribution limit will only receive a subsidy equal to 0.5 times the average salary paid for social insurance.

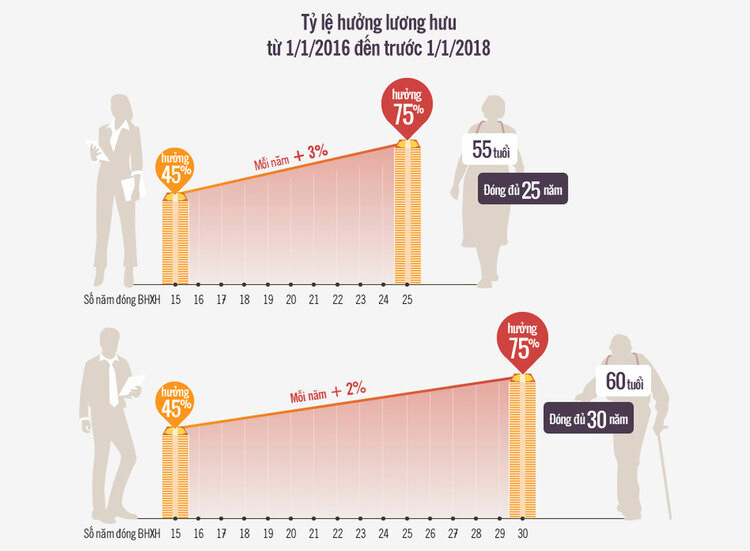

After many amendments, the Law on Social Insurance has adjusted the way to calculate the pension rate of workers. Before 2018, for each year of social insurance participation, women were added 3%, men 2% until reaching a maximum of 75% of the average salary used to calculate social insurance contributions. From 2018 onwards, both men and women are 2%.

Since 2016, the deduction rate for early retirees is 2%, instead of 1% as before. The law stipulates that workers working in normal conditions who want to retire early (the roadmap gradually increases to 62 for men and 60 for women) must, in addition to paying 20 years of social insurance, have a work capacity reduction assessment result of 61% or more.

The early retirement period shall not exceed 5 years for those with a disability of 61% to less than 81% and shall not exceed 10 years for those with a disability of over 81%. For each year of early retirement, the employee's pension rate shall be deducted by 2%.

If the reduction is less than 61%, the employee is not eligible for early retirement. If he/she still wants to quit his/her job, the employee's social insurance contribution period will be reserved in the system until he/she reaches the age to receive pension and will not be deducted % when receiving.

For example, in 2023, a 54-year-old female worker, who has participated in social insurance for 35 years, has a 61% reduction in working capacity, and chooses to retire early while the required age is 56. This person will receive a pension of 71% (4% deducted due to retiring 2 years early) along with a one-time subsidy of 2.5 times the average salary calculated for social insurance contributions for 5 years exceeding the frame.

If male workers have accumulated over 35 years of social insurance and female workers have accumulated over 30 years of social insurance, in addition to the maximum pension of 75%, they will receive a one-time subsidy for each year equal to 0.5 times the average salary used to calculate social insurance contributions. The draft revised Law on Social Insurance proposes that people in the above group who continue to pay social insurance will receive a subsidy for each year exceeding 2 times the average salary used as the basis for payment.

Hanoi elderly relax by Hoan Kiem Lake

Many experts consider the subsidy of 0.5 times the average contribution to be too low because the total amount of money contributed to the fund each year is equal to 2.64 months' salary. "The revised law needs to raise the subsidy to at least 2 times the average contribution," a social security expert suggested.

He also said that the proposal to subsidize people who have received a maximum pension of 75% but continue to participate in social insurance is not feasible, the benefit level is too low, not attractive while they have to contribute the entire 22% to the Pension Fund. Workers who have received a maximum pension of 75% often want to rest and enjoy their old age and rarely choose to continue contributing.

Sharing the same view, Mr. Ta Van Duong, Head of the Department of Legal Policy and Labor Relations, Hanoi Labor Federation, said that the deduction of 2% when workers retire early makes participants feel disadvantaged. Meanwhile, each year of exceeding the limit, they only receive a subsidy of 0.5 times the average salary calculated for contribution. This is a paradox. Many workers, despite seeing the disadvantages, still choose to "close the book" for early retirement rather than being interested in staying in the system.

"They feel that the difference between paying and receiving is unfair. Through contact with voters, workers want to receive this subsidy that is equal to the amount paid into the Fund or at least twice the average salary paid," said Mr. Duong. For example, if a person pays more than the 10-year limit, the lowest subsidy that should be received should be 20 months of average payment, not 5 months as per current law.

According to him, "early retirement" is still the biggest concern of direct production workers. Increasing the retirement age is stipulated in the Labor Code, but the Social Insurance Law can still adjust the age, conditions and calculation of pensions because it is related to the retirement and social security regime, not heavily related to labor relations.

The retirement age was increased to 60-62, while direct production workers found it difficult to stay in the factory at the age of 45-50. Many people, even if they wanted to stay, found it difficult because the company cut back, even found excuses to rearrange production, but in reality, it was laying off older workers. Many people left the factory, struggling to make ends meet, let alone continuing to participate in social insurance, even if it was voluntary. Workers at that time often chose to withdraw their social insurance at once rather than wait for retirement.

Mr. Duong suggested that the revised law could consider the option of exchanging the time of payment exceeding the framework for the missing years in the case of early retirement. The binding condition is that the exchange period must not exceed 5 years, and not mechanically calculate that paying 10 years beyond the framework can be converted into 10 years of early retirement. In reality, many workers have paid social insurance for nearly 40 years, have enough time to receive the maximum 75% but are still not old enough to retire, so they are very discouraged.

In addition, with short-term funds such as maternity sickness, occupational accidents and diseases, it is necessary to expand the beneficiaries, increase the benefit level, and reduce administrative procedures to make it easier for workers to access. "To amend the law to increase attractiveness, for the benefit of workers, we must clearly show them the benefits, so that they themselves consider staying in the system long term," Mr. Duong stated his opinion.

Mr. Nguyen Duy Cuong, Deputy Director of Social Insurance Department, Ministry of Labor, War Invalids and Social Affairs, explained that the regulation on subsidies for those who pay beyond the limit is to encourage workers to continue working and paying social insurance after retirement age.

People who retire earlier than the prescribed age do not continue to contribute while the Pension Fund must pay early, so they cannot claim the same benefits as people who retire at the right age. The deduction of the pension rate due to early retirement is in accordance with the contribution and benefit principles, international practice and only ensures fairness for those who retire at the right age.

The one-time pension of 0.5 months on average for each year of contributions exceeding the limit is to acknowledge the long-term participation of the employee. Mr. Cuong said that this pension has been loosened, previously the maximum benefit was limited to 5 months.

Regarding the proposal to swap the years of contribution beyond the time limit for early retirement, Mr. Cuong said that the issue of retirement age has been regulated in the 2019 Labor Code, which specifically defines cases of early retirement. Social insurance principles and international practices do not recognize the swapping of years of contribution for early retirement.

Social insurance policies are designed to combine two principles: contribution and sharing. Retirement is more about the contribution principle, while short-term policies such as sickness, maternity, and work-related accidents are more about sharing. "All social insurance policies must have this principle, depending on the policy, the level is different, there is no policy that is absolutely contribution or absolutely sharing," he explained.

Looking back on the nearly 20-year journey after many law amendments, Mr. Cuong said that previous amendments focused on measures to ensure long-term balance for the Pension Fund. This amendment prioritizes expanding coverage and increasing benefits so that workers stay in the system for a long time.

According to statistics from the social insurance industry, the gap between the number of pensioners and pensioners is getting smaller. In 1996, there were 217 pensioners for every one pensioner; in 2000, the number of pensioners decreased to 34; in 2016, there were 9 pensioners; and currently, there are about 6.5 pensioners for every one pensioner.

According to VnExpress