The Ministry of Home Affairs has just provided guidance on implementing policies and regimes for officials and civil servants who retire early when rearranging the apparatus of the political system.

Minister of Home Affairs Pham Thi Thanh Tra has signed and issued Circular 002/2025 amending and supplementing a number of articles of Circular 01/2025 guiding the implementation of policies and regimes for cadres, civil servants, public employees and workers in the implementation of organizational restructuring of the political system. The Circular takes effect from April 4, 2025.

This Circular guides the implementation of policies and regimes for cadres, civil servants, public employees, and workers (including those working in key organizations) in agencies, organizations, and units specified in Article 1 of Decree 178/2024 (amended and supplemented in Decree 67/2025) in the process of restructuring the apparatus, administrative units at all levels, and streamlining the payroll.

Specifically, the circular guides how to determine the time and monthly salary to calculate policies and regimes; how to calculate policies for people who retire early; cadres, civil servants and commune-level cadres and civil servants; public employees and workers.

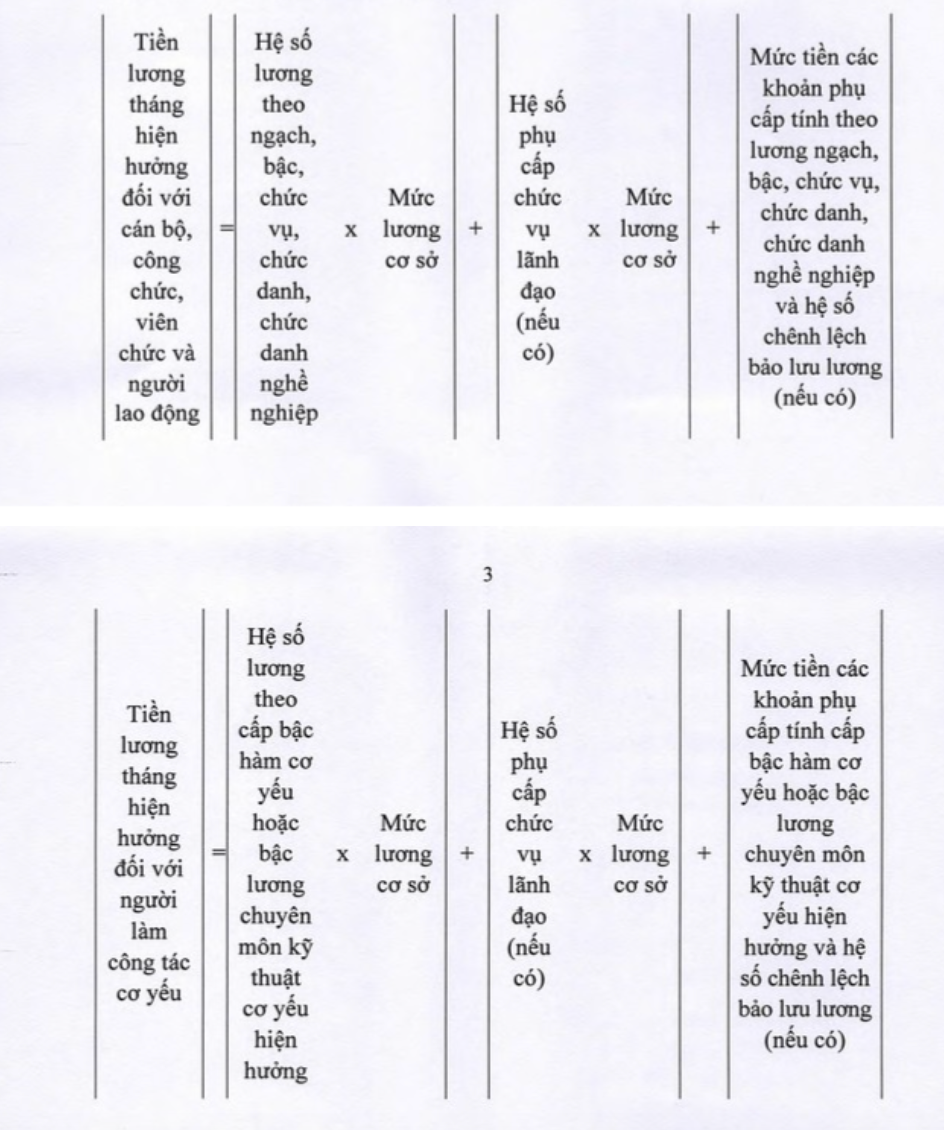

For those receiving salaries according to the salary table prescribed by the State, the circular clearly states that the current monthly salary includes:

Salary levels according to ranks, grades, positions, titles, professional titles and salary allowances (leadership position allowance; seniority allowance beyond the framework; seniority allowance...) and salary retention differential coefficient (if any) according to regulations of the law on wages.

The basic salary used to calculate the current monthly salary is the basic salary prescribed by the Government at the time of the month preceding the month of leave.

Regarding the calculation of policies for people retiring before the retirement age, cadres, civil servants, public employees and workers who are eligible and have been decided by competent authorities to retire before the retirement age, will immediately receive pension according to the provisions of the law on social insurance without having the pension rate deducted due to early retirement.

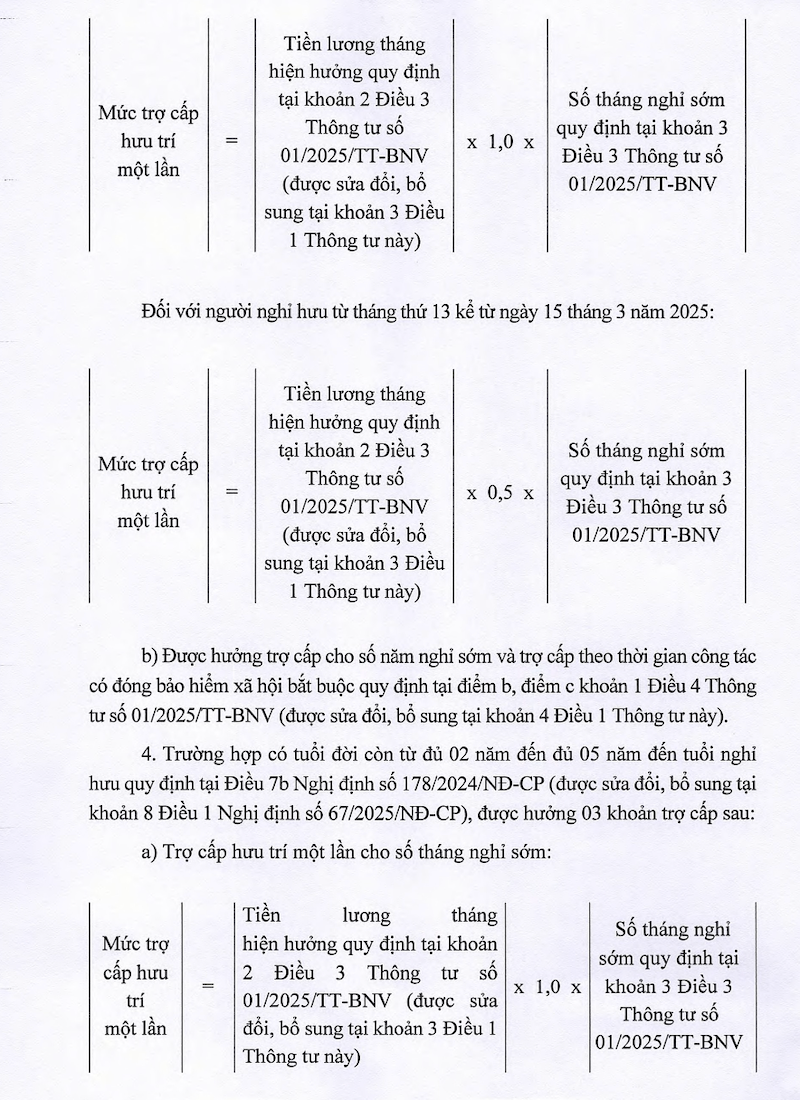

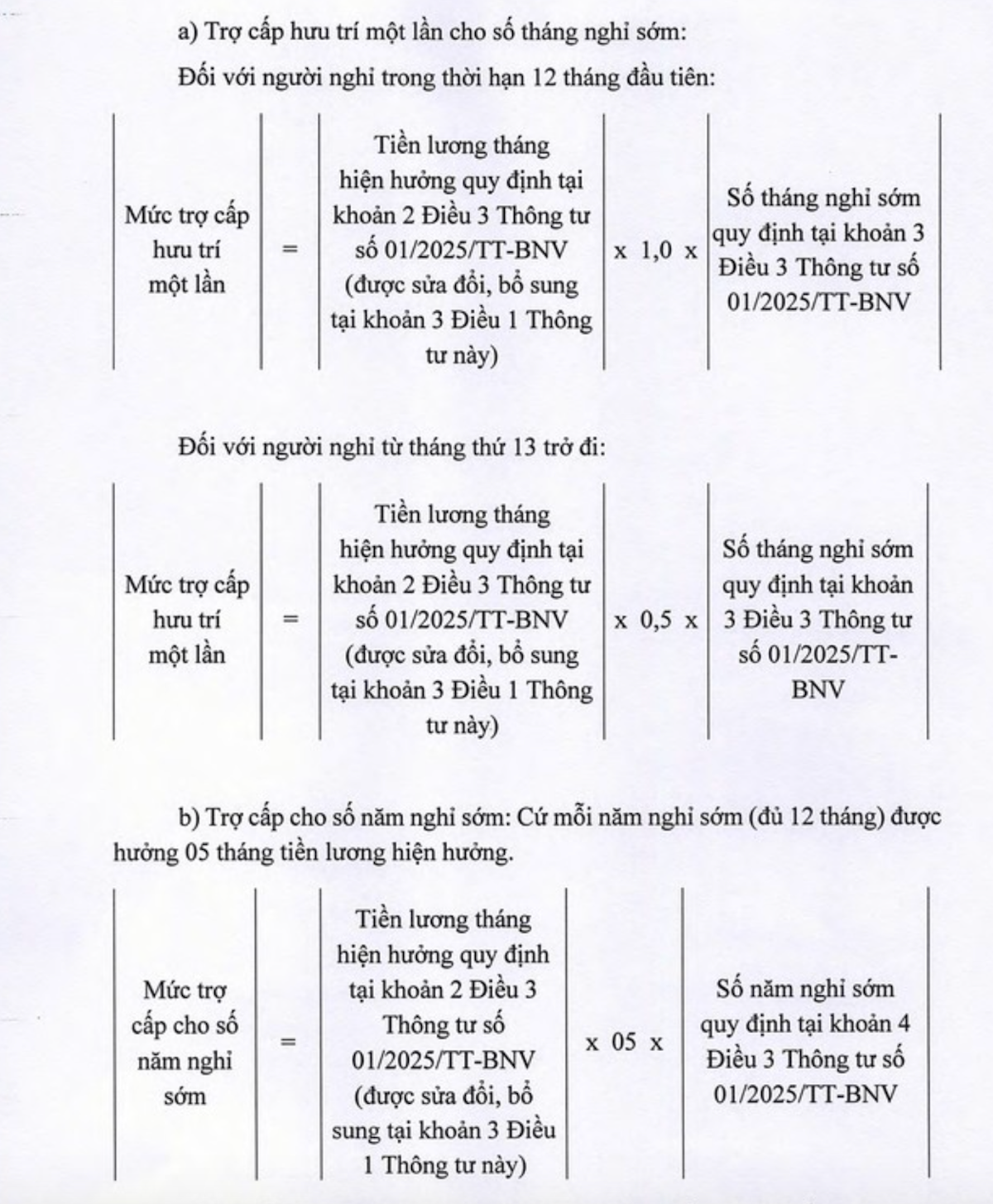

At the same time, this subject is also entitled to a one-time retirement allowance; allowance based on the number of years of early retirement and allowance based on the working time with compulsory social insurance.

Including one-time pension for the number of months of early retirement; allowance for the number of years of early retirement - for each year of early retirement (full 12 months), receive 5 months of current salary and allowance according to the working time with compulsory social insurance.

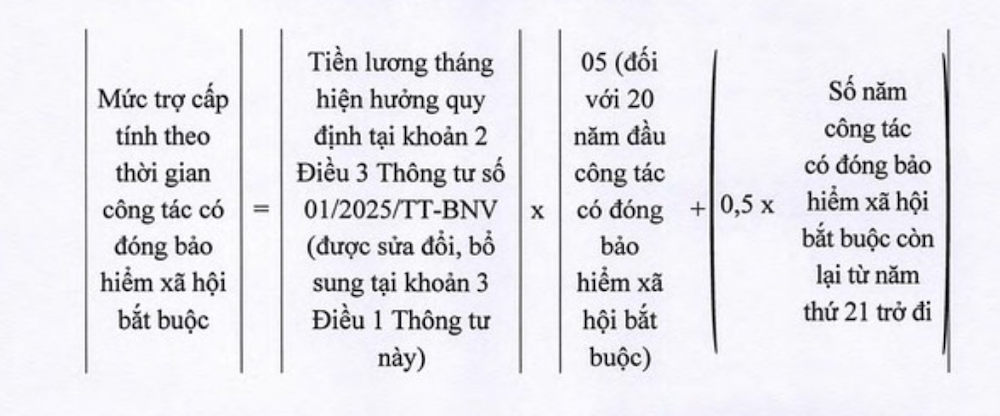

The first 20 years of work with mandatory social insurance contributions will receive a subsidy of 5 months of current salary; for the remaining years (from the 21st year onwards), each year will receive a subsidy equal to 0.5 months of current salary.

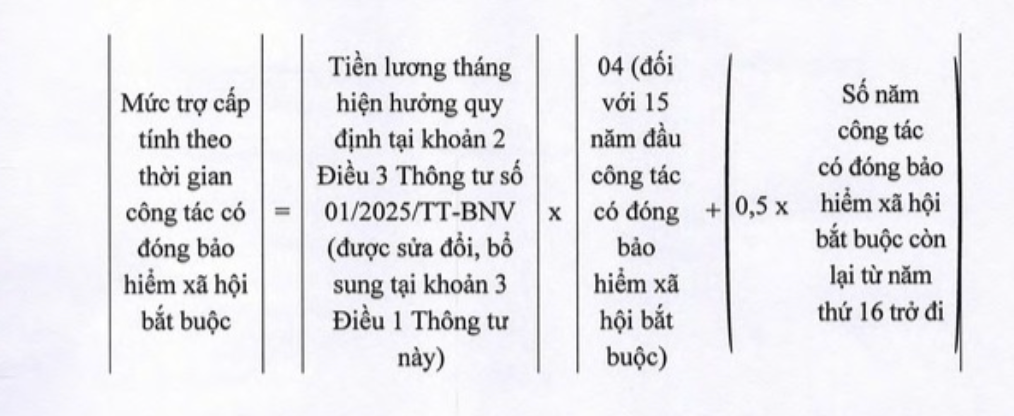

The first 15 years of work with compulsory social insurance are subsidized with 4 months of current salary; for the remaining years (from the 16th year onwards), each year is subsidized with 0.5 months of current salary.

One-time pension for months of early retirement; pension for years of early retirement and pension based on working time with compulsory social insurance contributions.