The sudden collapse of cryptocurrency exchange FTX, one of the biggest names in the industry, once again shows the fragility of the sector and the great risks for investors.

Cryptocurrency giant FTX plunges into bankruptcy within a week - Photo: REUTERS

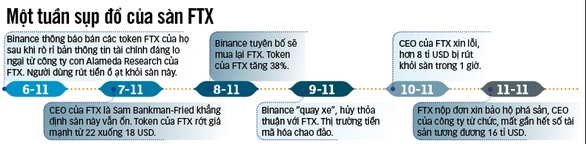

On November 11, FTX officially filed for bankruptcy protection after a stormy week that ended with rival Binance pulling the plug on its acquisition of FTX. The largest cryptocurrency bankruptcy to date stemmed from leaked information about a billion-dollar hole in FTX’s balance sheet.

Add a stain

Binance played a big role in FTX’s downfall. Both are the world’s largest cryptocurrency exchanges today. The CEOs of the two companies, Sam Bankman-Fried (FTX) and Changpeng Zhao (Binance), were partners before becoming rivals.

Bankman-Fried’s net worth was still $16 billion as of last week, while Zhao’s was $16.4 billion (after dropping from $79 billion over the past year), according to Bloomberg. Their relationship has been strained for more than a year as FTX surged to a valuation of $32 billion, attracting investors from Singapore and Canada to sports stars and celebrities.

The incident began when CoinDesk published the balance sheet of Alameda Research, an investment fund of FTX, on November 2, showing that 40% of assets were secured by FTT (the token used on the FTX exchange).

Reuters news agency explained this from the fact that Mr. Bankman-Fried transferred $4 billion, including customer deposits, to Alameda Research after the company suffered heavy losses earlier this year. The information immediately raised concerns because the decline of FTT could affect both companies.

Rival Binance had announced it would sell FTX tokens before “extending an olive branch” with an offer to buy FTX on November 8. But Zhao himself withdrew the rescue offer overnight, explaining that “the matter was beyond our control and support capabilities.”

“It’s a sad day,” Zhao said. For FTX, Binance’s U-turn means there’s no way out after customers have withdrawn billions of dollars in recent days.

On November 11, when FTX filed for bankruptcy, the exchange's token lost nearly 90% of its value, to just $2.57 per token, and CEO Bankman-Fried's fortune evaporated.

The shock also sent shockwaves through the cryptocurrency industry, which has become accustomed to volatility. Bitcoin prices continued to fall sharply, falling to around $16,000 per bitcoin by the end of the day on November 11.

"It's another stain on the industry," AFP news agency quoted cryptocurrency expert David Holt at CFRA Research Company, commenting on the collapse of FTX.

FTX CEO Sam Bankman-Fried - Photo: REUTERS

Investors "sitting on fire"

The collapse of FTX has also caused many consequences as hundreds of thousands of investors are wondering when and how they will get their billions of dollars back. FTX is facing asset freezes and investigations globally, from the Bahamas to Japan and Europe.

In the US, Reuters news agency reported that the Securities and Exchange Commission (SEC), the US Department of Justice and the US Commodity Futures Trading Commission have entered the investigation. "It's not clear exactly what happened, but from all the reports it seems like there was a lot of wrongdoing," former SEC lawyer Howard Fischer told CNBC, predicting that many customers will sue to get their money back.

What worries governments is the future of companies less stable than FTX. US Senator Elizabeth Warren, a Democrat who has been critical of cryptocurrencies, said FTX's collapse is a wake-up call for Congress and regulators to hold the industry and its leaders accountable.

“Much of the crypto industry is a sham. It’s time for stronger rules and more aggressive enforcement to protect the public,” Warren suggested.

But will that make investors more cautious? Kevin O'Leary, a venture capitalist who invested in FTX, called on regulators to protect the cryptocurrency industry but told CNBC: "I lost money in my account, but I will continue to invest in crypto."

Data: Tran Phuong - Source: Reuters, Guardian - Graphics: N.KH

According to Tuoi Tre