After the US announced lower-than-expected economic figures, global stocks immediately sold off violently, especially technology stocks.

|

| US stocks have worst day in a month |

Global stock markets plunged after new data from the US raised concerns about the health of the economy. Technology stocks were among the sectors that corrected sharply and led the indexes.

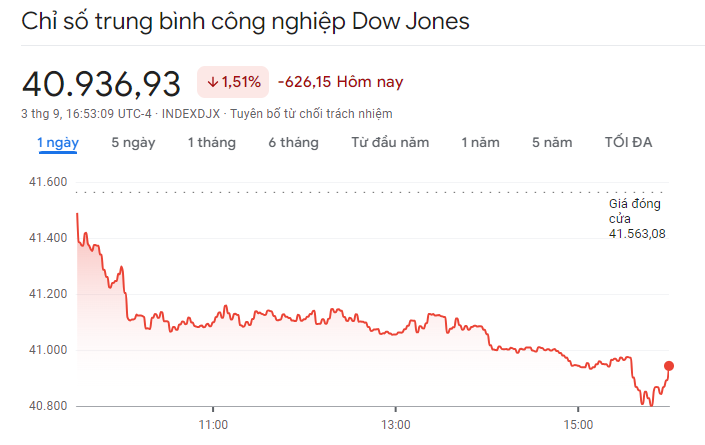

In the US market, all three major indexes recorded their worst trading day since the global sell-off on August 5. Closing the session on September 3, the Dow Jones index fell more than 626 points (-1.51%) to 40,936 points; the S&P 500 fell 119 points (-2.12%) to 5,528 points and the Nasdaq Composite fell 577 points (-3.26%) to 17,136 points.

Investor sentiment was weighed down by the 8-10% decline in technology stocks such as Micro Technology, Intel, KLA and AMD.

The S&P 500’s basket of information technology stocks led the declines, posting its worst day in two years. The VanEck Semiconductor ETF, which tracks semiconductor stocks, also fell more than 7%, its worst day since March 2020.

Notably, shares of AI chipmaker Nvidia fell more than 9%, wiping out279 billion USDcapitalization, a record high ever for an American company. Recently, sources from Bloomberg revealed that the company has received a subpoena from the US Department of Justice in an antitrust investigation.

|

| Dow Jones was blown away more than 600 points |

The market only fell slightly at the beginning of the session. However, after two data, the Purchasing Managers' Index (PMI) in the manufacturing sector, showed signs of weakness.

The S&P 500 Global PMI came in at 47.9 in August, down from 49.6 in July. It was the lowest reading since December 2023 and the second straight month of deterioration in manufacturing activity.

Meanwhile, data from the Institute for Supply Management (ISM) showed that the August PMI improved slightly from July to 47.2, but was still below the Dow Jones survey estimate. A PMI below 50 indicates that manufacturing activity is shrinking.

According to CNBC, the above data raised concerns about the slowing growth of the US economy, which was also the cause of the sell-off early last month.

“The market is sensitive to any data that comes out. It’s becoming more and more data-driven,” said Larry Tentarelli, chief technical strategist at Blue Chip Trend Report.

On the other side of the globe, the Asia-Pacific market did not fare much better as Japan's Nikkei 225 fell 3.19%, leading the decline in the region. Meanwhile, the Topix also fell 2.79%.

South Korea's Kospi and Kosdaq also fell 2.17% and nearly 3%, respectively; Australia's S&P/ASX 200 fell nearly 1.7%, mainly due to weak oil prices; Taiwan's TWSE fell 3.73%; Hong Kong's Hang Seng fell 1.5%, and mainland China's CSI 300 fell 0.47%.

Overall, technology stocks contributed greatly to the market correction today.

Semiconductor-related stocks such as Renesas Electronics (-8%), Tokyo Electron (-7%), Advantest (-7.7%), Samsung Electronics (-2.62%), SK Hynix (-6.36%), Foxconn (-3.51%)... all adjusted with large amplitude.

Chinese chip stocks have also been hit in the same vein, though they are not closely tied to Nvidia's supply chain.

|

| VN-Index falls close to 1,270 point mark |

Vietnam's stock market was no exception, falling nearly 15 points at the beginning of the session. By 10 a.m., the VN-Index had narrowed its decline to nearly 9 points, but was still at its highest level in the past month.

Of which, FPT shares recorded a decrease of 1.6% and were in the group with the most negative impact on the index. In addition, this group also had the participation of other codes such as VCB (-1.2%), TCB (-1.5%), GVR (-1.7%), CTG (-1.1%), VPB (-1.1%), HDB (-1.8%), MBB (-1.2%), MSN (-0.9%), SSB (-2.3%).

On the other hand, stocks such as GAS (+0.8%), VHM (+1.1%), BID (+0.6%) and DGC (+1.9%) are trying to stop the market's decline.

Foreign investors joined the strong selling wave in today's session with a net value of more than300 billion VND, concentrated at DGC codes (-50 billion VND), HPG (-41 billion VND), MSN (-33 billion VND), FPT (-24 billion VND).

TB (according to Znews)