The US stock market recovered strongly after President Donald Trump's announcement, with the Nasdaq index posting its biggest increase in 24 years.

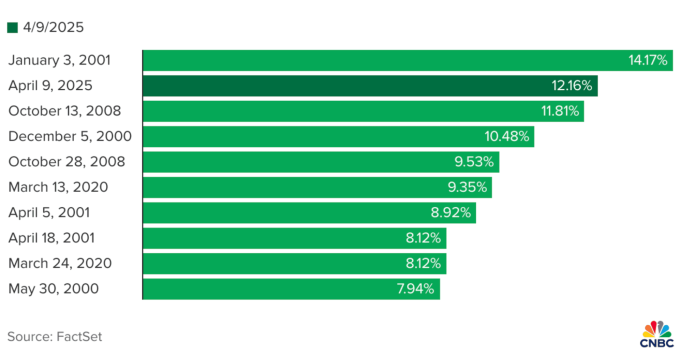

At the close of trading on April 9, major US stock indexes such as the S&P 500, DJIA and Nasdaq Composite all increased sharply, with Nasdaq increasing by more than 12%. This is the second largest increase in a single session in the history of US stocks. Previously, this index increased by more than 14% in January 2001.

The S&P 500 rose 9.52%, marking the third-largest monthly gain for the major U.S. stock index since March 2020, according to FactSet. The DJIA also rose 7.87%, its strongest since June 2020.

US stocks surged after President Donald Trump announced a 90-day delay in imposing reciprocal tariffs on countries other than China, relieving pressure that had weighed on the market for the past week.

Apple shares rose more than 15% - the biggest one-day increase since January 1998. Apple has just experienced its worst four-day trading streak since 2000. This caused them to lose the title of the world's most valuable company to Microsoft when their market capitalization evaporated by $774 billion. However, after the April 9 session, Apple regained this position.

Many technology stocks also recorded double-digit growth such as Nvidia 22%, Meta nearly 15%, Amazon 12%, Microsoft and Google parent company - Alphabet both increased about 10%.

Semiconductor stocks, which had been hit hard by concerns about tariffs eroding demand for electronics and slowing economic growth, also rebounded. AMD rose 24%, while Intel rose 19%, and Broadcom and Apple suppliers Qorvo and Skyworks Solutions each gained more than 18%.

This is the pivotal moment that investors have been waiting for, said Gina Bolvin, president of Bolvin Wealth Management Group. “The immediate market reaction was positive as investors saw this as a step toward clarity,” Bolvin said.

Similarly, Vital Knowledge founder Adam Crisafulli also said that the tax delay has removed huge pressure from the market, triggering a strong recovery.

However, Morningstar's chief US market strategist cautioned that it was too early to call all the risks over. "The trade talks haven't even started yet. When they do, there will definitely be a mix of negatives and positives as each side tries to maximize their own gains," said Dave Sekera, chief US market strategist at Morningstar.

TB (summary)