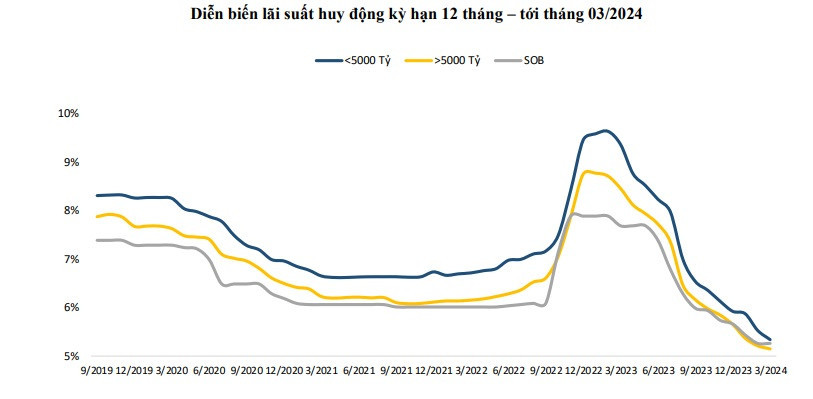

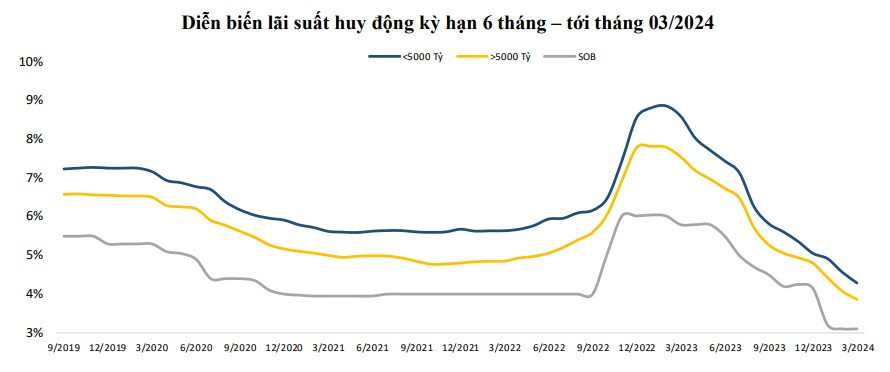

Interest rates will fluctuate in the coming time.

According to statistics in March, 25 commercial banks reduced interest rates, but very few banks adjusted their interest rates more than once (only 6 banks), while in previous months, many banks reduced interest rates 2-3 times in a month.

Moreover, the interest rate reduction margin of banks in March is not as large as before.

Notably, in just over 10 days at the end of March, 4 commercial banks increased their deposit interest rates, including: SHB, Saigonbank, Eximbank, and VPBank.

Is this a new trend in the interest rate market this April when 3 out of 4 banks that have just increased deposit interest rates are large banks that have a certain influence on the market situation?

Of which, the "big guy" VPBank is the only bank that increased deposit interest rates for all terms, with an increase of 0.1-0.2 percentage points.

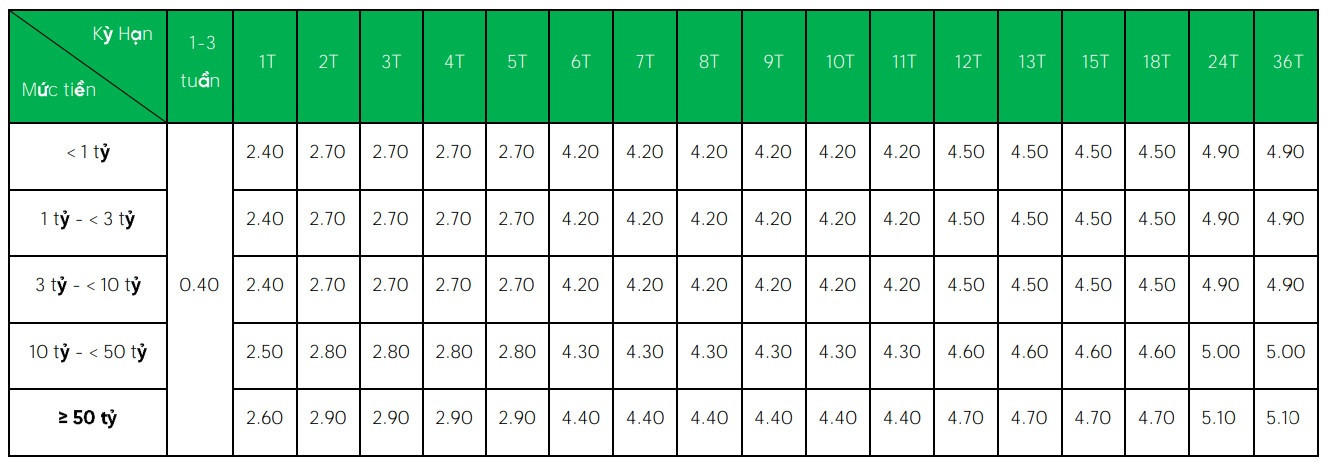

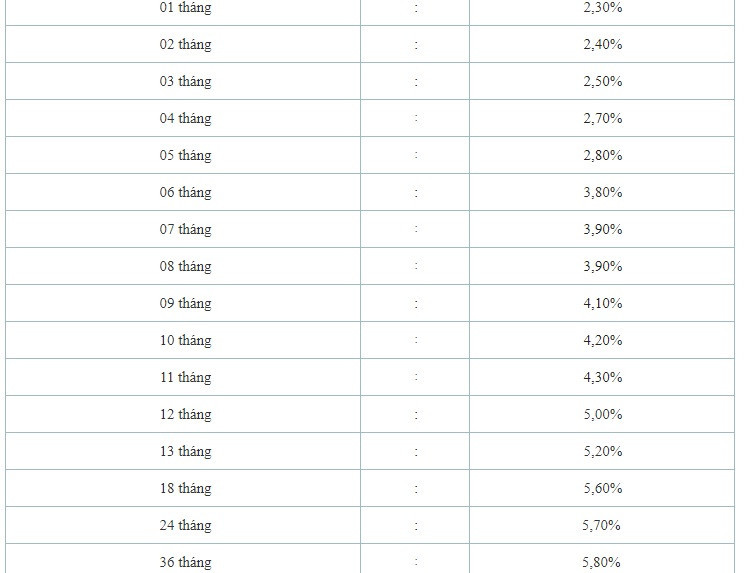

Currently, the interest rate for online deposits with a term of 1 month (applied to deposits under 10 billion VND) at VPBank has increased to 2.4%/year. The interest rate for bank deposits with a term of 2-5 months is 2.7%/year, 6-11 months is 4.2%/year, 12-18 months is 4.5%/year and 24-36 months is 4.9%/year.

For deposit accounts from 10 billion VND to less than 50 billion VND, and deposit accounts from 50 billion VND or more, interest rates are respectively increased by 0.1 and 0.2 percentage points.

In addition, VPBank applies a priority customer policy with a minimum balance of VND 100 million and a minimum term of 1 month, which will be added 0.1%/year compared to the current listed interest rate.

Thus, the highest interest rate at VPBank can be up to 5.2% if customers deposit from 50 billion VND, term 24-36 months.

Previously, on March 26, SHB adjusted to increase deposit interest rates at some terms.

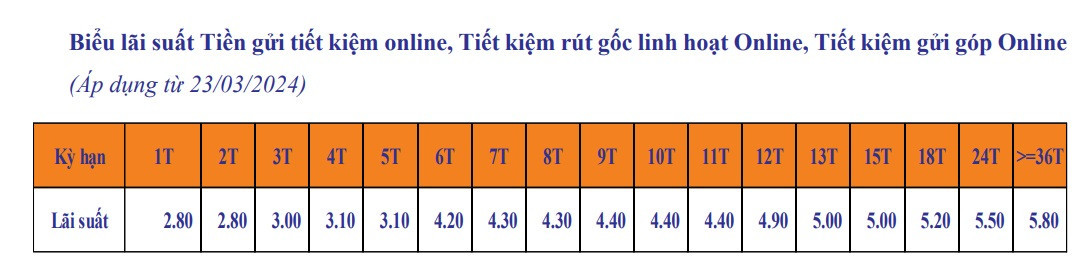

According to the online interest rate table, the 1-month and 2-month terms were both adjusted up to 2.8%/year, after increasing by 0.2 and 0.1 percentage points, respectively.

Interest rates for 12-month deposits increased by 0.1 percentage points to 4.9% per year; 13-15-month deposits increased by 0.2 percentage points to 5% per year; 18-month deposits increased by 0.1 percentage points to 5.2% per year.

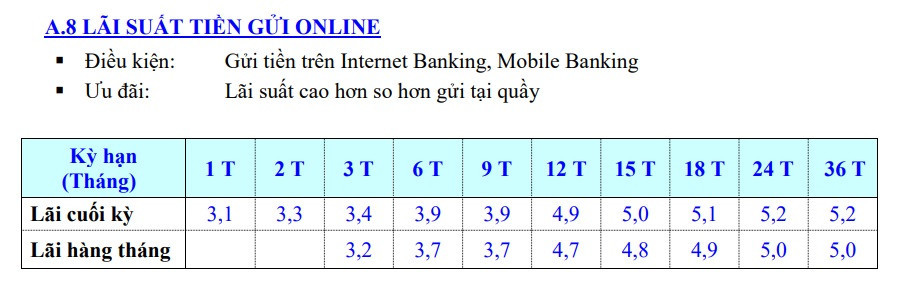

At Eximbank, the interest rate for 1-3 month terms was unexpectedly adjusted up by 0.3 percentage points. Accordingly, the 1-month term increased to 3.1%/year, the 2-month term was 3.3%/year and the 3-month term was 3.4%/year.

On March 19, Saigonbank suddenly increased interest rates for deposits with terms from 18-36 months.

The 18-month term bank interest rate increased by 0.2 percentage points, to 5.4%/year; the 24-month term increased by 0.3 percentage points, to 5.7%/year and the 36-month term interest rate increased by 0.4 percentage points, to 5.8%/year.

However, except for VPBank, which increased deposit interest rates for all terms, the remaining 3 banks only increased them slightly for certain deposit terms.

It is likely that interest rates will fluctuate in the coming time, instead of just decreasing over the past year.

According to statistics, since the State Bank started selling treasury bills again on the open market, this agency has withdrawn a net of VND144,697 billion.

As of the end of last week, interbank interest rates for overnight, 1-week, and 2-week terms decreased by 0.66%; 0.62%; 0.25% to 0.13%; 0.48%; and 1.18%, respectively.

HA (according to Vietnamnet)