The massive influx of imported steel into Vietnam, with import output at times nearly 200% higher than domestic production, has caused businesses to lose their market share of hot-rolled steel sales to imports.

Cheap imported steel continues to flood the domestic market with increasing numbers, causing many domestic manufacturing enterprises to worry. Experts say that with an import level equal to 151% of domestic production, if appropriate defense measures are not taken soon, losing the market is entirely possible.

According to customs data, in June alone, Vietnam imported 886,000 tons of hot-rolled coil (HRC), equal to 151% of domestic production; of which the amount of steel imported from China accounted for 77%.

In the first 6 months of the year, the cumulative output of imported hot-rolled steel reached nearly 6 million tons, an increase of 32% over the same period in 2023. This import volume is equal to 173% of domestic production; of which, the amount of steel imported from China accounts for 74%, the rest is from Korea, India, Japan...

The value of HRC import turnover in the first 6 months reached 3.46 billion USD, of which China alone accounted for 2.5 billion USD. Regarding the price of imported HRC, imported products from China are very low, averaging 560 USD/ton, lower than the domestic offering price by about 15-20 USD/ton and lower than other countries by 45-108 USD/ton.

A representative of the Vietnam Steel Association (VSA) said that the demand for hot-rolled steel in Vietnam is about 12-13 million tons/year. The capacity of domestic factories is currently about 9 million tons.

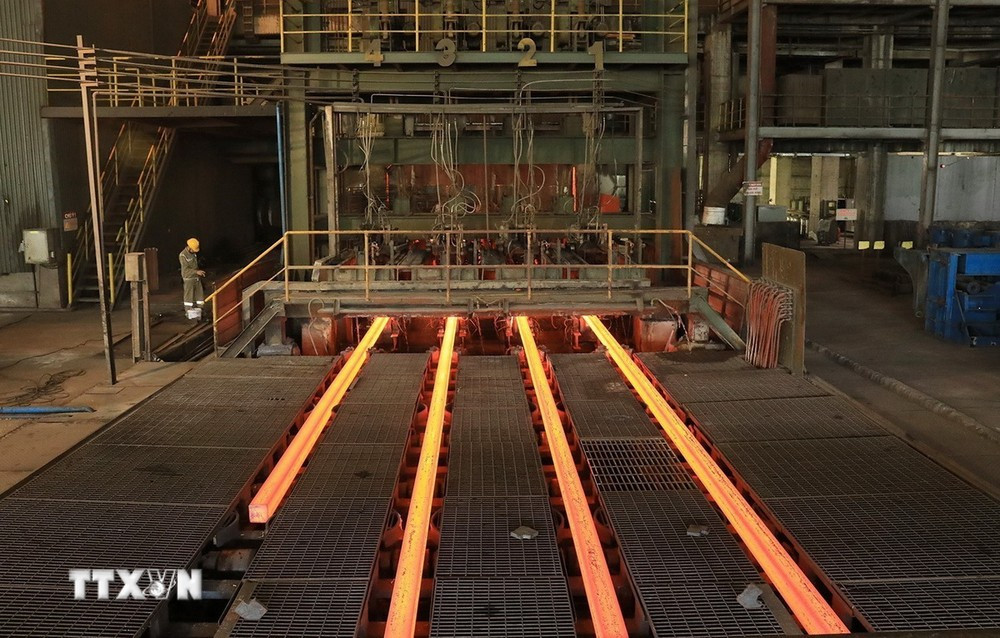

The massive influx of imported steel into Vietnam, with import output at times being nearly 200% higher than domestic production, has caused businesses to lose their market share of hot-rolled steel sales to imports. The market share of HRC sales of domestic businesses such as Hoa Phat and Formosa has decreased from 42% in 2021 to 30% in 2023 and is currently continuing to decline.

This makes it impossible for businesses to fully exploit their design capacity because they have to compete with cheap imported products that show signs of dumping.

In 2023, the production of Vietnam's hot-rolled steel manufacturing enterprises reached only 6.7 million tons, equivalent to 79% of the design capacity, a sharp decrease compared to 86% in 2021. Meanwhile, in 2023, the amount of imported HRC steel reached 9.6 million tons, 1.5 times higher than domestic production.

"The amount of imported HRC steel in the first 6 months of the year continued to increase sharply, 1.7 times higher than domestic production, this is alarming," said a VSA representative.

According to Mr. Phan Dang Tuat, Chairman of the Vietnam Association of Supporting Industries, in the past, Vietnam could not produce hot-rolled steel because the investment capital was too large and the technology required was very high, but now Formosa Ha Tinh and Hoa Phat have invested in producing this product.

"When we could not produce hot-rolled steel, it was natural to have to import it, but now we can produce it and the products are highly competitive. However, this product line is still flooding in in large quantities, especially recently there have been signs of selling below cost, so we need to consider, because it will greatly impact domestic production and lose the market," said Mr. Phan Dang Tuat.

Faced with the situation of massive imports of hot-rolled steel coils at cheap prices, businesses and experts also said that relevant agencies should continue to build and perfect the system of technical management standards, quality management standards, technical barriers, and at the same time have reasonable defense measures, thereby preventing steel products that do not meet technical safety and environmental standards from flooding the Vietnamese market.

Mr. Nghiem Xuan Da, Chairman of VSA, expressed that the Ministry of Industry and Trade needs to speed up the progress of building and submitting the Vietnam Steel Industry Development Strategy to 2030, with a vision to 2050, in conjunction with specific policies for the steel industry to grow green and sustainably. VSA requested the Ministry to continue to guide and support steel exporting enterprises to promptly and effectively respond to trade defense cases against steel production abroad.

Recently, the representative of the Ministry of Finance also agreed with the opinion of the Vietnam Steel Association on the need to apply appropriate trade defense measures to protect domestic manufacturing enterprises. Regarding import and export taxes, they are adjusted in an increasing direction, the input is at a low level, while the tax on more refined products is higher, contributing to creating legal barriers to protect domestic manufacturing enterprises.

Dr. Nguyen Thi Thu Trang, Director of the WTO and Integration Center (VCCI), said that through monitoring, all trade defense cases against steel have not been refused to apply trade measures. Up to now, the Center has not received feedback from partners or other members of the WTO about whether Vietnam has not applied correctly or has not ensured the requirements of the WTO.

The Center’s report said that in Vietnam alone, 12 out of 28 trade defense cases were against steel products, accounting for about 46% of the total trade defense cases ever conducted against all types of products in Vietnam so far. Meanwhile, countries have launched 73 trade defense cases against Vietnamese steel exports. This shows that countries have applied many trade defense measures to protect their markets.

Therefore, Ms. Trang believes that it is necessary to establish technical barriers according to international standards to prevent poor quality imports. On the other hand, it is necessary to develop processes and procedures to check the quality of steel imported into Vietnam. Imported steel must have a certificate of compliance with Vietnam's quality standards.

Regarding this issue, the Ministry of Industry and Trade said that it is reviewing the dossiers of domestic enterprises requesting an investigation to impose anti-dumping tax on hot-rolled steel imported from China and India. The prescribed review period is 45 days from the date of official receipt of complete dossiers (June 14, 2024).

The Ministry of Industry and Trade said that the work of initiating lawsuits, investigating and applying trade defense measures continues to be promoted, re-establishing a fair competitive environment for domestic manufacturing industries. In fact, recently, imported goods have shown signs of dumping or being subsidized, causing serious damage to a number of manufacturing industries, most notably the steel industry.

Currently, the Ministry of Industry and Trade is developing and is expected to soon submit to the Prime Minister for promulgation the Strategy for Development of Vietnam's Steel Industry to 2030, with a vision to 2050. The Ministry is also completing the draft to report to the Government to submit to the National Assembly for promulgation of the Law on Development of Key Industries. The long-term goal is to develop the steel industry into a national foundation industry, meeting domestic demand and rapidly increasing exports...

VN (according to VNA)