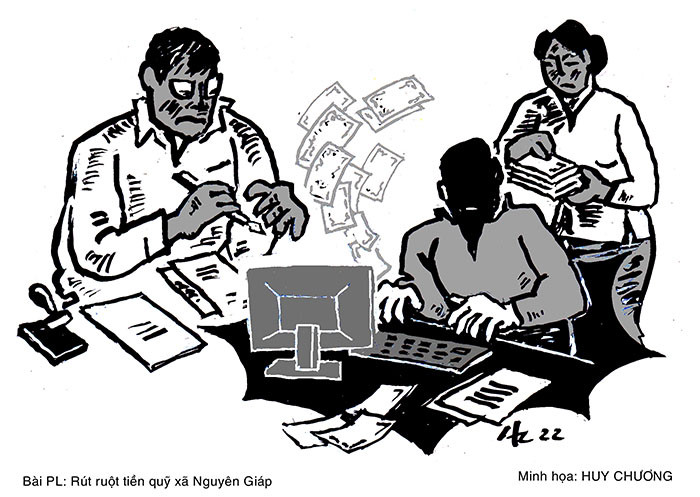

Due to subjectivity, carelessness, and failure to comply with regulations when performing duties, leaders and employees of the People's Credit Fund of Nguyen Giap commune (Tu Ky) caused the unit to lose billions of dong.

Long-term violations

In July 2017, the State Bank of Vietnam, Hai Duong branch, decided to conduct a surprise inspection of the People's Credit Fund of Nguyen Giap commune. The inspection team discovered many violations occurring there. There were violations with signs of crime, so the case was transferred to the Investigation Police Agency of Hai Duong Province for clarification. The investigation results determined that there were 3 serious violations of the law at the fund involving the following subjects: Phung Van Trong, born in 1981, accountant; Pham Huu Tuong, born in 1960, Director; and Le Thi Thu Ha, born in 1986, cashier. All three people are from Nguyen Giap commune.

With the aim of appropriating property, on the afternoon of November 3, 2015, at the People's Credit Fund of Nguyen Giap commune, Trong arbitrarily created a file to close the savings book of a customer named Pham Huu N. (born in 1967, in Nguyen Giap commune) with a deposit of 500 million VND without the presence of the customer and without the original savings book of the customer. Then, Trong brought the file including: savings book card, principal payment slip, interest payment slip for Tuong to review. Without the presence of the customer and without the original savings book, because he trusted Trong, Tuong still signed to approve the payment of the principal of 500 million VND and interest of 55,300 VND. Then, Trong transferred the file to Ha to complete the payment procedure. Ha checked the file and found that there was no original savings book, no customer, no head of the fund's control board present, but still completed the payment procedure for Trong. Forged Mr. N's signature on the list of cash receipts and received the money.

On February 6, 2017, Mr. N. brought the original savings book to the Nguyen Giap Commune People's Credit Fund to close the account. Seeing this, Trong erased the information on the savings book card kept at the fund to complete the closing of Mr. N.'s savings book. Therefore, the fund did not detect the closing on November 3, 2015.

Seeing that the above work was successful and not detected, with the same method and tricks, on December 30, 2015, Trong continued to arbitrarily create a file to close the savings book of a customer named Tran Huy D. (born in 1974, living in Quy Cao street, Nguyen Giap commune) with a deposit of 950 million VND. Trong brought the file including: savings book card, principal payment slip, interest payment slip to Tuong for approval and then brought the file to Ha to complete the payment procedure. Because they trusted Trong, even though they did not have complete documents, vouchers, customers and the head of the fund's control board according to regulations, Tuong and Ha still approved the file and completed the payment procedure for Trong. On October 11, 2016, Mr. D. brought the original savings book to the People's Credit Fund of Nguyen Giap commune to complete the payment procedure. Trong also erased, deleted and closed the savings book for Mr. D. without being detected for his previous violations.

Expanding the investigation, the police agency also discovered another "embezzlement" case that occurred at the fund. In 2011, Tuong, as the Director of the People's Credit Fund of Nguyen Giap Commune, signed a contract as a domestic money transfer agent and opened an account at a bank. The bank gave Tuong and Trong each a security code to manage money transfers from the fund's account deposited there. According to regulations, each person must keep a security code, the accountant creates money transfer documents on the computer, before transferring money, the director must check the documents on paper and on the computer to see if they match. Then, the director and accountant's security codes must be entered for the money transfer order to be executed. Due to trust, as well as poor computer skills, Tuong gave his security code to Trong to manage and at the same time let Trong create money transfer orders without checking. From July 2014 to January 2017, Trong arbitrarily made 20 illegal money transfer orders, causing a loss of nearly VND616 million to the fund. Of these, 14 orders were to transfer money to Trong's account and 6 orders were to transfer money to other people's accounts to pay off debts for house design rentals and loans to friends.

Painful consequences

After the audit and inspection of cash balance of the State Bank of Vietnam, Hai Duong branch, on July 4, 2017, knowing that the incident had been exposed, Trong committed suicide by hanging himself that same afternoon.

The People's Court of Tu Ky district has just brought the above case to trial. For the crimes, the court sentenced Tuong to 9 months in prison, Ha to 6 months in prison but suspended the sentence for the crime of unintentionally causing serious damage to property.

In addition, the subjects involved must bear civil liability to compensate the entire amount of damage caused to the People's Credit Fund of Nguyen Giap commune. Because the subject Trong involved in the case has died, his wife has taken on the civil liability instead.

According to regulations, Trong must compensate more than 1 billion 041 million VND; Tuong compensates more than 716 million 440 thousand VND; Ha compensates more than 201 million 457 thousand VND. Before the trial, Trong's family had compensated 594 million 987 thousand VND; Tuong compensated 500 million VND; Ha compensated 170 million VND. The court ordered the subjects to continue to compensate the remaining amount.

This is a valuable lesson for leadership, management, inspection and supervision in the operations of credit institutions.

Danh Trung