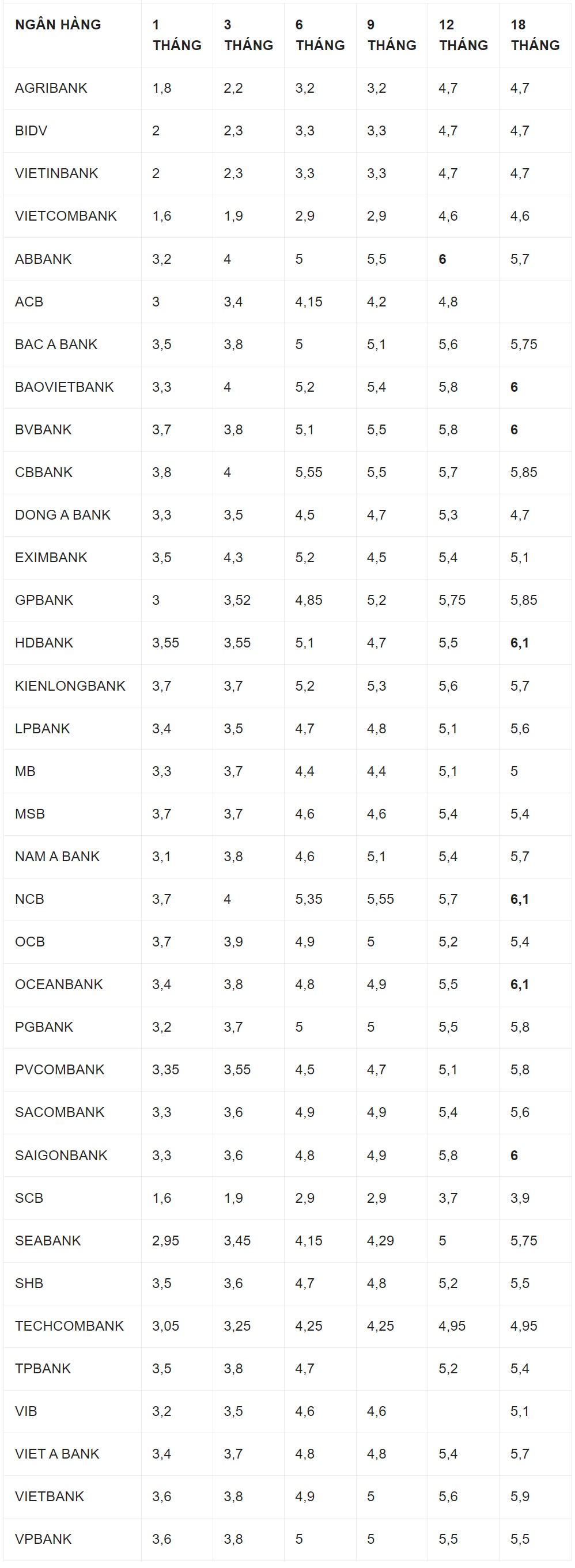

Bank interest rates today, August 15, did not record any cases of adjusting deposit interest rates. Some banks sent "hidden" signals about special interest rates.

The highest online deposit interest rate is currently 6.1%/year, listed at SHB (term of 36 months or more), Saigonbank (term of 36 months). The remaining two banks, NCB and OceanBank, both list interest rates of 6.1%/year for deposits with terms of 18-36 months.

Some banks are also listing online deposit interest rates of up to 6%/year, including: ABBank (12-month term), BaoViet Bank and BVBank (18-36 month term), Saigonbank (18-24 month term) and OCB (36 month term).

Notably, some banks are maintaining a “special interest rate” policy for customers who deposit large amounts of money at the counter. The “special interest rate” has been kept unchanged by most banks for many months now, except for MSB, which has reduced it from 8.5%/year to 7%/year after two months.

The condition that MSB gives to customers who deposit money to receive interest rates of up to 7%/year is that the deposit amount is from 500 billion VND and the deposit term is from 12-13 months.

This interest rate is 2.9%/year higher than the regular deposit interest rate announced by MSB.

However, the highest “special interest rate” currently listed at 9.5%/year, announced by PVCombank for 12- and 13-month term deposits, is 4.5-4.7%/year higher than the counter interest rate listed by this bank for regular deposits.

However, the condition for customers to enjoy the 9.5%/year interest rate is to open a new savings account with a deposit balance of 2,000 billion VND or more.

HDBank is also one of the banks applying the “special interest rate” product. This bank listed the 13-month deposit interest rate at 8.1%/year, the 12-month deposit interest rate at 7.7%/year. These interest rates are 2.3%-2.5%/year higher than the counter deposit interest rate applied by HDBank to regular customers.

In addition to the above banks, ABBank implicitly announces "special interest rates" on the counter deposit interest rate table.

This bank listed an interest rate of 5.5%/year for 13-month term deposits at the counter. Although it no longer publicly announced the “special interest rate”, ABBank reminded customers that the interest rate of 5.5%/year for 13-month term deposits only applies to savings deposits “with a value of less than VND 1,500 billion”.

Previously, in early April 2024, ABBank announced an interest rate of 9.65%/year for depositors with a term of 13 months or more. However, very quickly after that, ABBank removed information about this interest rate.

In addition to the "special interest rate" which rarely fluctuates, the interest rates mobilized at the counter and online are usually updated regularly by banks.

From the beginning of August until now, only half a month but 12 banks have increased their deposit interest rates, including: Agribank, Eximbank, HDBank, Sacombank, Saigonbank, TPBank, CB, VIB, Dong A Bank, VPBank, Techcombank and VietBank. Of which, Sacombank is the bank that has increased its interest rates twice.

On the contrary, Bac A Bank and SeABank unexpectedly reduced deposit interest rates during this time.

VN (synthesis)