The retirement age has increased and the contribution period to the Pension Fund has become longer, so the maximum pension rate needs to be increased from 75% to 79.5%, according to the Chairman of the Ho Chi Minh City Labor Federation.

The revised Law on Social Insurance has just been discussed by the National Assembly with many concerns about how to calculate pension benefits when reducing 15 years of social insurance contributions. According to the draft, the pension calculation inherits all current regulations. Male workers who pay social insurance for 15 years will receive a minimum pension of 33.75%, and those who pay for 35 years will receive a maximum of 75%. Women who participate for 15 years will receive a minimum of 45%, and those who pay for 30 years will receive a maximum of 75%. Using the same minimum of 15 years of social insurance contributions, the pension accumulation rate of men is 11.25% lower than that of women.

Ms. Tran Thi Dieu Thuy, President of the Ho Chi Minh City Labor Federation, assessed that social insurance policies are tending to limit workers' autonomy, while management agencies are "busy considering the issue of revenue and expenditure for the sustainable Social Insurance Fund". She cited the proposed solutions of increasing revenue, reducing expenditure, increasing retirement age and extending working years, but reducing workers' pension benefits.

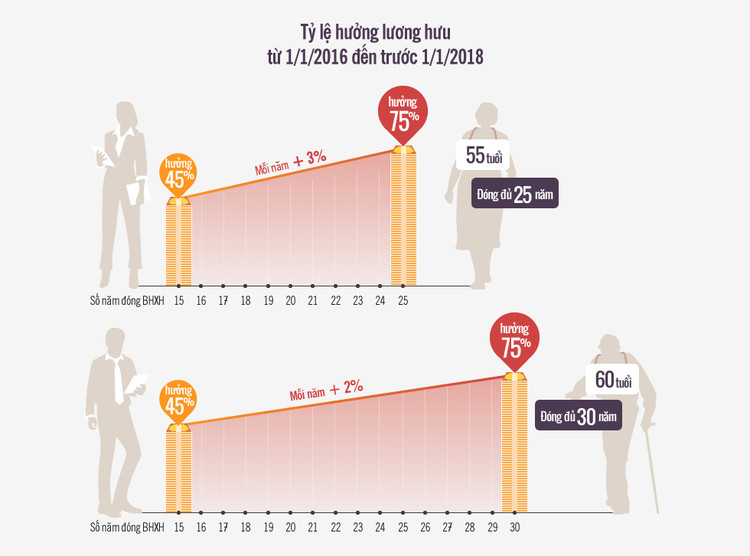

Specifically, from 2018, the monthly pension calculation will gradually increase the number of years of contribution. To reach the maximum level of 75%, workers must pay 30-35 years of social insurance instead of 25-30 years as before. Before 2018, female workers accumulated 3%, male workers 2% for each year of social insurance participation. After this point, the gender ratio will be 2%.

"The regulation has reduced the pension level of workers, reducing the motivation to attract them to stay in the social security system," said Ms. Thuy, proposing to recalculate the pension level for each year of social insurance contribution to 2.3% instead of 2% as currently, and the maximum pension rate to increase to 79.5% instead of 75%.

The basis for the proposal is that the retirement age has been increased gradually to 60 years old for women and 62 years old for men, which means that workers have to work longer. Their contribution period to the Pension Fund is longer, 2 years more for men and 5 years more for women, while the calculation method and maximum pension rate remain the same.

"As the working age gets longer, more money is contributed to the fund, so the rate of each year of participation and the maximum pension level must be higher, not to mention the interest earned throughout the years of participation," she said.

The Chairman of the Ho Chi Minh City Labor Union maintains that the benefit level must be proportional to the contribution period, although the drafting agency and many people are concerned that increasing the benefit rate will become a burden for the Pension Fund. Reality shows that the pension is not high, the conditions for receiving benefits are increasingly tightened, making workers discouraged, choosing to withdraw their social insurance at once instead of waiting for retirement.

Ms. Thuy also pointed out the paradox that people who have paid more than the ceiling of 30-35 years of social insurance are only entitled to a subsidy equal to 0.5 average salary for each excess year. According to her, this amount should be calculated as at least 2 months of average salary for insurance payment, as proposed by Ms. Nguyen Hoang Bao Tran (Vice President of Binh Duong Labor Federation) in the parliament on November 23.

Reducing the contribution period to 15 years is beneficial for the group of late participants, about 7,000 beneficiaries each year as calculated by the Ministry of Labor, War Invalids and Social Affairs. However, this policy can also lead to a situation where workers pay social insurance in a rotating manner, that is, participate for a short time and then withdraw, then continue to pay with a higher salary.

"The ultimate goal of social insurance is retirement, amending the law is like making the cake sweeter to attract workers. The next generation looks at their predecessors, sees many benefits, and a pension that is enough to live on, and will automatically participate. Only when the labor force continuously contributes will the Pension Fund be sustainable," she said.

Hanoi elderly relax in Thanh Cong flower garden

Sharing the same view, Mr. Pham Van Hoa (Vice President of the Dong Thap Province Bar Association) suggested that the Drafting Committee should study and adjust the minimum benefit rate to the same 45% after 15 years of social insurance contributions for both men and women. After 15 years of contributions, women receive 45% while men receive only 33.75%, which "does not ensure gender equality".

He assessed that the 2% deduction per year for early retirees is a heavy rate, and proposed to reduce it to 1% and raise the subsidy level to match those who have paid more than one year of social insurance. With the current low social insurance contribution level, the pension will not be much. "If we do not re-study soon to calculate fairly, the number of workers withdrawing social insurance at one time will continue to increase," he warned.

According to the drafting agency, the revised Law on Social Insurance this time does not change the calculation formula or pension rate, only focusing on measures to expand coverage. However, Ms. Tran Thi Dieu Thuy said that the new bill was discussed by the National Assembly for the first time and will be discussed in the following sessions, there is still time to consider and make changes. The drafting committee as well as the Government need to listen to the voices of delegates and workers for the sake of long-term social security, reducing the budget burden due to the consequences of the elderly not having a pension.

Vietnamese people enjoy a maximum pension rate of 75%, higher than some countries in the region, according to the Ministry of Labor, War Invalids and Social Affairs. However, the pension rate is low due to the low salary base for social insurance contributions. With the current average contribution of 5.7 million VND, the pension of male workers will reach nearly 2 million VND and that of female workers will reach about 2.6 million VND if the social insurance contribution period is reduced to 15 years.

Nationwide, there are 2.7 million elderly people currently receiving pensions from the Social Insurance Fund, while the number of workers participating in the system is 17.4 million. On average, for every 6.5 people paying social insurance, there is one pensioner. In 1996, there were 217 people paying for one beneficiary; in 2000, the number of people paying was 34, and in 2016, there were 9 people paying for one beneficiary.

The gap between the number of contributors and beneficiaries is narrowing, partly causing the balance of the Pension Fund to gradually become unbalanced. Therefore, the Social Insurance Law and the previous revised Labor Code both focused on comprehensive measures such as changing the way pensions are calculated, increasing the retirement age... to balance the fund in the long term.

Overall, the policies are proving effective after a period of implementation, according to Labor, War Invalids and Social Affairs. The pension fund has been relieved of pressure, ensuring balance in the long term. By the end of 2022, the fund had a surplus of more than VND988,400 billion and is expected to reach VND1.1 million billion by 2023.

The revised Law on Social Insurance is expected to be passed by the National Assembly in May 2024 and take effect from July 1, 2025.

According to VnExpress