While Highlands and Phuc Long are busy opening new stores, Trung Nguyen is promoting its overseas development strategy and The Coffee House is reducing its sales points.

2023 is probably the year when the F&B industry can confirm that it has overcome the post-COVID-19 crisis. Large coffee chains such as Highlands Coffee, Phuc Long, Starbucks, Katinat... are tirelessly racing to capture market share.

The 2023 F&B market report by iPOS.vn released last April showed that by the end of 2023, the number of coffee/tea shops in Vietnam reached 317,299 stores, an increase of 1.26% compared to 2022. This increase was lower than predicted at the beginning of the year, due to many chains closing stores and reducing their scale. Although the number of stores did not increase much, the industry's revenue still grew by double digits, with 11.6%, reaching VND590,000 billion.

The big guy returns to the race

Looking at the Vietnamese F&B market in 2023, it can be seen that mid-range and high-end beverage chains have returned to the fierce race for market share as before 2021. The most bustling are probably the giant Highlands and the emerging competitor Katinat.

Highlands still maintains its unrivaled position with 777 stores operating in many provinces and cities nationwide according to the latest update on the company's website. This number increased by more than 170 stores compared to 605 stores at the end of 2022. In addition, there are more than 50 stores in the Philippines.

The number of Highlands stores is not surprising, as the chain chooses to position its brand through coverage rather than developing a diverse menu like its competitors. Also in 2023, a series of stores launched in prime locations attracted attention, including Highlands Ho Chi Minh City Post Office, a prime location between the post office and the book street, with a direct view of Notre Dame Cathedral and 30/4 Park. The two spacious floors of this restaurant are always crowded from opening time until late at night.

This is the first complete premium model of this chain, also the first and only store currently serving entirely in glass cups, without using plastic cups or straws, and having its own menu alongside familiar products.

Along with continuously opening beautiful, large-area shops, this chain has officially stopped selling take-away coffee with street-side carts that were born during the COVID-19 pandemic last year.

In Ho Chi Minh City, Highlands is currently present in the most prime locations, such as the tallest building in Vietnam, Landmark 81, the Notre Dame Cathedral, Diamond Plaza, Saigon Center, Saigon Trade, Vincom Dong Khoi, Tran Quang Khai intersection...

Also last year, this chain invested 500 billion VND to build a coffee roasting factory in Ba Ria - Vung Tau with an initial capacity of nearly 10,000 tons of coffee/year and increasing to 75,000 tons/year in the next phase. This is confirmed to be a strategic step in the race to compete directly with global coffee brands.

Phuc Long also had a fierce 2023 in opening luxury stores. About 25 flagship stores were opened in the last 6 months of the year, with the goal of making this brand the 2nd largest beverage chain in Vietnam.

According to the system update as of May 15, Phuc Long has 157 stores and about 45 integrated kiosks at Vinmart+ stores. The most explosive of which is the launch of the 2,000 m2 Phuc Long Premium store in Thao Dien, Thu Duc City. This is a high-end store with an on-site coffee roasting area and the prices of items on the menu at Phuc Long Thao Dien are positioned on par with Starbucks.

Masan aims to make Phuc Long the beverage chain with the second largest number of stores in Vietnam this year.

Trung Nguyen of coffee king Dang Le Nguyen Vu has a different direction compared to other chains in the segment, although the number of stores is not inferior to Highlands. On Trung Nguyen's system, updated to mid-May 2024, this chain has about 700 stores, including 108 Trung Nguyen Legend stores, 548 E Coffee stores and stores abroad.

In its strategy, Trung Nguyen Legend did not choose to position itself by quickly duplicating stores like Highlands, but chose to go abroad.

However, compared to the end of 2022, when Trung Nguyen Legend had only 77 stores and nearly 100 stores in 2019, Mr. Dang Le Nguyen Vu's coffee chain has completely recovered to the level before the COVID-19 pandemic and is on the way to booming again.

Trung Nguyen also said the company is planning to develop 1,000 Trung Nguyen Legend coffee spaces in China and about 100 stores in the US.

The most surprising factor in 2023 is the young chain Katinat Saigon Cafe. Since the end of 2022, Katinat has been passionately opening new stores in prime locations in the center of Ho Chi Minh City. Almost all intersections in the most expensive areas have Katinat's presence, many locations with Highlands have Katinat.

At the end of 2023, Katinat attracted attention when it opened a store right at Bach Dang Wharf, District 1, a place that is very popular with young people and requires reservations during festival events in the central area of Ho Chi Minh City.

It can be seen that a series of shops at golden addresses were massively opened by this chain throughout 2023 and early 2024, all located in the center of District 1, Thu Thiem area, District 10, District 3, Binh Thanh...

Updated data to mid-May, Katinat has 65 stores in many provinces and cities across the country, with the most in Ho Chi Minh City. The stores all impress with their striking blue design, spacious, luxurious space, most of which are 2-3 floors high.

At the end of 2021, Katinat was just a small coffee chain with about 10 stores in Ho Chi Minh City. With the number of new stores appearing in 2023, it can be seen that Katinat's store opening speed is only behind Highlands Coffee and Phuc Long.

The Coffee House also surprised the market in 2023, but in the opposite direction. This chain seemed to be on the defensive as the number of stores decreased. If the number at the end of 2022 was 155 stores, then the update on the company's website until May 15, 2024 was 133 stores.

As for Starbucks, by mid-May 2024, it had 108 stores after 11 years of entering the Vietnamese market. It seems that the American giant is very thoughtful and calm in expanding its stores, and many Starbucks stores in central locations in Ho Chi Minh City have had to close.

Divide the billion dollar pie

According to the 2022 coffee shop chain market report published by Vietdata, the scale of the restaurant and beverage chain market in Vietnam is estimated at about 1.3 billion USD per year. Meanwhile, the 2023 F&B market report by iPOS.vn shows that the F&B industry's revenue in 2023 will reach 590,000 billion VND, of which the beverage industry accounts for 16.52%.

By the end of 2023, Masan's report said that the average monthly revenue per Phuc Long store was VND986.79 million and nearly VND33 million/day, contributing more than VND1,535 billion to the group's annual revenue. In fact, in 2023, Masan calculated that Phuc Long will bring in net revenue of VND2,500-3,000 billion.

Notably, according to data from Masan Group, the Phuc Long chain is leading in terms of profit margin. In 2022, Phuc Long achieved VND 195 billion in pre-tax profit, thanks to the effective operation of its flagship stores. This year, Phuc Long ranked second in revenue and first in gross profit margin among the domestic coffee and tea chains, the best among Masan's business segments.

Thus, Phuc Long is currently accounting for about 15% of the estimated billion-dollar market share, and will increase to about 20% if it achieves its 2024 target.

In 2024, Phuc Long is expected to bring in 1,790 - 2,170 billion VND in revenue. This beverage chain wants to open 30-60 new stores, concentrated in Hanoi and Ho Chi Minh City. Phuc Long will also expand to the international market in the period 2024 - 2025.

For Highlands, Jollibee Group's data shows that in 2022, monthly revenue per store reached VND516.89 million. On average, a Highlands store brings in VND16.5 million per day. This year, Highlands contributed 3% of the group's total revenue, equivalent to about VND3,569 billion, with after-tax profit of more than VND265 billion.

This number means that more than 30% of the market share of the billion-dollar pie is in the hands of Highlands.

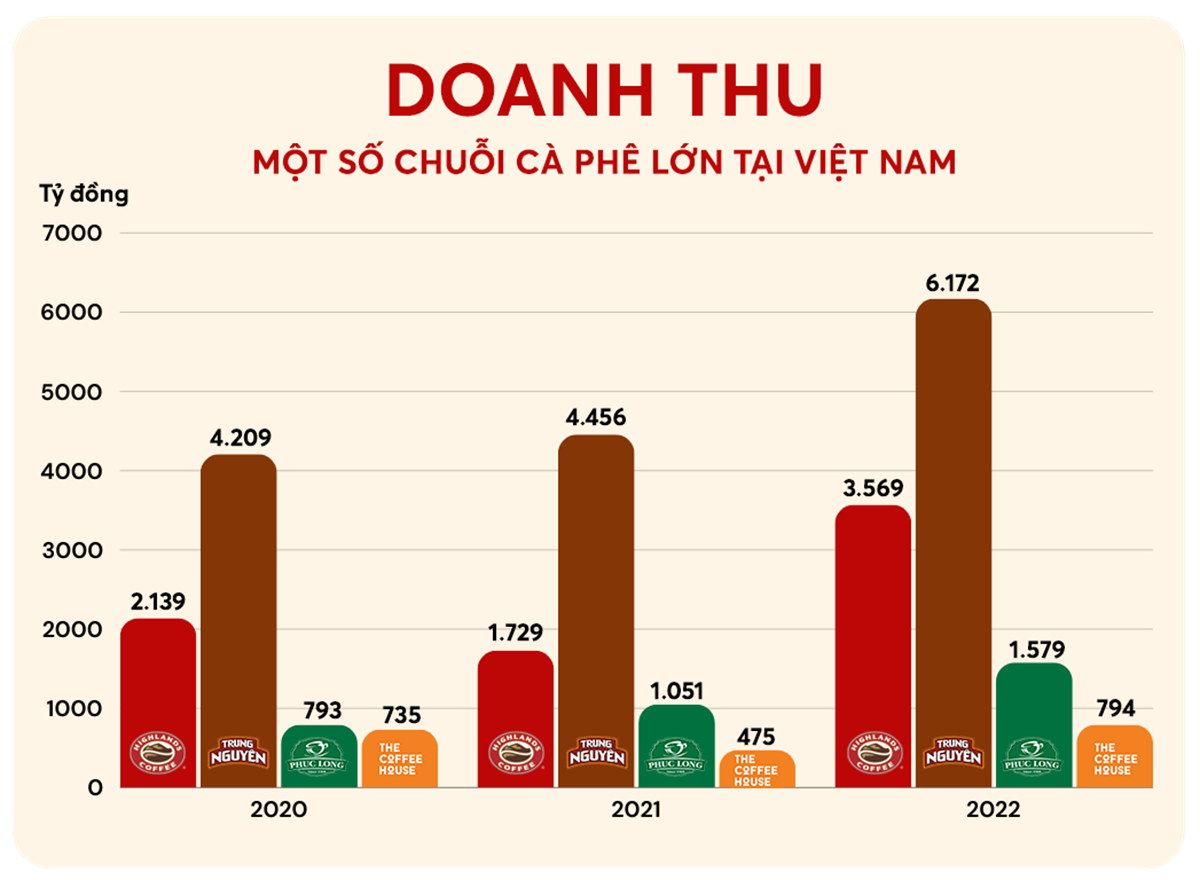

Previously, in 2019-2020, the chain's revenue reached over 2,100 billion VND. In 2021, the revenue was only about 1,700 billion VND and the loss was 19 billion VND due to COVID-19.

Regarding Trung Nguyen, Vietdata's report shows that Trung Nguyen Legend has a relatively stable after-tax profit and revenue increases steadily over the years.

Specifically, in 2020, Trung Nguyen Legend's revenue reached more than 4,200 billion VND, with after-tax profit of nearly 130 billion VND. In 2021, revenue increased slightly by 6% but after-tax profit jumped 337%, reaching more than 560 billion VND. In particular, revenue exploded in 2022, reaching nearly 6,200 billion VND, with after-tax profit at nearly 435 billion VND.

TB (according to VTC)