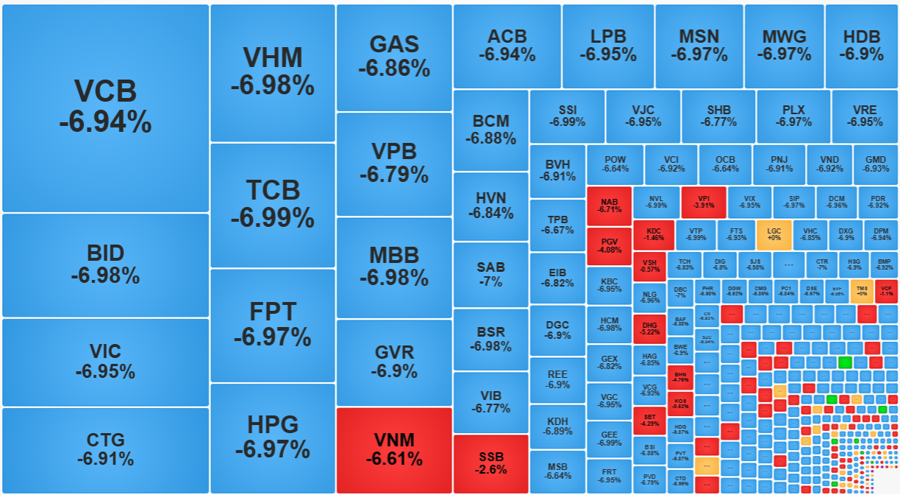

Vietnam's stock market had the most 'fierce' trading session in history when 517 stocks fell, of which 263 hit the floor, causing the VN-Index to lose 88 points.

US President Donald Trump this morning (Vietnam time) announced import tariffs on more than 180 economies, of which Vietnam will be subject to a rate of 46%. The news immediately had a negative impact on the domestic stock market, creating a widespread sell-off.

VN-Index lost 67 points in the opening order matching session (ATO), then narrowed the range to 40 points. This development did not last long because the selling pressure of domestic and foreign investors suddenly increased from the second half of the morning.

At one point, the market had only 5 stocks gaining points, including YBM, DTL, S4A, PGI and HAS. On the other hand, the number of stocks falling was up to 521. More than half of these stocks lost all their amplitude and had no buyers, while the remaining volume of stocks sold amounted to tens of millions of shares.

All large-cap stocks closed below reference, of which 28 stocks hit the floor. According to statistics from VNDirect Securities Company, the 5 stocks that had the most negative impact on the market today also topped the capitalization rankings, respectively VCB, BID, VIC, CTG, VHM.

Scattered demand for some stocks in the last minutes could not save the VN-Index from the sharpest decline in history (in absolute points). The index representing the Ho Chi Minh City Stock Exchange closed at 1,229.84 points, down nearly 88 points from the reference.

In terms of relative scores, the VN-Index lost 6.68% - close to the maximum fluctuation range of 7% according to the market management agency's trading regulations. This is the second sharpest drop in history according to this criterion. The sharpest drop ever recorded was on September 10, 2001 with 6.89%. However, the correlation between the present and 2001 is completely different, because the Vietnamese stock market at that time was still in its infancy, with only 5 stocks and the VN-Index was just over 200 points.

Foreign investors dumped stocks on a large scale with a net selling value of approximately VND3,700 billion. MBB was under the most intense selling pressure when the net trading volume of foreign investors reached 30 million shares, followed by TPB, TCB, and SSI.

The only positive point of the market is the strong absorption force, thanks to which the market liquidity also reached a record high. Today, 1.76 billion shares were successfully transferred on the Ho Chi Minh City Stock Exchange. The transaction value accordingly reached 39,630 billion VND, double that of yesterday.

However, experts recommend that investors do not disburse money in a hurry, but buy slowly to explore the market.

It has been a long time since the market has seen such a terrifying trading session as today with hundreds of stocks falling to the floor. The most recent session with 200 stocks hitting the floor on the VN-Index was on November 15, 2022 (including HNX, 275 stocks), the VN-Index evaporated 29.14 points (-3.1%). The most recent session with over 300 stocks falling to the floor on the 2 exchanges was on May 9, 2022 with 221 stocks on the HoSE and 103 stocks on the HNX, the VN-Index fell 59.64 points (-4.5%).

Looking back in time, many new investors have never seen such a shock, especially when it happened overnight and the market was quite excited just before.

In terms of points decreased, today is a historical record because the index is at a high level. However, in terms of percentage change, today is not the deepest decrease because in the past there were situations where all stocks decreased to the limit, but today only about 75.2% of the codes in VN-Index.

TT (synthesis)