According to the latest report of the State Bank of Vietnam (SBV), the amount of money people deposit into the banking system reached more than 6.3 million billion VND, this is a record high.

People's savings deposits in banks increased to a record high

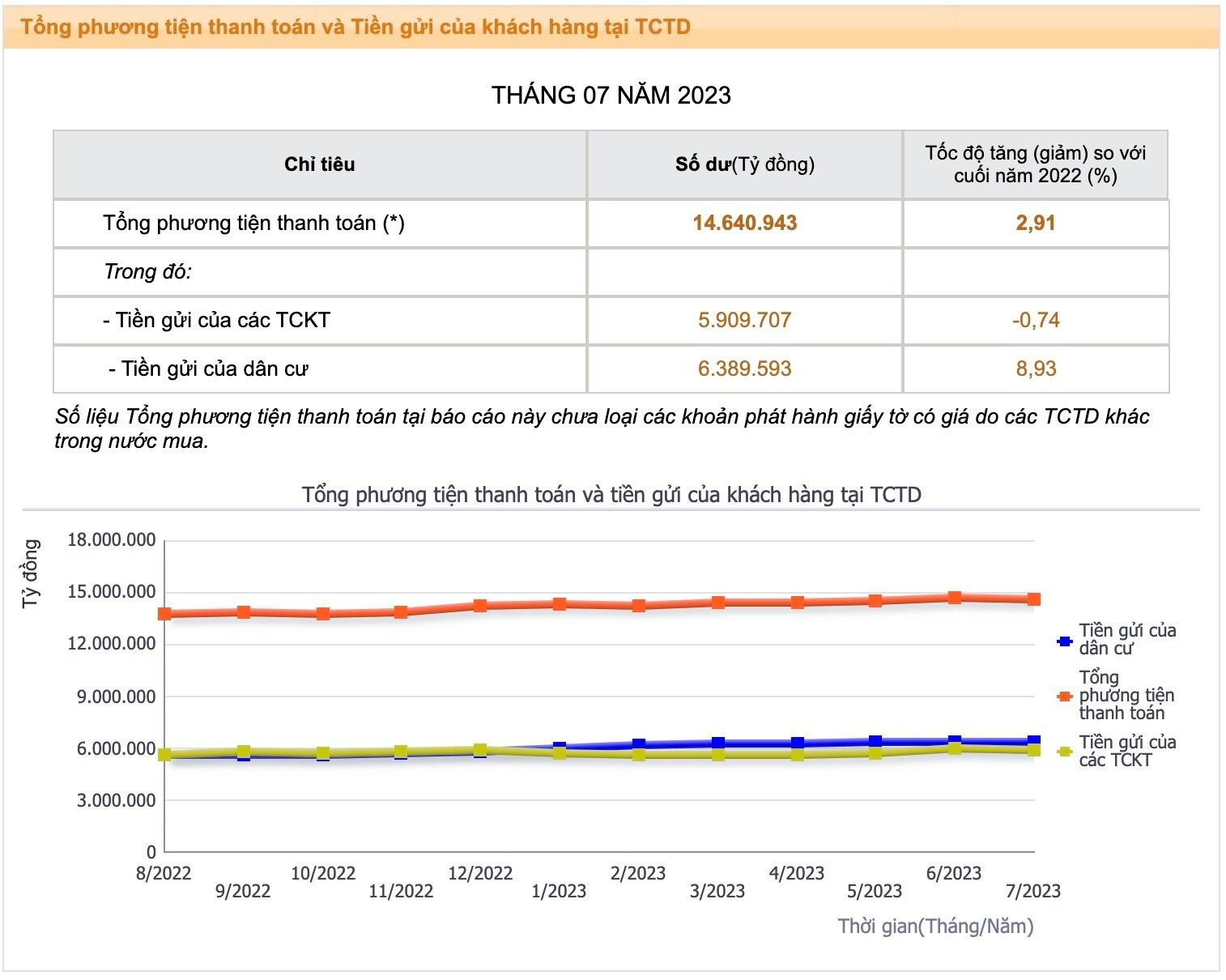

Specifically, by the end of July 2023, the balance of residents' deposits in the banking system reached VND 6,389,593 billion, an increase of VND 6,707 billion compared to the previous month and an increase of 8.93% compared to the end of 2022.

Compared to the end of August 2022, the total balance of savings of residents deposited in banks increased by nearly 752,600 billion VND.

Thus, the amount of deposits from residents each month is continuously higher than the previous month. This trend has been maintained throughout the past year, despite the continuous decrease in deposit interest rates.

Record-high data on people's deposits into the banking system shows that other investment channels such as real estate, stocks, bonds, gold, etc. are no longer very attractive in the eyes of investors.

This explains why, although deposit interest rates have maintained a downward trend for most of the time since the beginning of 2023, the record for people's deposits in the banking system has been continuously broken.

Since the beginning of the year, the average deposit interest rate has decreased by about 2%. Even the deposit interest rate is only at 3%/year. Specifically, Hongleong Bank listed an interest rate of 3%/year for a 3-month term. Also for this term, the Big4 group including Agribank, BIDV, Vietcombank, Vietinbank listed only from 3.3 - 3.5%/year.

Since the beginning of the year, the State Bank has continuously adjusted down the operating interest rates 4 times with a reduction of 0.5-2%/year.

In addition, the monetary authority has also implemented many measures to reduce lending interest rates such as: Encouraging credit institutions to reduce costs to stabilize lending interest rates to support businesses in recovering and developing production and business; Having many documents directing and working directly with credit institutions, proposing to continue implementing measures to reduce deposit interest rates; continuing to implement solutions to reduce lending interest rates for existing outstanding loans and new loans...

According to banking experts, input interest rates have fallen sharply in the context of banks treating excess money, meaning they are mobilizing more than they are lending.

Speaking at the regular September Government press conference held on the afternoon of September 30, Deputy Governor of the State Bank Dao Minh Tu said that as of September 30, the total mobilized capital of commercial banks reached about VND 12,900,000 billion, an increase of about 5.9% compared to the end of 2022.

Meanwhile, in terms of lending, by the end of September, the total outstanding debt of the economy reached about VND 12,630,000 billion, estimated to increase by 6.1 - 6.2% compared to the end of 2022.

According to VTC News