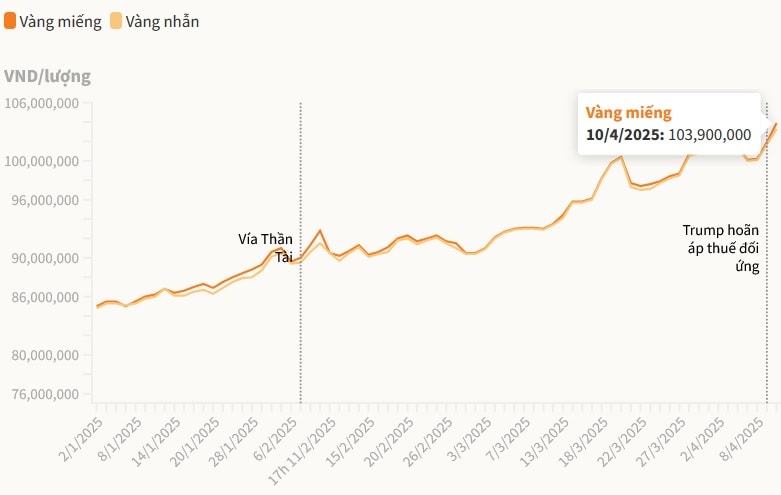

The price of gold bars increased sharply this morning by 2 million VND, up to nearly 104 million VND per tael. The price of plain rings also exceeded 103 million VND per tael.

At 9:30 a.m. on April 10, Saigon Jewelry Company (SJC) adjusted the gold bar price list for the second time, raising the buying and selling prices to VND100.9 - 103.9 million/tael, an increase of VND1.2 million for buying and VND2 million for selling compared to the end of yesterday. The difference between buying and selling prices widened to VND3 million/tael.

At the same time, the price of plain rings was also pushed up by brands to more than 103 million VND/tael. SJC listed the buying and selling price of plain rings at 100.3 - 103.3 million VND/tael. At Bao Tin Minh Chau, the price of plain rings increased to 100.5 - 103.5 million VND/tael.

Domestic gold prices opened sharply higher following the precious metal's developments on the international market. The price of each ounce of gold increased to 3,117 USD at 9:00 a.m. (Hanoi time), equivalent to 97.7 million VND/tael according to Vietcombank's selling rate. Currently, the gap between domestic and international gold prices has widened to more than 5.5 million VND/tael.

Immediately after the US President announced a 90-day postponement of reciprocal tariffs, except for China, not only the gold market, but all other investment channels such as stocks, cryptocurrencies... responded positively after recent sell-offs.

In their latest report, Goldman Sachs analysts also said they maintained their year-end gold price forecast at $3,300 an ounce, reflecting largely increased risks associated with investors’ long and short positions.

According to Goldman Sachs, the precious metal is supported by structural demand from central banks in emerging markets, along with increased capital flows into ETFs due to concerns about economic recession and the possibility of the US Federal Reserve (Fed) cutting interest rates.

TB (summary)