Frontier markets, including Vietnam, have been likened to big fish living in a narrow pond for many years.

Therefore, the issue of upgrading the market to emerging market status has become more urgent than ever with the expectation that foreign capital flows will reverse to net buying.

From the shock of the dissolution of iShares MSCI Frontier and Select EM ETF

In June 2024, BlackRock Asset Management Group suddenly announced the dissolution of the iShares MSCI Frontier and Select EM ETF - an exchange-traded fund (ETF) specializing in investing in frontier and emerging markets established in 2012.

With an asset size of 425 million USD, of which Vietnamese stocks account for the highest proportion (28% of the portfolio), the "disappearance" of iShares MSCI Frontier and Select EM ETF also caused the wave of net selling of stocks from ETF funds to be the strongest ever recorded in the Vietnamese market.

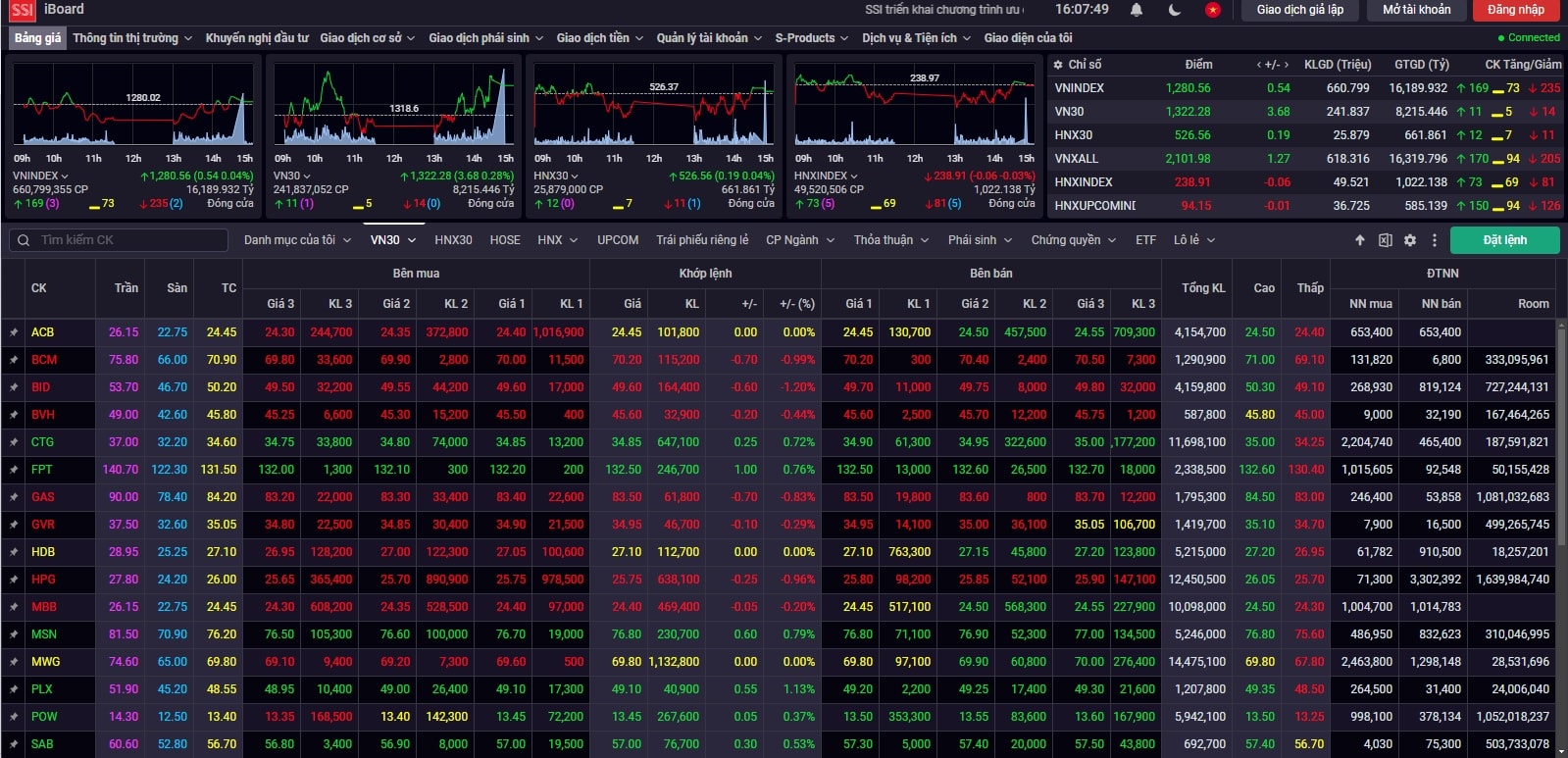

According to statistics from SSI Securities Corporation, by the end of July 2024, ETF funds had withdrawn a total of VND 18,500 billion, equivalent to a decrease of 24.4% of total assets by the end of 2023. This wave of net withdrawal brought the total assets of ETF funds to only VND 59,900 billion. Of which, the capital withdrawal pressure was most concentrated in DCVFM VNDiamond (-VND 1,480 billion), Fubon (-VND 925 billion), and Xtracker FTSE (-VND 316 billion).

SSI experts believe that the dissolution of iShares MSCI Frontier and Select EM ETF will be a temporary disadvantage for Vietnam when it wants to attract capital disbursement into multinational ETFs along with the trend of cash flow rotation. In addition, Vietnam's index fund options are not very diverse (mainly based on the VN30 and VN Diamond index baskets).

At the Investor Day event held in August 2024, Mr. Le Anh Tuan, Director of Investment Division of Dragon Capital, said that the frontier market is declining sharply and shrinking, leading to all frontier ETFs being sold out, including Vietnam. Therefore, the important issue now is that Vietnamese stocks must be upgraded to emerging market status.

Experts from BIDV Securities Company (BSC) previously said that BlackRock's dissolution of the iShares ETF fund was an isolated event related to the group's investment strategy. However, looking more broadly, the Vietnamese stock market needs to soon improve the remaining criteria according to FTSE and MSCI to complete the goal of upgrading the stock market from frontier to emerging as set by the Government in 2025. This will be an important turning point for the Vietnamese stock market to attract foreign investors, new capital flows as well as open up new opportunities for domestic enterprises.

Urgent need to upgrade market

Recently, the Ministry of Finance and the State Securities Commission (SSC) announced the Draft Circular amending 4 circulars related to foreign institutional investors being able to buy securities without having enough money (NPS) and the roadmap for information disclosure in English.

Specifically, the handling of the prefunding issue is proposed through a solution that allows securities companies to provide payment support to foreign institutional investors. In which, foreign institutional investors buy shares at T+0 and are funded at T+1 to T+2.

According to SSI Analysis Center, this will address the upgrade request from FTSE Russell, including the transfer of payment counter-transfer (transfer of shares at the time of payment) and the handling of failed transactions.

Regarding the roadmap for information disclosure in English, the goal is that from January 1, 2028, all public and listed companies will periodically and irregularly disclose information in English. This will help increase foreign investors' access to information, increase market transparency, and resolve MSCI's concerns regarding market regulations and information flow.

SSI expects the circular to be implemented soon in the fourth quarter of 2024 and will be the basis for FTSE Russell to give a positive assessment in the September 2024 rating period and decide to upgrade Vietnam in the September 2025 rating period.

With the upgrade to emerging market, SSI preliminarily estimates that capital flows from ETFs could reach up to 1.6 billion USD, not including capital flows from active funds (FTSE Russel estimates total assets from active funds are 5 times higher than ETFs).

“The upgrade from frontier to emerging is not just a name change, but a change in quality and capital flows will come mostly from professional foreign institutional investors, or in other words, achieving the goal of developing the investor base. Being upgraded to emerging market status by FTSE will be a good opportunity for the Vietnamese stock market to receive attention from MSCI, in the context that the list of stock markets with the opportunity to be upgraded to emerging is quite limited (Vietnam currently holds the highest proportion in the MSCI frontier basket)”, SSI commented.

According to Mr. Ketut Ariadi Kusuma, senior financial sector expert of the World Bank (WB), many foreign investors are interested and expect to invest in the Vietnamese stock market, due to its high economic growth. However, because Vietnam is still a frontier market, while international institutional investors often only invest in emerging or developed markets, the proportion of foreign investors in the Vietnamese stock market is still low, just under 10%.

This proportion is also very low compared to the five largest economies in the ASEAN region, where international investors’ transaction value often accounts for 40% or more. Therefore, Vietnam’s recent reforms in eliminating pre-transaction margin requirements, improving the supply of shares in the context of foreign ownership limits, and improving access to information are very important to move towards an upgrade to emerging market status, the expert said.

In the August 2024 review report with the theme “Reaching the heights in the capital market”, WB experts said that to become a high-income country, Vietnam needs to attract significant international investment to create long-term growth momentum. Upgrading to emerging market status will be an important driving force for Vietnam’s market to be recognized as investable, considering the accessibility of foreign investors, as well as the number of stocks with sufficient size and liquidity to become attractive.

The World Bank recommends that Vietnam needs to make specific improvements to be upgraded to emerging market status; at the same time, it must have a solid infrastructure and overall environment. This means that regulations must be stable, strongly enforced, creating reliable and transparent prices for businesses, supported by efficient and reliable market infrastructure for trading, clearing and settlement as well as information infrastructure…

“If Vietnam’s stock market is upgraded to emerging market status by MSCI and FTSE Russell, it would mean a net inflow of $5 billion into Vietnam’s stock market, as global emerging market portfolios are reallocated to Vietnam after the upgrade. The inflow could even reach $25 billion by 2030, if strong reforms continue and the global investment environment remains healthy,” the WB said.